"One may safely say that it would be no sin if statesmen learned enough of history to realise that no system, which implies control of society by privilege seekers, has ever ended in any other way than collapse."William E. Dodd, US Ambassador, Address to the American Chamber of Commerce in Berlin, 1933

“Our pundits and experts, at least those with prominent public platforms, are courtiers. We are captivated by the hollow stagecraft of political theater as we are ruthlessly stripped of power. It is smoke and mirrors, tricks and con games, and the purpose behind it is deception...A culture that does not grasp the vital interplay between morality and power, which mistakes management techniques for wisdom, and fails to understand that the measure of a civilization is its compassion, not its speed or ability to consume, condemns itself to death.”Chris Hedges, Empire of Illusion: The End of Literacy and the Triumph of Spectacle"People only see what they are prepared to see."Ralph Waldo Emerson

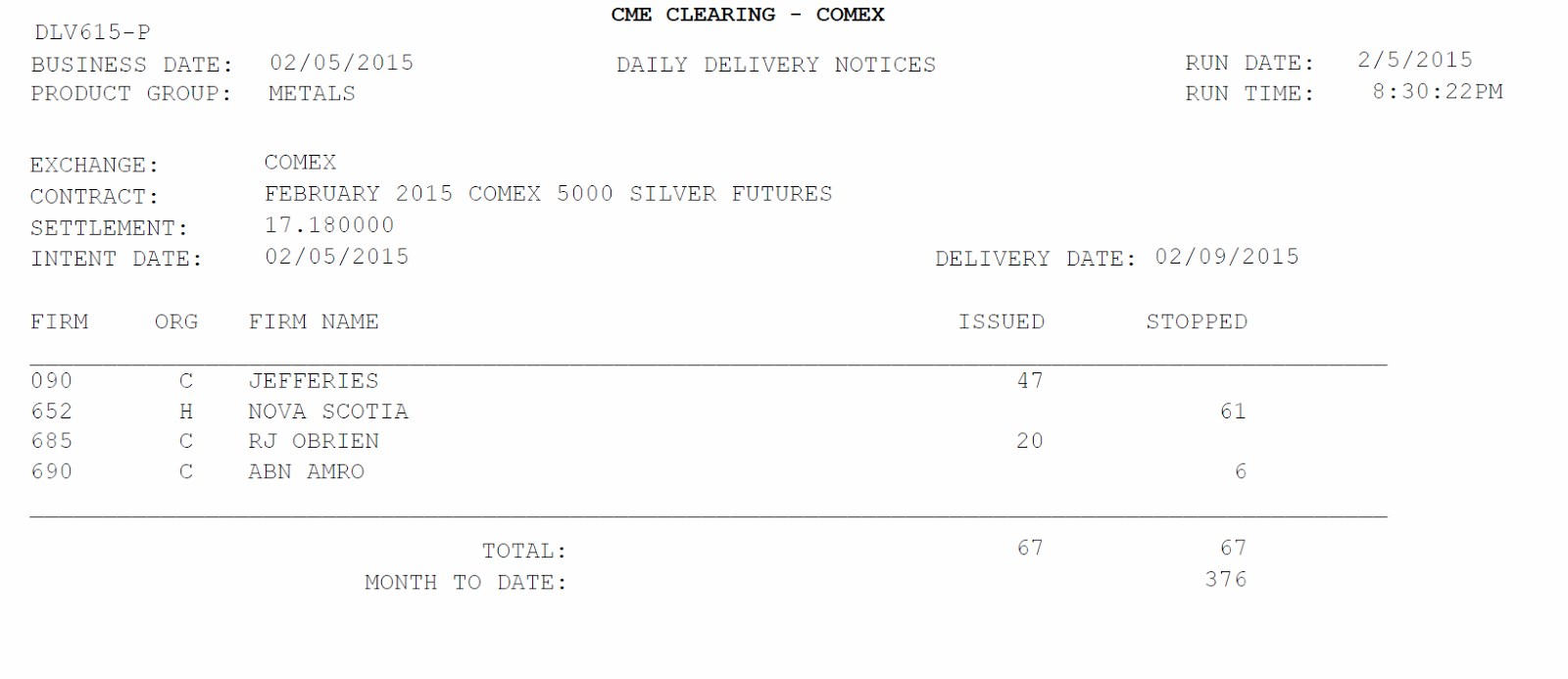

Could they get any more blatant and careless in just hitting the market with massive sell orders to drive down the price? It's a great way to collect on short positions on the miners among other things, as some joker noted on bubblevision today.

I would not trade gold and silver futures on the Comex in this environment. I rode some pretty hairy markets in the early 2000's, and enjoyed aggressively trading the stock futures.

But based on what I see now I think the rules and regulation have become so captured by a few big players that it just makes no sense for even a seasoned investor to get near them. But that is what I am doing for myself. You can make up your own mind.

The Non-Farm Payrolls report was 'better than expected.' It caught a lot of analysts off balance because it was the net result of a pretty profound revision of the numbers going back at least a year. I won't say much more than that for now, since I have not had the time to sit down with a spreadsheet and see what was actually done.

But if the Fed wanted cover to change their wording in March, and then hike a bit in June to give themselves some cushion for lowering rates after their later experiment in policy error blows up (again), then I think they have it.

It is pretty obvious that the Fed is making public policy by default. The default of course is their willingness to use their self-funding ability, taking the gains they make from creating money and trading in sovereign debt for their expenses, and returning the leftovers to the Treasury.

The Fed is stepping into an obvious policy vacuum that has been created by a corrupt and servile Congress and Executive who have lost the will and the ability to govern, which has now become more of a pastime to their own posturing and looting.

So we will sit back quite a bit over the next few weeks and wait to see what the philosopher kings at the Fed decide to do, with the unfolding freak show of the Congress as backdrop. Americans love to ignore international developments, but the Ukraine and Greece will continue to weigh on the financials.

And as always, lest you forget, we are in a currency war. And when the going gets tough, the privileged cheat, steal, and lie.

I said several times we might see some antics in the metals today, and what we got was 'a message.' I think these jokers are getting nervous, and when the pampered princes get nervous they tend to lash out.

Putin was meeting with Hollande and Merkel in Moscow, and the US/UK are concerned that they will negotiate a separate deal with Russia and not maintain their 'Nato unified front.'

And of course there is Greece. A small people seem to be standing up to the moneyed interests and are saying 'enough.' And those who are in pursuit of global empire want that movement contained.

That sort of thing can give other people ideas. As President Snow said in the Hunger Games:

“Hope. It is the only thing stronger than fear. A little hope is effective, a lot of hope is dangerous. A spark is fine, as long as it’s contained. So, contain it.”

Have a pleasant weekend.