So the dollar slumped, because the reality is that the US is not exceptional, and is certainly in no recovery. The Atlanta Fed's forward projection of US GDP for the 2Q is only marginally positive at 0.7 percent, after a likely negative number on a more realistic revision for 1Q.

There was intraday commentary on the lack of sustainable recovery and the harvest of corruption because of the lack of meaningful reform here.

As the dollar slumped, the bonds also continued to slump, which is starting to frighten quite a few traders, analysts, and economists who actually watch the markets in addition to their artificial models. Something has the financial class uneasy, and given the proportions of the latest in a series of asset bubbles created by the Fed, that is what is known as 'bad news.'

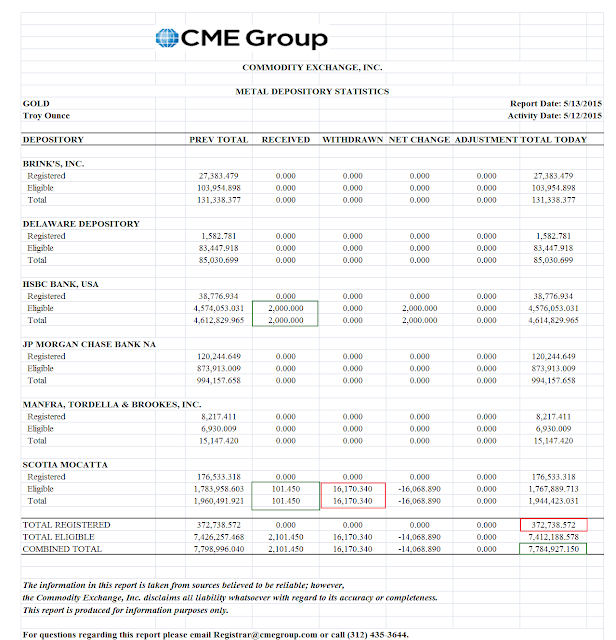

Gold and silver therefore found purchase as 'safe havens.' They were allowed to run back up to the top of their recent trading ranges, which are still in force, most likely backed by the Western banks and their agents of fortune in the financial sector.

Let's see if the metals can finally break out, or if we will have to go around another wash and rinse cycle again. It doesn't bother me all that much if we do, since this is just the sort of thing that sets up a move higher that will be of epic proportion when the metals pricing pool finally breaks down.

What should concern any thoughtful person is the inestimable damage being done to our society by these caustic and malicious policies of market rigging and wealth transfer that have been undermining the strength and the moral integrity of our nation for far too long.

And even worse is the allure of violence and oppression from opportunists who are only interested in plunder, an endless cycle of greed, bubble and bust, that leads only to spiritual death and madness.

Now is the time and the place to say 'no.'

Have a pleasant evening.