“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Upton Sinclair

"A hypocrite despises those whom he deceives, but has no respect for himself. He would make a dupe of himself too, if he could."

William Hazlitt

"Tyranny is always better organized than freedom."

Charles Peguy

And its faithful servants often have more titles and access to power as well, common born, otherwise undistinguished, but uncommonly well pedigreed, having been confirmed by Mammon to all that this entitles: money, success, fame, glamour.

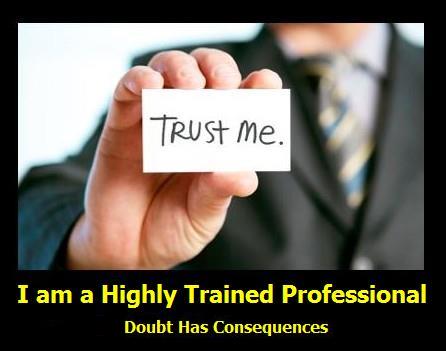

The single biggest impediment to reform is that no one in the status quo wishes to admit that they were wrong. And especially if they were wrong having been prompted by considerations of personal gain, reputation, or career. This is what is known as the credibility trap. Those who can best effect a reform cannot even admit to the problem, because they fear that they themselves are in some way complicit in it, either by their actions or their silence.

The fear of losing credibility prevents those in power from doing anything to effectively reform the system once it has gone off the rails. Credibility is confidence, a faith in someone or something based on accomplishment and credentials. And those who have been in power may be implicated in the disaster, either directly or indirectly, and suffer a loss of loss of wealth, reputation, or power.

This essay by John Kay excerpted below is a nice summary of the problem we have in modern economics. It may be a bit dry for the layman, but it touches on the distortions that crept in to economic thought and their intellectual sources, and in particular the operational rather than political means.

I do not think it was entirely unintentional. Economics has served to distort public policy and blind people to their unfolding reality. Investments in think tanks and universities encouraged and paid for misleading reports and studies, draping propaganda in the faux garments of respectable academia and science.

How else can one explain the general acceptance of the 'the efficient market hypothesis,' the fallacy of which is palpably obvious to anyone who has ever driven on a modern expressway or gone to a major sale at a department store?

People are not always serenely rational, acting for the greatest good, limited in their appetites, and respectfully self-regulating. And what makes this belief especially pernicious it that those who have the most power are often the worst, because this is how they have obtained that power in the first place. In the light of history, such a belief is madness. And yet this unmistakably utopian theory went unchallenged, shaping public policy for decades, and still lingers on as a major political influence.

Oh no, they say. You are confused. It is not the individual that is perfect, but the market, which is a collection of individuals all balancing each other out, achieving perfectibility.

Well, another name for a large collection of people is a mob, and we certainly have seen the effects of mob rule in our financial markets since this great Enlightenment burst forth, of the natural wisdom, of people acting in herds, being driven by jackals. Brilliant.

This is certainly not the first time this sort of thing has happened. Medicine has a rather checkered history in service to power. These types of distortions can of course cut both ways, and science has been used to justify abuses from all ends of the political spectrum.

Economics and other sciences are no fair substitutes for a priori objectives in the creation of sound public policy. Policy is not an outcome of economic science, but rather, policy is set and renewed from first principles, a commitment to certain ideals and common objectives. Economics and other sciences play a role in shaping the details of implementation. But we must revisit and determine the effect which those details have on the achievement of first principles which are the sine qua non.

In other words, economics does not dictate anything. It suggests differences and forecasts outcomes. But there is no economic principle that says that we must disregard the role of regulation and the fostering of well being in society because the market dictates that it must be done. This is sophistry and rubbish.

Unfortunately we must sift all the opinions and inputs to policy decisions with care, and especially the assumptions on which they are based, because the professions have shown a willingness to misrepresent, distort, and even lie for money and power.

One must always come back to first principles, to some notion of what they, and by extension their community, wish to be. Is the first principle of the US the maximizing of profit? By what measures, and to whom? Or is it something else again.

This philosophical notion that the end of all human activity is the maximization of profit is one of the most pernicious assumptions in all history. It is the antithesis of all that is human.

This is the question that the protesters of Occupy Wall Street were asking in their own inarticulated way. People of the status quo say, 'What do they want? What is their desire?' No, it is the protesters who are asking the question of those comfortable people in their power. 'What is this madness? Where are we going?' If they have any statement to make, it is that 'The Emperor has no clothes.' Their protests are wasted on those who are barely self-aware, much less willfully blind.

And since the modern day Emperors do not wish to, or cannot, answer the people plainly and honestly, having only their tired old lies, they become uncomfortable and afraid. Instead they ignore, ridicule, and silence the question, offering new lies and scapegoats, claiming that all is well. And it is, at least for them.

