Stocks dumped hard on post end of quarter selling, even though the economic news was not too hot and not too cold.

The metals came roaring off their oversold conditions with gold leading the push higher.

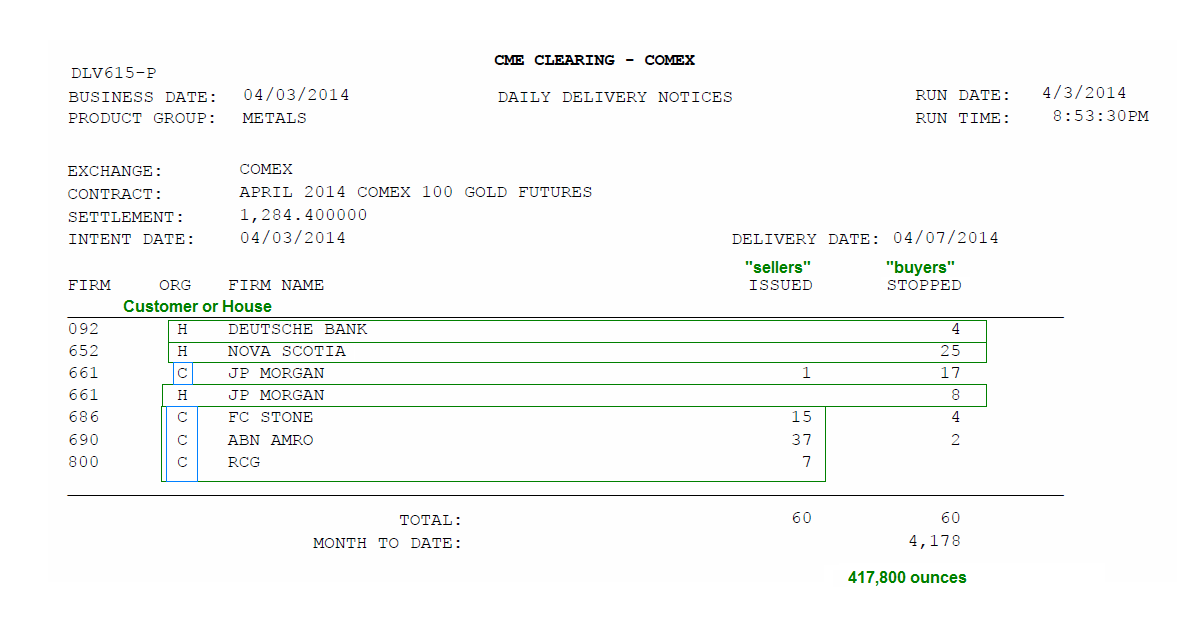

There was little activity in the Comex gold warehouse, and a few more traders stood for delivery.

I explained again the other day that not all those who stop a futures contract for delivery actually end up taking the physical gold. And further, if they do take it, that may not be reflected immediately in the warehouse report, because they take the title to the gold if you will, but may not move it or change its status right away. So we can see a lag, or even nothing.

But again, as I seemingly have to say again and again, the Comex setting gold prices is the tail wagging the dog. It is just that the tail is easier to see.

Gold is moving from West to East, and the glimpses we get of that trade confirms its size. And I think we understand why it is moving, because a great change is taking place in the world's thinking on international currencies.

It appears that the currency war may be heating up on a number of fronts: Russia Prepares To Attack the Petrodollar. If someone is going to attack something, why would they preannounce it? Most likely in response to the threat of increased sanctions I would imagine. The US has expressed its displeasure that Russia is crafting a bilateral trade deal with Iran, and has threatened additional sanctions if they break the embargo on that country.

There are some increased international tensions certainly, and some of the most recent movement in gold, which is outpacing silver, *might* be due to a flight to safety or supply pressures in the markets where physical supply really makes a difference.

This is playing out and we have to be patient in watching it, and try not to fill in the blanks too aggressively with what can be or might be. But as for what is, I think we have a decent idea of the longer term reasons why things are happening the way that they are.

I have included a special thanks to Zerohedge and the other bloggers in my stock market commentary today. I started to thank ZH for publishing an interesting stock valuation chart from JPM, and then I started thinking about all the other sites I look at every day, and felt a need to just say 'thank you.' They are included in my blogroll, and there are quite a few. You can scroll down or simply click here for the stock market comments.

It is easy for us to criticize each other, and find those areas where we might disagree, often on details and interpretations. But I think we can all agree that without the internet, and the bloggers and columnists who work long hours for relatively little reward, the void created in the news by the mainstream media would be even more intimidating and daunting than it already is.

Have a pleasant weekend. Spring is in the air.