Put another nickel in

In the nickelodeon

All I want is having you

And music, music, music.

Teresa Brewer, Music, Music, Music

"A nickel's not worth a dime anymore."

Yogi Berra

The FOMC did nothing with rates, but remarked that in their judgement the growth in the economy has changed from 'moderate' to 'solid.' The market is looking for a rate increase at the December meeting.

I am solidly willing to speculate that the Fed will flip their judgement faster than a flapjack in a NJ diner in the not too distant future. But let's see what happens.

The markets are widely pricing in a rate increase from the Bank of England this week. Let's see if they get it.

Donald l'Orange will be spilling the beans on his pick for Fed head tomorrow. Presumably it will be someone not currently under indictment. It is said by insiders that his pick will be Jay Powell. As the Wall Street hot money hopheads say, 'Pass that J my way.'

I have included the chart for the little followed industrial metal nickel futures directly below. It has been on a tear of late. And, (want yearn), is taking a crack at the kind of breakout attempt that we have looking for in gold and silver. From what I hear this is an electric car play. Or blockchain. lol

We are still looking for the results and effects of the Non-Farm Payrolls report on Friday.

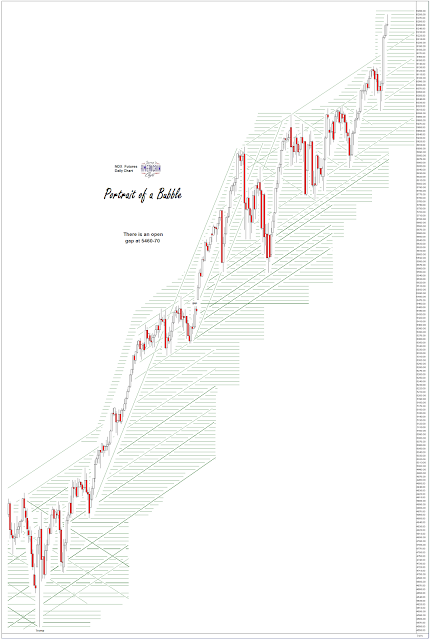

Here is a link to a paper from Artemis Capital titled Volatility and the Alchemy of Risk. It does a decent job of describing the setup for a hyper-correction that may occur based on the systematic mispricing of risk and market manipulation by the Banks, both global and central. In other words, the third collapse of a major financial asset bubble since the repeal of Glass-Steagall in 1999.

At some point in this correction I expect the Bankers to try and stop it, and restore confidence, in the manner of what was done in 1929. They will have more time and ways to do this than in 1987, if they wish to avail themselves of it. Circuit breakers, cooling off periods and all that. Still, fortunes may be lost, and made.

That no one can see it coming is utter rubbish, although the timing is problematic. But as Walter Bagehot once famously observed, 'Life is a school of probabilities.'

Or in other words, as Dirty Harry phrased it, "you've gotta ask yourself one question: 'Do I feel lucky?' Well, do ya, punk?" Since we have established the principles of too big to fail (or jail) and government bailouts, they may indeed be feeling rather lucky, playing heads I win and tails you lose with other people's money. And that is the moral hazard of the system as it feeds the snakes of Wall Street today.

Have a pleasant evening.