If the people are ignored and abused long enough they will stop asking questions and begin to make demands and push them forward, and then it may be too late as these sort of social movements tend to obtain their own momentum.

Economics is a discredited science at the moment. A few practitioners sold its soul and honor to a small group of wealthy ideologues while the great majority remained silent. But certainly no more discredited than the doctors who served the policies of euthanasia or the Russian abuse of psychiatric wards. It is sad but true, that when the destroyers of civilization appear on the horizon, the quantitative sciences and their purveyors, the professionals, are often seen swimming out to meet the boat.

Those who promoted false theories and dreadfully ineffective policies in return for power and money are still at work, and the results of their betrayal of conscience will be measured in piles of dead bodies, and a mass of broken dreams.

The answer is not to turn away from knowledge, and embrace a hatred of science like a new crop of passionate know-nothings. Science has its proper place. But it is not at the top, dictating outcomes in the social world like the answers to irrefutable equations. And it is especially good that we remember this when science is abused, and used to justify cruelty, selfishness, and plunder.

"The preposterous claim that deviations from market efficiency were not only irrelevant to the recent crisis but could never be relevant is the product of an environment in which deduction has driven out induction and ideology has taken over from observation.

The belief that models are not just useful tools but also are capable of yielding comprehensive and universal descriptions of the world has blinded its proponents to realities that have been staring them in the face. That blindness was an element in our present crisis, and conditions our still ineffectual responses.

Economists – in government agencies as well as universities – were obsessively playing Grand Theft Auto while the world around them was falling apart."

John Kay, An Essay on the State of Economics

This intellectual and financial decline traces back perhaps to the closing of the gold window by Nixon, and the rise of the willful relativism of value with fiat money. But more important is the subsequent rise of the financialization industry, under the flag of efficient markets and deregulation and globalization.

The country once again became gripped by a preoccupation with aggregating wealth from the real economy by manipulating paper. Not only were there real direct effects, but there were profound long term effects through the malinvestment and diversion of strategic resources. And the absolute worst of it has come from the most powerful corporations and those who serve them.

As Satyajit Das puts it in a book interview:

"The best and brightest went into finance because... it paid better than every other profession. So we had this whole generation of people — who would have been great scientists, great doctors, great creators of other things — attracted to a business which ultimately only provided, to a substantial degree, toxic waste. And that is the tragedy of our time. ... It was this diversion of enormous amounts of talent."People can point to select innovations like Facebook and the iPod, but in fact America's technical and physical infrastructure has been distorted, and has languished, and is in decline, because public policy unleashed the financiers, the money magicians, and then became captive to them. And they have willfully led the country into a lingering period of stagnation. The private sector serves none but itself, and often shockingly narrow and short term interests.

I hope to have no illusions. Those who give themselves over to the dark impulses of their imagination often prove more impervious to reason with each victory.

No one knows how this will turn out yet. There is always hope against forces that seem far too powerful at the moment. And tyranny is always better organized than freedom.

Some inquiring student may read this little morsel of thought, and if his mind is provoked, a flickering light of truth will be struck from that spark, about the corruptibility of even the best, about the dark hearts of predators who walk among us, and about the danger of too much power in too few hands.

If not now, then perhaps in some better tomorrow. Nothing is ever wasted in God's economy.

This is a reprise of an essay originally published in 7 October 2011, with some minor editing.

And if you will not learn from goodness and reason, then learn from this:

From the foldings of its robe, it brought two children; wretched, abject, frightful, hideous, miserable. They knelt down at its feet, and clung upon the outside of its garment.

"Oh Man! look here. Look, look down here!" exclaimed the Ghost.

They were a boy and a girl. Yellow, meagre, ragged, scowling, wolfish but prostrate too in their humility. Where graceful youth should have filled their features out, and touched them with its freshest tints, a stale and shrivelled hand, like that of age, had pinched and twisted them and pulled them into shreds. Where angels might have sat enthroned, devils lurked, and glared out menacing. No change, no degradation, no perversion of humanity, in any grade through all the mysteries of wonderful creation, has monsters half so horrible and dread.

Scrooge started back, appalled. Having them shewn to him in this way, he tried to say, they were fine children, but the words choked themselves, rather than be parties to a lie of such enormous magnitude.

"Spirit! are they yours?" Scrooge could say no more.

"They are Man's," said the Spirit, looking down upon them. "And they cling to me, appealing from their fathers. This boy is Ignorance. This girl is Want. Beware them both, and all of their degree, but most of all beware this boy, for on his brow I see that written which is Doom, unless the writing be erased. Deny it!" cried the Spirit, stretching out its hand towards the City. "Slander those who tell it ye! Admit it for your factious purposes, and make it worse! And bide the end!"

Charles Dickens, A Christmas Carol