Gold and silver caught a little bounce today off dollar weakness and technically oversold conditions.

And there is the matter of very large physical offtake of bullion in the Shanghai markets, together with a pricing differential that shows the strain on the Western gold pool to sustain these prices.

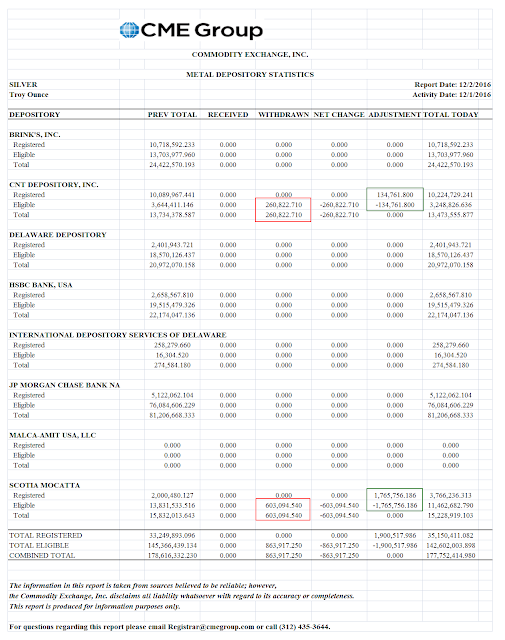

But we are now in December, and the large open interest on the Comex has been changing hands from speculators and customers to the bullion banks. Mission accomplished.

Unfortunately, the Comex is now becoming more of an anachronism, a price setting tool without a firm foundation in the mechanics of global supply and demand.

This will not end well for many, as these sorts of protracted deceptions almost always do.

Have a pleasant weekend.