Tony Sanders made a confoundedly interesting observation today.

"I keep hearing from anti-Brexit cheerleaders that it is about immigration. While there may be some who voted for Brexit to get their borders under UK control again, it is mostly about the big banks and who is going to bail them out. Again."

And that may be a good question for most of the beleaguered citizens of the Western developed nations to consider.

I wonder if the sado-monetarists will be as hard on the shareholders and management of Deutsche Bank as they have been on the people of Italy Greece, Portugal and Spain.

Mexico's central bank raised interest rates 50 basis points today to 4.25%, largely in a market positioned move to give a pause to the forex traders who had been players various crosses short the peso. It certainly wasn't due to a robust economy.

The British pound fell today as the Bank of England's Mark Carney suggested today that they would be back in the monetary stimulus saddle in response to Brexit.

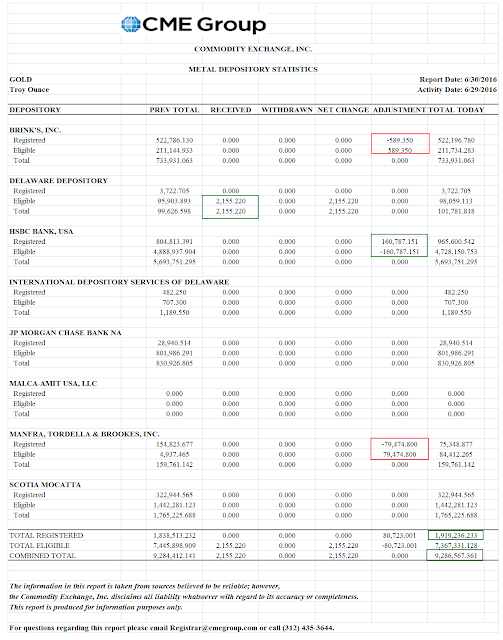

And as you can see below we saw the first significant deliveries in Comex silver, as the July contracts come into play, which is an active month for silver and not gold.

So keep an eye on it, because except for the huge physical hoard in JPM's warehouses, physical silver seems a little on the tight side against demand at these prices historically.

The 'breakout levels' for both gold and silver are fairly easily seen on the two charts below.

Have a pleasant evening.