"The suspicions that the system is rigged in favor of the largest banks and their elites, so they play by their own set of rules to the disfavor of the taxpayers who funded their bailout, are true. It really happened. These suspicions are valid.”

Neil Barofsky, TARP Inspector General

"We didn't truly know the dangers of the market, because it was a dark market," says Brooksley Born, the head of an obscure federal regulatory agency — the Commodity Futures Trading Commission [CFTC] — who not only warned of the potential for economic meltdown in the late 1990s, but also tried to convince the country's key economic powerbrokers to take actions that could have helped avert the crisis. 'They were totally opposed to it,' Born says. 'That puzzled me. What was it that was in this market that had to be hidden?'"

PBS Frontine, The Warning

What was hidden in the markets was the massive mispricing of risk in a pervasive fraud.

And it was wrapped in a massive web of lies and shrouded by deception by those who profited from it, and from the silence of their enablers in privileged positions. As Jamie Galbraith said of economics, it was shown to be a 'disgraced profession'. But it was surely not alone among the professionals who sold themselves.

It will be a hard judgement for any who abuse their oaths of office and positions of authority in order to gain some advantages, by deception or indifference, for themselves.

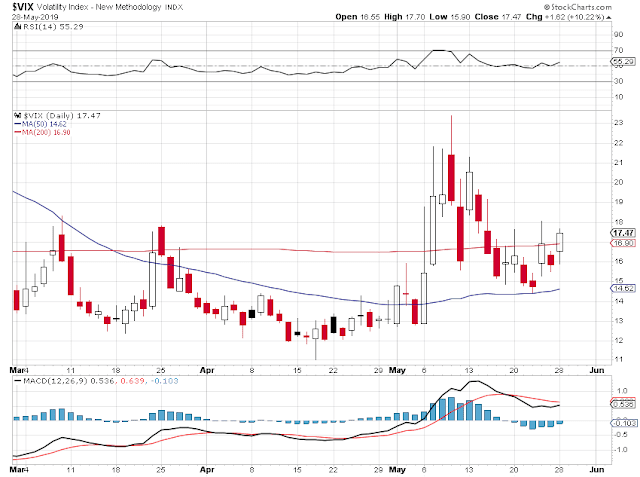

Stocks attempted to rally early today, but ended going out on the lows of the day.

The bond market continues to move higher in what appears to be a clear 'flight to safety.'

The Dollar also rallied today.

The muppets and spokesmodels were overtaken by confusion this afternoon, given the high customer confidence report this morning, and the wonderful economic conditions that they seem to be enjoying. Why were stocks not celebrating this wonderful economy?

Consumer confidence does not lead— it lags. And in times of general deceit and delusion, it can lag rather badly. But when the realization of the truth comes, then the bottom can fall out quickly.

Gold did not join in the flight to safety today, and silver was also driven lower.

The paper market in NY continues to set the price for the world, or at least heavily influence it during its time of the day. And they tend to shove the price of gold around to suit their trading like any other currency or financial asset which they manipulation for short term profits.

A discerning eye notes that the number of ounces of gold declared to be deliverable on the Comex at these prices has dropped below 200,000 ounces. It has not been that low in quite some time.

Today was the end of trading and the settlement for gold and silver options for May.

June is an active contract month for gold. So after the Non-Farm Payrolls report we may wish to hold on to our hats, if the yellow metal is indeed coiling on the chart.

People seem to embrace their delusions every more tightly, as they slip closer into an abyss of consequence. They become ever more defiantly stubborn and belligerent.

Please do not allow yourself to be blinded by some ideology, or misplaced loyalty to some corrupted popular figure or belief.

I realize this will fall largely on deaf ears, and I just do not have the words it appears. My lack of ability weighs on me at times. But we have to make some sort of effort even if it seems so ineffective.

Have a pleasant evening.