Gold and silver moved sharply higher today, after having moved sharply lower the day before.

And so were the antics into the options expiration. Smash gold and silver lower, and then cash in the short positions and pick up the intermarket bargains in the miners and the ETFs.

There was intraday commentary here on the unseen but formidable risks which I see in the financial markets and why.

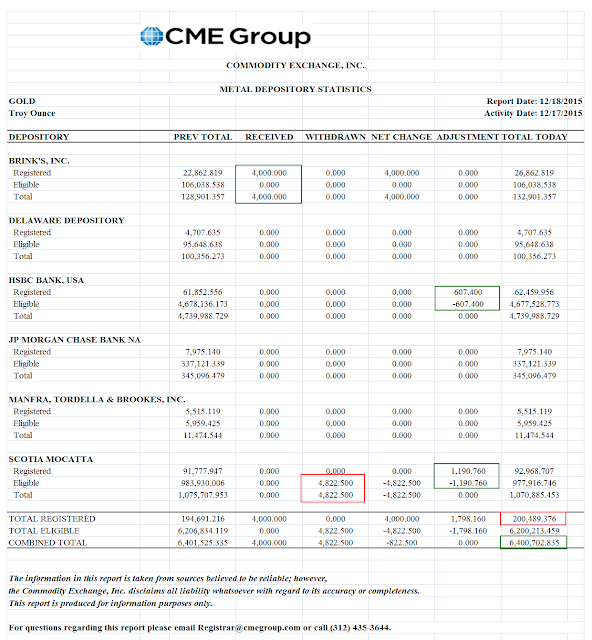

The Bucket Shop was again relatively quiet during the 'active month' of December.

JPM took down a little more gold bullion deliveries. I have not calculated it, but I believe that have taken most of all the gold delivered this month for their house account.

After a brisk start, silver deliveries have been shut down to a trickle.

Of course, this is the phenomenon in the synthetic metals markets of NYC and London. The actual trade in real bullion has never been more brisk in the East, with China well on the way for a year of record gold purchases.

As a reminder, next week will be the observance of the Christmas holiday on Friday 25 December.

I still have not heard from the monarch of the household how many and who will be coming to dinner next Friday. Fish on the eve and prime rib roast on the day are the usual fare.

Speaking of El Niño, we are expecting continued warm, wet weather in the high 60s, and I may have to take the lawnmower out of storage for the day after Christmas. The poor snowblower is feeling neglected. It seems like winter has not been arriving around here until January of late, and then it comes with a vengeance.

At any rate I do hope to be otherwise occupied than watching these jokers pick over the carcass of the real economy, but I should be posting at least once per day.

Have a pleasant weekend.