“Several centuries ago the greatest writer in history described the two most menacing clouds that hang over human government and human society as 'malice domestic and fierce foreign war.' We are not rid of these dangers, but we can summon our intelligence to meet them.

Never was there more genuine reason for Americans to face down these two causes of fear. 'Malice domestic' from time to time will come to you in the shape of those who would raise false issues, pervert facts, preach the gospel of hate, and minimize the importance of public action to secure human rights or spiritual ideals.

There are those today who would sow these seeds, but your answer to them is in the possession of the plain facts of our present condition.”

Franklin D. Roosevelt, Address at the San Diego Exposition, October 2, 1935

The financial asset bubbles since the turn of the 21st century have been enabled by four basic instruments of monetary policy error: Greenspan, Bernanke, Yellen, and Powell.

Whether we will have a third major collapse and crash to follow this latest asset bubble, as a consequence of misguided monetary policy, economic priorities, and bank regulation is not the issue. The question is, shall we have a system that holds together long enough to have a fourth?

Certainly the Fed is not alone in this. But in addition to their power to set short term interest rate targets and engage in open market operations, they are also a singularly powerful banking regulator, wield through this office tremendous power in all the financial asset markets, right down to reserve and margin requirements, and the activities in them of the Banks.

Stocks rebounded somewhat today. Whether this bounce will stick, and increase to allow yet another top in equities is certainly an open question.

It seems probable that the Fed will keep raising their benchmark rate as long as the fig leaf of recovery permits, as they recoil in horror from ZIRP. For they maintain as their highest priority the process itself, and the banking system to which they are beholden.

This is the great challenge of our day. The system has been co=opted by and for the benefit of the few, and the people as a whole are suffering for it.

Gold and silver bounced a little today, as the Dollar shows continued weakness.

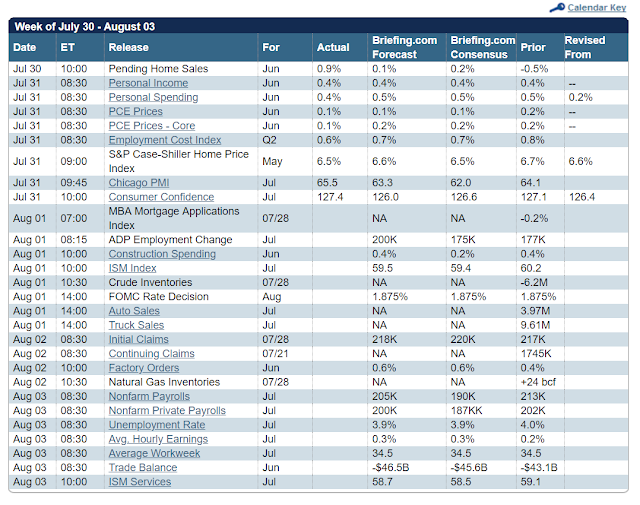

Tomorrow we will have the decision of the FOMC.

On Friday we shall be treated to the Non-Farm Payrolls Report.

As an aside, does anyone else know who FDR is describing as 'the greatest writer in history' in the quote above, the person who wrote several centuries ago about 'malice domestic and fierce foreign wars?' I have not been able to find out, and seem to be the only person who uses this quote who even wonders. Let me know if you can discover this person's identity.

Answer: Thanks to astute readership, the author is Shakespeare as one might expect, from Macbeth, Act III, Scene 2.

"...better be with the dead,And even further, as the definitive answer, we have the admission of an advisor to FDR, Raymond Moley, that the phrase was a conflation that he created in error. As recounted in his book Seven Years:

Whom we, to gain our peace, have sent to peace,

Than on the torture of the mind to lie

In restless ecstasy. Duncan is in his grave;

After life's fitful fever he sleeps well;

Treason has done his worst: nor steel, nor poison,

Malice domestic, foreign levy, nothing,

Can touch him further."

This reference sent the literati to their Shakespeares, and elicited no small amount of good-natured chaffing. It was, I regret to say, a garbled one, and 1 was responsible for the garbling. Somehow or other, the phrase "Malice domestic, foreign levy"-levy meaning armed force-from Act 3, Scene 2 of Macbeth got mixed up in my mind with the phrase, "Domestic fury and fierce civil strife," from Act III, Scene 1 of Julius Caesar..

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.