“There is a mysterious cycle in human events. To some generations much is given. Of other generations much is expected. This generation of Americans has a rendezvous with destiny.

In this world of ours in other lands, there are some people, who, in times past, have lived and fought for freedom, and seem to have grown too weary to carry on the fight. They have sold their heritage of freedom for the illusion of a living. They have yielded their democracy. I believe in my heart that only our success can stir their ancient hope. They begin to know that here in America we are waging a war against want and destitution and economic demoralization.

It is more than that; it is a war for the survival of democracy. We are fighting to save a great and precious form of government for ourselves and for the world.”

Franklin D. Roosevelt

Stocks were wobbly again today, ahead of the FOMC announcement on interest rates tomorrow.

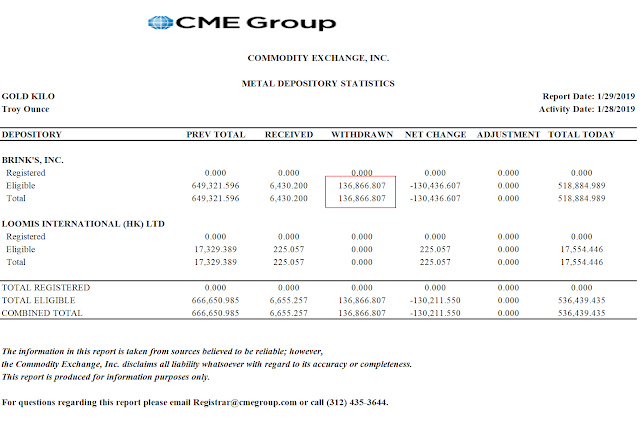

Gold and silver continued to move higher.

There may be brighter times ahead for silver this year according to Bloomberg.

"Silver Shortage Promises to Boost Price in 2019 - Think of it as a potential silver lining for investors. A burgeoning shortage of the precious white metal is promising to boost its price as 2019 rolls out. Silver surged 9.1 percent in December, its biggest monthly gain in almost two years. This year, with miners avoiding new projects amid global economic uncertainty, the price could spike as high as $17.50 an ounce from about $15.87 now, according to a Bloomberg survey of 11 traders and analysts."Gold will be passing through a kind of gauntlet for the next week or so, as it attempts to take on the long term resistance at $1310.

First we will have the FOMC announcment tomorrow. The market will be looking hard for an indication of the Fed's intentions about the unwinding of their Balance Sheet.

On Friday there will be a Non-Farm Payrolls report, and a 'hot number' will raise expectations of further action to increase rates and unwind the balance sheet by the Fed.

And finally, the celebrations for Chinese New Year, also known as 'Spring Festival', will be commencing quite appropriately for the Year of the Pig.

This is a multi-day celebration. For example, the Shanghai stock exchange will be closed for the entire week from February 4 through February 8.

This typically is a weak period for the price of gold because of the huge presence of China in the demand for physical gold bullion.

So let's see how gold makes it through this most difficult period.

It is very difficult to forecast these things in a 'managed markets' economy. But the minimum measuring objective I have on a breakout is $1490 for gold.

Have a pleasant evening.