"An acute shortage of readily marketable physical gold is developing that we believe will deepen in years to come. This possibility seems to be unrecognized by those who are short the gold market through paper contracts.

The relentless dumping of synthetic or paper gold contracts since 2011 by speculators in Western financial markets has caused the shortage. The steady selling has driven down the price of physical gold, hobbled the gold-mining industry, and drained the stores of gold held in the vaults of Western financial centers.

We believe that the shortage will worsen because (1) the precursors of production (exploration, discovery, reserve life) are very negative, (2) the mining industry has little financial credibility and seems unlikely to attract capital even with a big rise in gold prices, and (3) refining capacity limitations tend to create supply bottlenecks when physical demand spikes."

John Hathaway, Utopia For the Paper Gold Alchemists

John Hathaway of Tocqueville Funds has a newsletter, which supplied the quote above, that is worth reading here.

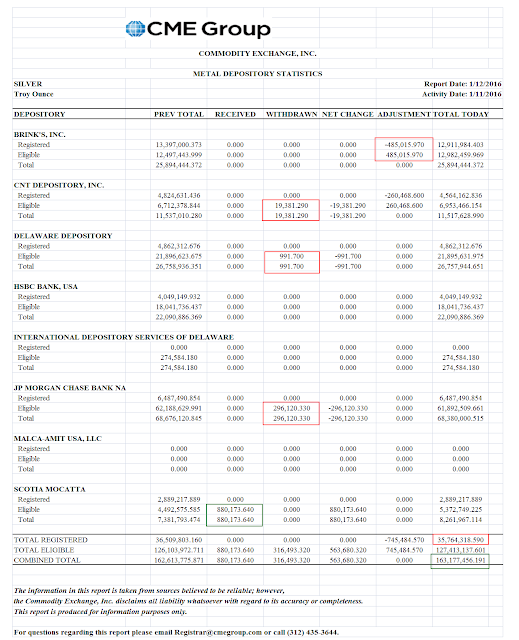

There were no deliveries in precious metals at The Bucket Shop yesterday.

And there was little net movement in the warehouses either.

Have a pleasant evening.