"Their upward path

was dark and steep; the mists that they encountered, thick;

the silences, unbroken. But at last they'd

almost reached the upper world, but he afraid

that she might weaken and be lost again,

and longing so to see her, turned to look

back at his beloved. And then she quickly slipped away –

His arms stretching desperately

to clasp and to be clasped by her again, but finding

nothing there but insubstantial air.

And as she faded, Eurydice found no

fault in him. How could she reproach him,

except that he had loved her all too well.

One final, faint 'goodbye,' she whispered

weakly so it scarcely reached his ears– was all

she said. Then, back into the netherworld, she fell."

Ovid, Metamorphoses: Orpheus and Eurydice

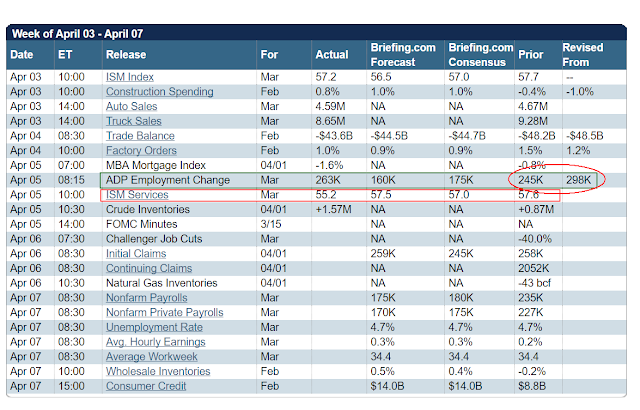

Stocks were rallying and gold and silver slumping today based on a much better than expected print in the ADP jobs report this morning.

I include the economic news below, and direct your attention to that ADP number, including the substantial downward revision taken on the prior month's number— a bit more mixed than the headlines would suggest.

And then the Fed's FOMC minutes were released in the afternoon and the markets sharply reversed. The minutes were a bit more hawkish than otherwise expected, with the central focus on the downsizing of the Fed's substantial book, somewhere north of $4 trillion or so. This reduction in the balance sheet, which as you may recall gets rolled over every month, was not expected until 2018.

So in essence this suggestion that the Fed may start unwinding its holdings of US debt this year was the equivalent to the market of another interest rate increase in addition to those already factored in.

The violence of the change in trend can also be attributed to the position of the markets. Stocks are pushing up against some strong overhead resistance. When the Fed minutes were released they were pushing hard against it‐ and then lost their momentum on the news, falling as sharply as they had risen to go out near the lows.

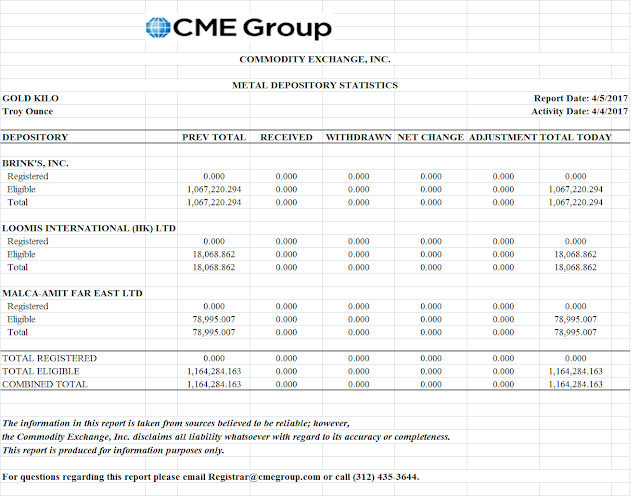

The metals ended the day largely unchanged as the dollar gave up its gains. And those metals are also straining to break out of their sideways track and take out the overhead resistance, activating some fairly bullish chart formations with significant upside measuring objectives.

I am troubled by much of what I see in these markets. Corporate profits are growing at a heady 10+% clip, which I suppose would be good news if the quality of the earnings per share were better. As it is, corporations are taking the bulk of their profits and reinvesting them in stock buybacks designed to increase their share price, and make the EPS look better. They also pay those profits out in dividends.

Alas, they are spending very low levels of those profits in capital investments and increased wages for their workers. This shows the great flaw in supply side stimulus and the 'trickle down' theory, which is a well known canard to anyone who knows their economic history.

So given the context of an economy which offers self-serving statistics as signs of health, and does not seem to be building a base for future organic growth in general consumption demand by the broader public, and one sees the potential for another financial bust in the making.

So many of our more important systems are broken, from politics to investment to healthcare, and are and have been failing to perform their desired functions because of the distortions introduced by the corruption of big money.

Policy has been twisted to serve a few at the expense of the many, and it has been so for quite some time.

And some day finally, at long last, we shall all sit down to a banquet of consequences. And that weighing of the scales of justice may be notable.

Have a pleasant evening.