Wow.

It was a 'risk on' kind of a day, as stocks managed to hold their early ground and power higher into the close.

The SP 500 and NDX are both running into the key overhead resistance that has kept them rangebound in the past few weeks.

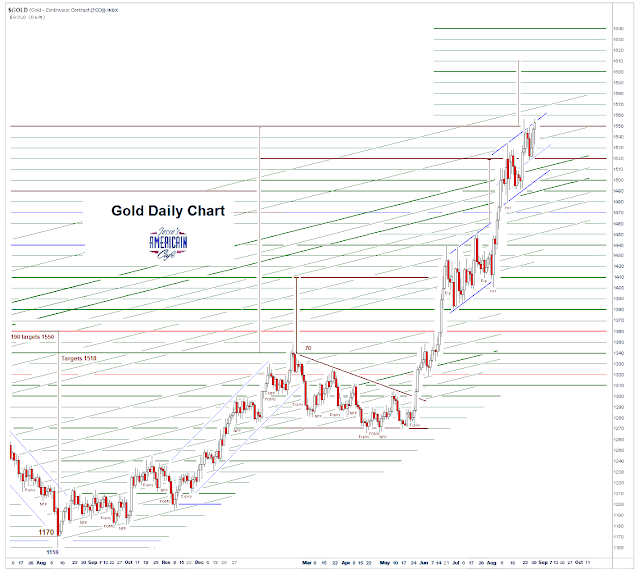

Gold held its recent gains and moved slightly higher, bumping into the upper bound of its consolidation pattern.

The Dollar continued its slight decline.

The VIX fell sharply with this new risk appetite in the short term punters.

But the real story was in silver, which continued powering upwards, going out on its highs.

This has all the signs of a short-covering rally.

I was reading the latest from Ted Butler today, to see if he could shed any insight on the reasons for this incredible silver rally.

His take is pretty much the same as my own. He does not know of any particular event that is driving this, although there could be one.

I also took a look at the usual suspects. The mainstream financial media continues to run their pom-poms for equities. Most of the usual sources don't know or aren't saying. I am chasing down rumors but haven't come up with anything that seems credible.

Most likely, given what we do know, this is an intense technical reaction to a breakout from a long period of price suppression driven by a few major players who were gaming the markets. Ted goes into much more detail and names the players, with the specifics of the market structure, but you'll have to read it on his site. (subscription)

I think the incredible out of norm level of the gold-silver ratio was a tipoff that at some point silver would shake off its market made bindings and bolt higher, following and exceeding gold. Or that gold would get crushed, which was a bit of a concern all things considered.

I think the incredible out of norm level of the gold-silver ratio was a tipoff that at some point silver would shake off its market made bindings and bolt higher, following and exceeding gold. Or that gold would get crushed, which was a bit of a concern all things considered.And so it has done. This is a familiar scenario to old market hands. Silver may be kept lower, but at some point the beta is unleashed.

There will likely be a correction at some point, but I would not wish to try and get in front of this. I'll leave that up to the banks who can stomach billions in paper losses. For a while.

Chart-wise silver looks to have its sights set on 22ish. It may go parabolic(er) and overshoot.

Slack, of recent IPO fame, was monkey hammered after the bell as its results did not nearly support its current valuations.

We may be hearing a lot more stories like this in days to come.

Have a pleasant evening.