There will be an option expiration tomorrow for precious metals on the Comex.

Gold and silver were hit in the classic contract dump early on in the New York Trade.

Surprisingly the US dollar also fell. Stocks tried to stage a rally but faded badly and fell into the close.

I wanted to take a moment to give the reader a little better view of the paper precious metals landscape into year end.

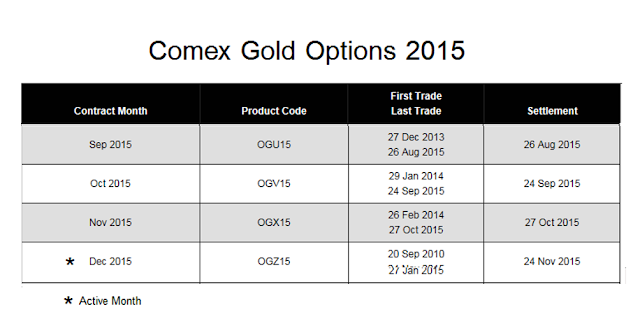

In the fourth chart below you can see the Comex gold contracts listed, with their volumes. As you can see the most active contract remaining is December. It will be the next active month. There is some minor activity in October because of the options activity.

The fifth chart shows the silver contracts. There the most active contracts are September and December.

So, if tomorrow is the option expiration for the September contracts, we would expect to see the action become more pivotal for silver, since silver is going to be an active month for that contract.

Gold, not so much as the active month fades. But that does not mean that gold will become quiet, except perhaps at The Bucket Shop. There is clearly a huge market for gold, and the exchanges in the East will keep buying and delivering large amounts of bullion.

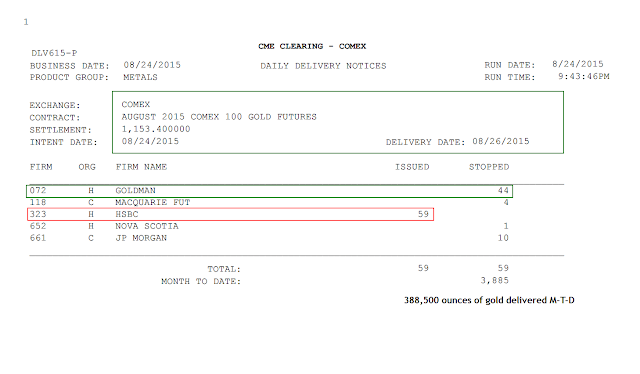

Lastly I show the small amount of 'delivery' at the Comex in gold yesterday in which Goldman was most notable taking 4400 ounces worth of contracts for their 'house account.'

Let's see what happens as we work our way through the option expiration tomorrow, and also see how the equity and bonds markets keep digesting this disruption in their long climb to bubbledom.

Honest markets are not a nicety; they are a necessity, a sine qua non for productivity and prosperity.

The appalling lack of reform in the Anglo-American markets is extracting a heavy price. We may not see it, we may be distracted and befuddled as to the true nature of things. We may be deluded, and blinded to the true nature of our involvement and actions with the global markets.

The rest of the world may not be so similarly inclined. And therein we have the basis for the currency war.

And finally at the end there is a brief video from Jim Cramer about how one goes about manipulating markets like stocks and commodities. You move prices up, and then you smack them lower to create negative sentiment.

You spread stories and biases with the media. You abuse the market system under the noses of regulators with the acquiescence hopefully of your fellow professionals, wreaking carnage on honest people and the real economy.

Have a pleasant evening.