As you may recall I said last month that we would probably be seeing 'better than expected' jobs reports from now until the election. The incumbent party wants to paint a pretty recovery picture quite badly.

And the Fed would at least like the option of pulling the trigger on their likely 'one and done' interest rate increase for the year. Its either September or December.

The dollar rallied and gold took a hit, on expectations of an improving US economy and higher interest rates. We are the champions of the world it appears, and the only thing that can spoil it is one of those backwards nations in Europe or Asia. har har har dee har har.

The queen had a bit of a relapse today with a seizure caused by her recent operation, and that occupied much of my thought and time for the morning. No permanent damage done with the fall, and as for the rest of it, time heals. Luckily we will be seeing doctors and hospitals almost every day next week as they scan and probe and analyse and develop their game plans, so it looks to be a timely coincidence.

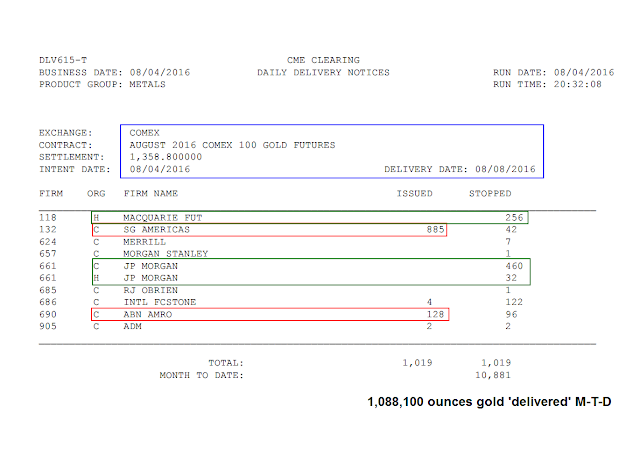

I have included the action on the deliveries which are still lively for gold, and put the warehouse data down for your viewing pleasure.

I am still in quite a bit of cash as I reduced positions dramatically ahead of the Payrolls. Election shenanigans looked likely, and I really was not interested in chasing this market around today. I took a little of it back but not all that much.

There was intraday figures of the Net Asset Values of the Funds. I was clearly shopping around. lol. Let's see if we get a good buying opportunity and/or a clear signal of direction.

Next week might be interesting to see how these trends breakdown or break out, as the case may be.

VIX is at a twelve month low. I wish the vehicles to play volatility in the ETF class were not such blatant sucker bets. But there are other ways to play the risk off flip side of this sort of thing.

Have a pleasant weekend.