"Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise."

Alan Greenspan, Testimony Before the Committee on Banking and Financial Services, U.S. House of Representatives July 24, 1998

"Secrecy is completely inadequate for democracy, but totally appropriate for tyranny."

Malcolm Fraser

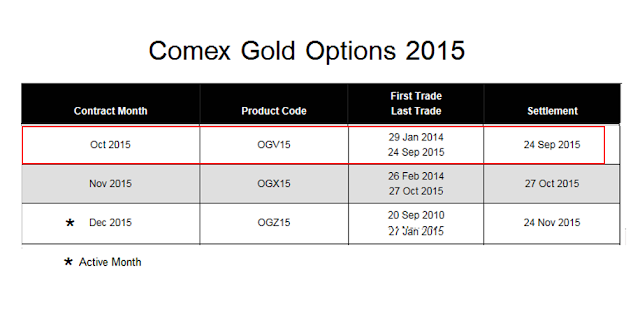

We are going to have an option expiration on the Comex on this Thursday the 24th. I am not expecting it to be a big event, since October is a light contract, with the real attention and action being concentrated in December.

However, there are over one thousand puts at the 1125 strike, so the cynical me might call that good support.

If I were trying to skin the specs and holders of options with shallower pockets, I would take gold down to about 1120ish, suck in more puts and scare the calls out, and then take the price up and skin all those put holders at expiry.

But this is a one dimensional view of the market, and does not take into account the trade in London and in the vastly out of control derivatives markets. Or the side action in the miners and ETFs for that matter.

There were no (zero) deliveries for gold and silver at The Bucket Shop yesterday.

The slow bleed out of the bullion warehouses continues.

I recall some fellow, I think it was from Barclays, saying that the record low plunge in deliverable (registered) gold bullion at the Comex was because those who owned it did not wish to see it stopped out 'in a short squeeze.'

And I remember thinking at the time, what short squeeze is he referring to? The non-delivery Bucket Shop?

And then the rumours regarding the shortage of delivery ready bullion at the LBMA came out, Peter Hambro said it was 'almost impossible to find,' and a few analysts noticed that the gold is in backwardation, meaning a premium is being paid for real gold in hand.

And then Rickards said that he thought a couple of Banks were in a pinch on delivery in London and were hedging their exposure in the futures in New York. As he noted, London is a 'fractional reserve' system, as is The Bucket Shop with a stated assumption of 2% redemptions, as are some unallocated depositories.

If this game of musical gold gets dodgy, it could begin to fall apart as fast as MF Global swirled down drain. I would not wish to see that. I would greatly prefer honest markets that are not so recklessly fragile, in which the small investors is not exposed to so much unknown counterparty risk.

The Banks participating in the London fix are now Barclays, HSBC, SocGen, Bank of Nova Scotia, UBS, and Goldman Sachs.

The Banks which Rickards said were rumoured to be caught short physical deliveries and had been hedging on the Comex with longs are JPM and Citi.

I should note that Jim, for all his expertise and knowledge which I do not dispute, has been leaning in this direction before but certainly early. He suggested that there might be a run on gold back in 2010.

So here we are. They will never admit there is a problem with this, never. They will keep doubling down while the music is playing and if it stops, they will run to the Treasuries and the central banks for a rescue, while keeping their profits and bonuses.

In the absence of enforcement of the rules and effective regulation I am afraid that the only thing that will stop this nonsensical looting is a bullion brick in the face.

The price discovery mechanism in the precious metals market is to hide the true state of the supply behind a wall of secrecy, and to jawbone the demand lower by saying ridiculous things and befuddling the average investors.

But there it is. The flow of gold and silver, a massive exodus of wealth moving from West to East, covered up by a storm of paper.

And the peoples of Asia are letting the malarkey of the bullion Banks and their apologists just float by on the breeze, while they keep stacking the only financial asset without counterparty risk.

As a caution, even if it proves that the highly leveraged LBMA in London, being backed up by the incredibly over-leveraged Comex, is indeed in a developing short squeeze, as Greenspan reminded us, the central banks have gold which they can lease out to their friends in the Banks, so it can be sold off in Asia, with a promise to return it at some future date.

As Sir Eddie George said, they were 'staring at the abyss' if a failure to deliver were to occur, and prompt a run on available gold forcing an unwind of the paper house of cards.

That may keep the books balanced, but it really does not solve the problem, the systemic fraud that is going on in this as it has in so many other markets.

I get the impression that Asia is in this for the long haul, and will not be deterred.

Stand and deliver, until you cannot.

Have a pleasant evening.