“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing,”

Chuck Prince, CEO Citigroup, July 9, 2007

Today was a quadruple stock option expiration fur June.

Last night it was revealed that the US was fully ready to strike Iran, but that at the last minute Trumpolini changed his mind, and pulled back the walrus.

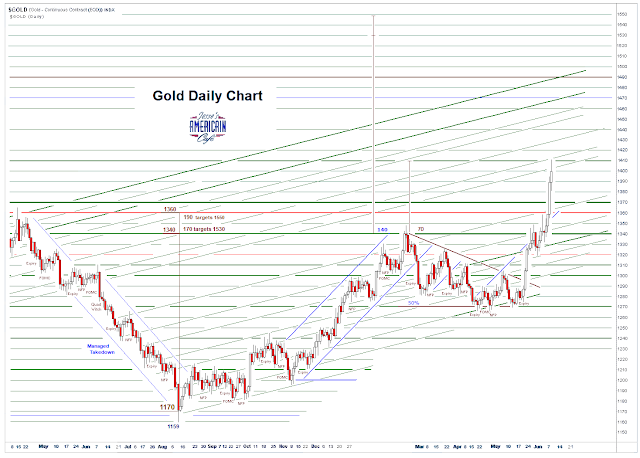

And while gold was soaring last night, fully hitting the short term objective of 1410, equities pretty much ignored the growing risks, preferring to wallow in the hot money promises of the Fed.

Stocks were attempting to rally today, but as is usual once the mischief was managed they gave the gains back into the close, ending up almost unchanged on the day.

I was surprised that so many bulls held their positions into this weekend.

Next week the focus will be on the geopolitical economic issues, with the G20 upcoming in Osaka. I don't think expectations should be set too high for any sort of progress in the US-China trade talks, but we'll have to see what happens.

The Dollar has given up quite a bit of ground in the latter part of this week, and is hovering around the 96 hand on the DX index.

We may see gold and silver backing and filling here after a serious move out of the hard coiling of the descending triangle.

The speed with which it reached its objective was almost stunning, especially after the long years of grinding sideways.

Need little, want less, love more. For those who abide in God abide in them.

Have a pleasant weekend.