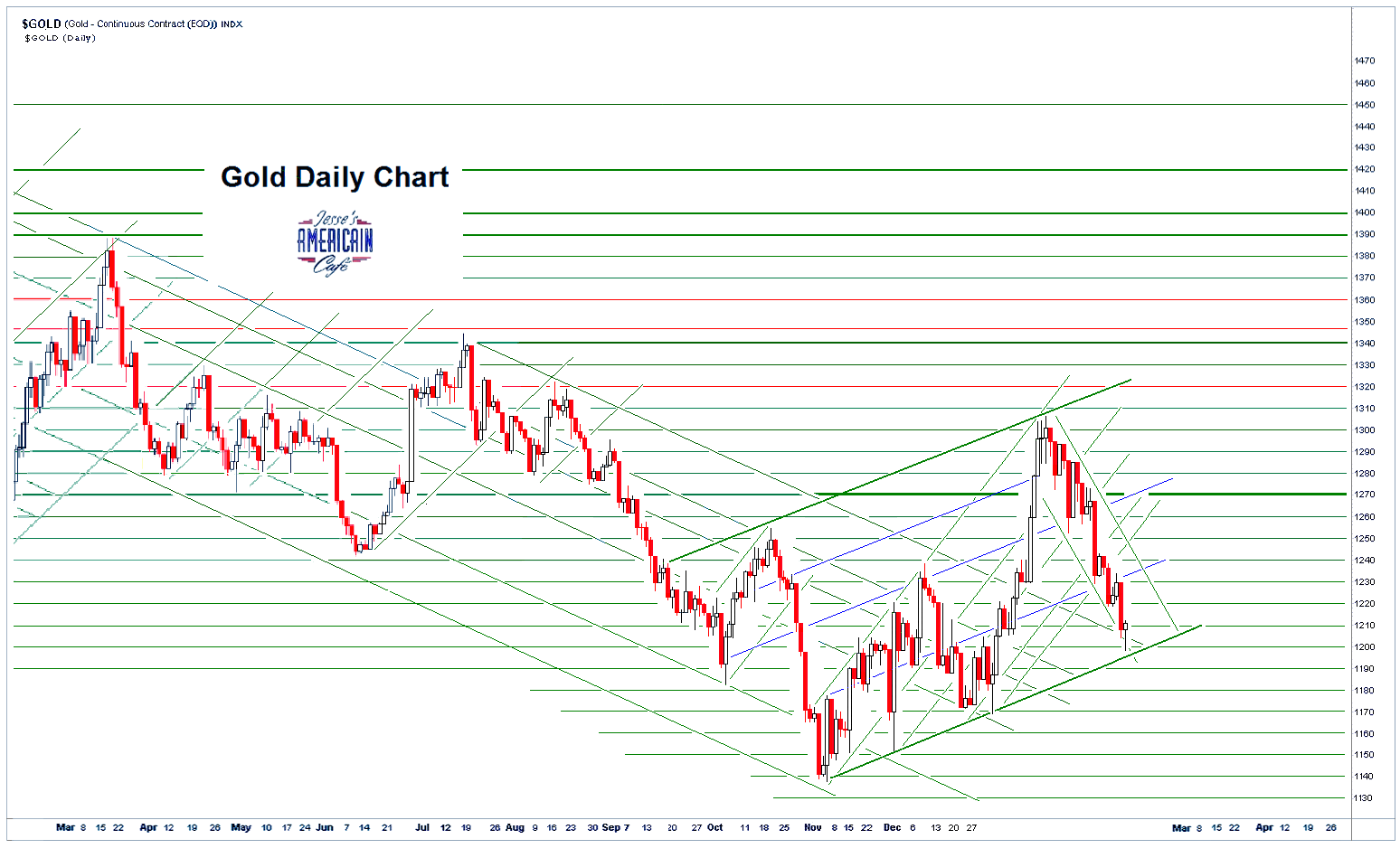

Gold was hit fairly hard for no apparent reason this morning, but recovered shortly afterwards.

See the Dr. Evil strategy favored by some of the large trading firms, and running afoul of the regulators from time to time when they step on the wrong toes, or skin the wrong cats.

Here is an account of Barclays being specifically fined for stepping on a big customer using gold manipulation.

This is the liar's poker market on the Hudson.

The Comex is now the kind of market where speculators and trading companies wager with many thousands of paper positions representing various real world items, with no intent to actually take or give delivery of them with any connection to the real world of commerce.

They wager with almost wholly synthetic positions. As such, the Comex has become a virtual bucket shop that is by tradition and custom still setting many critical prices for the world markets.

As defined by those august solons on the US Supreme Court in Gatewood v. North Carolina, 27 S.Ct 167, 168 1906 a bucket shop is:

"an establishment, nominally for the transaction of a stock exchange business, or business of similar character, but really for the registration of bets, or wagers, usually for small amounts, on the rise or fall of the prices of stocks, grain, oil, etc., there being no transfer or delivery of the stock or commodities nominally dealt in."

These sorts of long term price manipulations have very corrosive effects on real world supply factors, and are often the source of market dislocations as they collapse, not to mention large fortunes for a few, and human misery for many.

There was intraday commentary here, Pictures of a Currency War, With Narrative.

They say that no non-purely defensive war can occur unless the moneyed interests see it as a profitable opportunity. And I say, that goes double for 'financial wars' such as we are seeing now.

A little gold and silver were shoved around the plate today in the 'Delivery Report' and the warehouses.

Have a pleasant evening.