"It is the eternal struggle between these two principles — right and wrong — throughout the world. They are the two principles that have stood face to face from the beginning of time; and will ever continue to struggle. The one is the common right of humanity, and the other the divine right of kings. It is the same principle in whatever shape it develops itself. It is the same spirit that says, 'You toil and work and earn bread, and I’ll eat it.'

No matter in what shape it comes, whether from the mouth of a king who seeks to bestride the people of his own nation and live by the fruit of their labor, or from one race of men as an apology for enslaving another race, it is the same tyrannical principle."

Abraham Lincoln, Oct. 15, 1858.

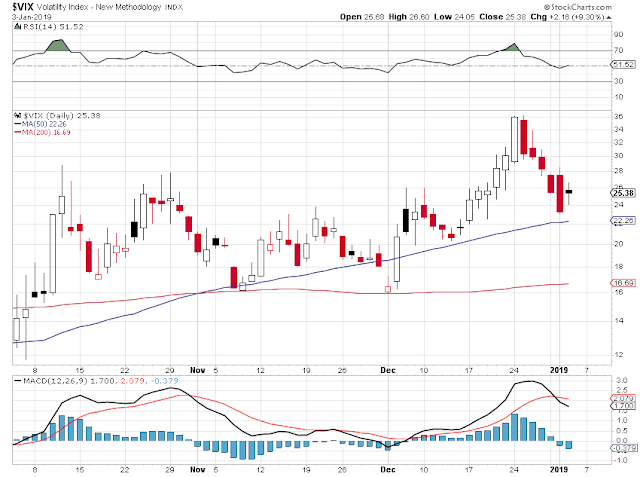

Stocks have managed to rebound from the big selloff in December, and hit the 38.2% Fibonacci retracement.

And then they failed, and have sold off again today, despite a number of 'rescue efforts' led by the powers that be to buy stock futures to support the markets.

This is not constructive action.

Gold continued to plow higher, acting as a safe haven from the risks of phony paper assets and undisclosed counterparty risks.

How unusual.

Big Pharma gave us a present, and raised the prices of over 1,000 prescription drugs for the New Year. It was somewhat ironic that as I was reading this article, the spokesmodels on financial tv were commenting on the Bristol-Myers acquisition of Celgene and said that pharmaceutical companies 'are scrambling to lower prices' and that there are no antitrust concerns in the sector.

Yeah, right.

Journalist William Arkin resigned from NBC/MSNBC with a rather scathing letter.

This is going to be an interesting year as the credibility trap compels our best and brightest to speak and act in a manner that is increasingly divergent from reality.

Apple's announcement of a big revenue miss was a bit odd, because they seemed to point the finger at an economic slowdown in China. Apple is not a major player in the cellphone market there as far as I know. Perhaps they are the victims of rosy forecasts of growth fueled by market penetration that did not materialize because they were just not competitive?

On a happy note, Wall Street On Parade is back online, after a long hiatus due to a family illness. It is so good to see them publishing again. Reform minded bloggers are in short enough supply.

Non-Farm Payrolls report tomorrow morning.

Have a pleasant evening.