"It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way – in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only."

Charles Dickens, A Tale of Two Cities

"The corporate Democrats who dominate the party’s power structure in Congress should fear losing their seats because they’re out of step with constituents. And Democratic voters should understand that if they want to change the party, the only path to do so is to change the people who represent them. Otherwise, the leverage of Wall Street and the military-industrial complex will continue to hold sway."

Norman Solomon, The Democrats' Fear

"In 1995 President Clinton signed a tax change law that effectively guaranteed that US wealth and income inequality would rise ad infinitum and that over time, the US stock market would effectively become the US economy. Seemed like a good idea at the time. This is one reason I can’t understand 'progressive' adulation of the Clintons. They did as much to screw American middle class as any Republican. Control the language, you control the dialog, you control the people."

Luke Gromen

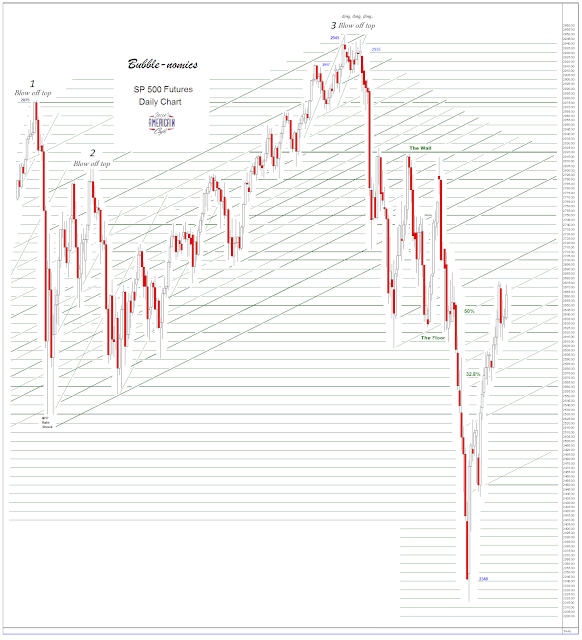

The biggest market-moving story of the day was the news broken by the Wall Street Journal that the Fed is considering the unwinding of their Balance Sheet much earlier than had been expected.

The markets had already been factoring in two or less interest rate hikes this year, down from the original three. The Fed's target is said now to be 3.00%.

But it was the liquidity being drained from the financial system by the Fed's Balance Sheet reductions that had traders on edge.

And on that news the US Dollar took a drop of a little over 80 cents, which is a fairly sizable move.

And gold and silver both rose sharply in reaction, with gold jumping almost $20 to close slightly higher than the magic $1300 level.

As you can see from the gold chart below, the breakout is not quite here yet. Gold needs to keep moving and stick a solid close over $1310.

Next week will be a key test as we will be getting quite a bit of economic news, including the January Non-Farm Payrolls Report. I have included the calendar below.

We will also be getting more earnings reports from US corporations.

Late in the day there was an announcement that a deal had been struck to 'temporarily' reopen the government for the next three weeks.

We will be watching the outcome of that, plus the budget debt ceiling discussions, and the impending visit by the China trade delegation.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant weekend.