"In the Incarnation the whole human race recovers the dignity of the image of God. Thereafter, any attack even on the least of men is an attack on Christ, who took on the form of man, and in his own Person restored the image of God in all.

Through our relationship with the Incarnation, we recover our true humanity, and at the same time are delivered from that perverse individualism which is the consequence of sin, and recover our solidarity with all mankind."

Dietrich Bonhoeffer

“We are slow to master the great truth that even now Christ is, as it were, walking among us, and by His hand, or eye, or voice, bidding us to follow Him. We do not understand that His call is a thing that takes place now. We think it took place in the Apostles' days, but we do not believe in it; we do not look for it in our own case.

And yet the ever-blessed Spirit of God is here, ten times more glorious, more powerful than when He trod the earth in our flesh."

John Henry Newman

“To escape the pain caused by regret for the past or fear about the future, this is the rule to follow: leave the past to the infinite mercy of God, the future to His good Providence, and give the present wholly to His love by being faithful to His grace.”

Jean-Pierre de Caussade, Abandonment to Divine Providence

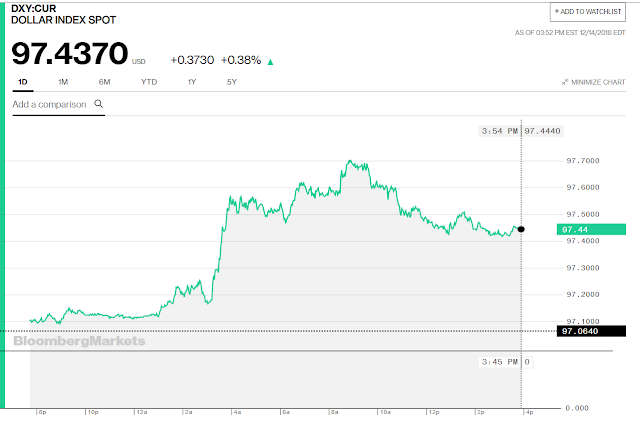

Stocks made yet another morning rally attempt.

But as it has so often been doing, it faded in late morning, and a slide began that ended up going out on the lows.

The spokesmodels fearfully wonder why the puppies are not eating their puppy chow.

This is not constructive action for any kind of market reversal.

Next week we will have an FOMC meeting. The Fed is almost universally expected to raise rates by 25 bp. The key factor will be the language they employ about the outlook for next year.

Some bullishness may be provoked by the way in which the Fed positions their interest rate stance for next year, whether it is substantial or not.

There will be the December stock option expiration on Friday.

This sets up the stage for a sharp relief or rebound rally IF the Trump-Trade-Brexit-Riots factors are at least benign, or ideally more optimistic.

And in another impressive feat and MAGA moment, for the first time in history, US 1Yr Treasuries are market priced as riskier than similar Chinese sovereign debt.

"Here’s another reason Donald Trump is “not at all happy with the Fed” and will continue to be frustrated by the world’s No. 2 economy. He is the first president to suffer the new normal of China becoming more creditworthy than the U.S. That’s right: America now pays more to borrow money than China does."I would not necessarily lay all of this on the Fed. How about another tax cut for corporations and the uber-wealthy with increased military spending? Oh yeah, deficits don't matter. For entitlements that serve the ruling elite.

Nothing to see there. Move along. (Got gold?)

Please remember the least of His creatures in these hard, barren months.

We have taken an abundant Eden, and turned it into a savage garden for the benefit of a few.

"Father, forgive them, for they do not know what they are doing."

Have a pleasant weekend.