31 August 2019

30 August 2019

Stocks and Precious Metals Charts - Tweet Baby Tweet - Three Day Weekend

"Canadian GDP number masked a renewed contraction in real final domestic demand— slipping in 3 of the past 4 quarters. Bank of Canada won't be on the sidelines for much longer. Sell the loonie! Consumer spending may be strong but the fundamentals supporting it are not. Real personal incomes actually dipped 0.1% in July and the broad trends are visibly cooling off. Pending home sales fell 2.5% last month. More pushing on a string. The Fed will cut rates to zero, but the failure of the bond market rally to elicit a pulse in the most interest-rate sector is rather telling."

David Rosenberg

"At gold’s most recent peak in 2011, it only took 135 ounces of gold to buy the average-priced home in the US. It took just 85 ounces in 1980. Today it takes 272 ounces. Because unlike the 1970s, most major asset classes are in a bubble today, something history has rarely witnessed.

The global financial system is also much more precarious, particularly when you include widespread negative rates and money printing that wasn’t present then. And debt loads are at all-time highs for most segments of society — government, corporate credit, global credit, student loans, auto loans, and derivatives, not to mention unfunded liabilities for both federal and many states.

Add it all up and it is hard to imagine a scenario where gold and silver don’t soar in the upcoming fallout. So yes, a gold/real estate ratio below 85 is possible, even if that means house prices rise like they did in the 1970s."

Jeff Clark, GoldSilver.com

And it is.

Stocks jammed up at the top of their recent trading ranges. I have tried to show that range more clearly on the stock charts.

Gold took a hit today as the US Dollar caught a bid up to a near term high today.

Silver continued to do its own thing.

Non-Farm Payrolls next week.

Florida is bracing for Hurricane Dorian, which looks as though it might be quite damaging. Remember them in our prayers.

We have some tariffs that are scheduled to take effect between the US and China on Sunday September 1.

Let's see what happens with that.

Have a pleasant holiday weekend.

29 August 2019

Stocks and Precious Metals Charts - Trade Optimism Based on Nothing Sparks Risk On Rally

"Seems a [trade] deal or truce would be enough to slow the contraction till after elections which is what Trump wants. That is likely Trump's hope. Maybe will buy him 3 months or so— but not long enough to block downturn before November 2020.

We are at end of cycle. CBs can play with financial asset pricing but cannot halt end of cycle. World financial mkt reporting today spiced by references to possible US-China trade truce. My renewed warning: US-China deal or truce will not alter world industrial production and orders contraction trend which began in 2018 and will continue through 2019 and 2020. No world trade rebound in sight."

Dr. Harald Malmgren

"The queen abides, growing quieter, and steadily a bit weaker, sleeping most of the time with Dolly at her side. I measure out the hours with patches and syringes, a tender touch of caring and a reassuring word, as I obtain similar consolations from my own angels of the moment, who bring a meal and a helping hand.

There is little fear and no pain. It is like watching a butterfly becoming. God is making an angel.

These are His tender mercies."

Jesse, 27 August 2017

Stocks rallied today on 'trade optimism' based pretty much on the same non-existent breakthrough talks and calls like those that Trump just made up out of thin air the last time.

So it was risk-on, and gold retreated and the dollar rallied a bit, and silver gave a little bit of its recent gains back.

Some things were short term overbought, and were hit by profit-taking and bearish technical traders.

Not one thing of stubstance has changed. But in the short run that does not matter.

Three day holiday weekend in the US coming up.

Very late tomorrow night is the second anniversary of the passing of the Queen.

Here's looking at you, kid.

Have a pleasant evening.

28 August 2019

Stocks and Precious Metals Charts - A Banquet of Consequences

"My cyclical calculations and trend forecasts suggest that July 2020 may be a decisive, if not pivotal, period in our time."

Jesse, Le Cafe Americain, 26 February 2019

"Sooner or later a crash is coming. And it may be terrific."

Roger Babson, Sept. 15, 1929

“Woe to you, scribes and Pharisees, hypocrites! For you are like whitewashed tombs, which outwardly appear beautiful, but within are full of dead people's bones and all manner of uncleanness. So you also outwardly appear righteous to others, but within you are full of hypocrisy and lawlessness."

Matthew 23:27

"My heart is restless until it rests in you my God."

Augustine of Hippo

Stocks managed to turn around early weakness, and squeezed out a minor gain.

The Dollar was up, gold was down, and silver was off doing its own breakout thing.

I do not know exactly how it might unfold, but I suspect that 2020 may be a significant time in our recent history.

And I will be surprised if we get out of this year without another major market correction on the order of 10 perent or more.

Trump is slowly imploding. And he may cause our lawmaking elite to rethink the terms of the imperial Presidency. I don't think he will be re-elected in 2020 if he runs. And I believe that there is a real possibility that he may not finish this full term.

But that's just my opinion, and I could be wrong.

Take comfort in knowing that while life exists, it is never too late to be what you might have been.

Repentance, forgiveness, thankfulness.

Have a pleasant evening.

Category:

July 2020

27 August 2019

Stocks and Precious Metals Charts - Hi Yo Silver - Silver Breaks Out

"Real journalism is different from the gossip, punditry and clickbait that dominates today’s news. Real journalism, in the words of Joseph Pulitzer, is the painstaking reporting that will “fight for progress and reform, never tolerate injustice or corruption, [and] always fight demagogues”. Pulitzer said journalism must always “oppose privileged classes and public plunderers, never lack sympathy with the poor, always remain devoted to the public welfare, never be satisfied with merely printing news, always be drastically independent, never be afraid to attack wrong, whether by predatory plutocracy or predatory poverty”.

When we have had real journalism, we have seen crimes like Watergate exposed and confronted, leading to anti-corruption reforms. When we have lacked real journalism, we have seen crimes like mortgage fraud go unnoticed and unpunished, leading to a devastating financial crisis that destroyed millions of Americans’ lives."

Bernie Sanders, The Media Today

Here are the charts.

Silver has broken out.

Gold is setting its mark higher again.

Stocks were lackluster.

Bill Dudley is always and everywhere a sycophantic tool.

In general, the news and commentary is full of people who are crooks and liars, and just plain nuts.

Try to refrain from joining in.

You will stand to account for all that you say and do. Of this you may be as sure.

You can rehearse all the witty justifications, flippant remarks, and clever arguments that you wish. But when the time comes to present them, and your naked self, before almighty God, I suspect that they will seem a bit thin.

They will be worth nothing then, as they are now.

So now is the time to cast your prideful selfishness asie, and accept the three great gifts of repentance, forgiveness, and thankfulness.

For what does it profit a man, to gain the whole world, but lose themselves.

Have a pleasant evening.

Silver Breakout Targets $22

Provided that the silver breakout is confirmed and holds $18, a target for this range breakout targets $22.

A similar breakout attempt failed around August of 2017 as you can see on this chart.

It must be noted that in a major stock market liquidity event, silver is like to take a drop in price because of its 'industrial component.'

Category:

silver breakout

26 August 2019

Stocks and Precious Metals Charts - Woe to You, Scribes and Pharisees, You Hypocrites - The Seven Woes

"Cass shipments index has gone from “warning of a potential slowdown” to “signaling an economic contraction.” This indicates US GDP growth turns negative in Q3 or at latest Q4. World shipping data already confirming word trade slump deepening even before Trump tariffs."

Dr Harald Malmgren

"Hot money seeks out the conscious mispricing of risk. Capital, in the form of both money and personal talent, increasingly flows into malinvestment and the gaming of markets.

The productive economy languishes, left wanting for the lack of creative resources and attention. The bubble rises to unsustainable valuations— and fails, and a nation's capital is consumed. The next five years are not about winning, but surviving."

Jesse, 5 August 2019

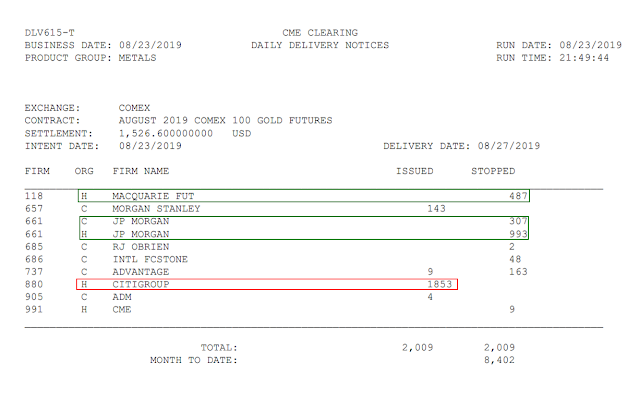

Citigroup dumped the gold contracts from its house account on Friday. The clearing report is below.

We will be having a minor Comex precious metals options expiration tomorrow.

Stocks and the metals went on a wild ride last night, in the latest episode of our bipolar President's trade war.

I spent a fruitful day taking Dolly to the groomer. She is pouting on her pillow, but very glad to be home.

Earlier this morning I did a minor rebuild on the carburetor and put a new fuel line in my Husqvarna chainsaw. The old fuel line pretty much fell apart. No wonder it would not start. lol.

The weather has turned glorious, an early taste of autumn. I am making borscht with beef bones and beets today, to be served cold with diced onion and sour cream. Yum.

Have a pleasant evening.

Subscribe to:

Posts (Atom)