"Neoliberalism sees competition as the defining characteristic of human relations. It redefines citizens as consumers, whose democratic choices are best exercised by buying and selling, a process that rewards merit and punishes inefficiency. It maintains that “the market” delivers benefits that could never be achieved by planning.

We internalise and reproduce its creeds. The rich persuade themselves that they acquired their wealth through merit, ignoring the advantages – such as education, inheritance and class – that may have helped to secure it. The poor begin to blame themselves for their failures, even when they can do little to change their circumstances.

It has played a major role in a remarkable variety of crises: the financial meltdown of 2007‑8, the offshoring of wealth and power, of which the Panama Papers offer us merely a glimpse, the slow collapse of public health and education, resurgent child poverty, the epidemic of loneliness, the collapse of ecosystems, the rise of Donald Trump. But we respond to these crises as if they emerge in isolation, apparently unaware that they have all been either catalysed or exacerbated by the same coherent philosophy; a philosophy that has – or had – a name. What greater power can there be than to operate namelessly?"

George Monbiot

"Over the past few years, in this Committee, we have seen the Trump Administration dismantle many of the protections we put in place after the last financial crisis, putting our financial system and hardworking families around the country at risk. The SEC has flown under the radar, but often the agenda has been the same – taking Wall Street’s side over and over, instead of standing with investors saving for retirement or college or a down payment."

US Senator Sherrod Brown, Oversight Hearing of the SEC, 10 December 2019

The Fed did nothing as expected today.

And the indications are that they will continue to do nothing for some time, unless their hand is forced by some exogenous event in the world, or some systemic misadventure with the mispricing of risk.

As I have indicated, the Fed now has a 'high bar' for raising rates. And lowering them will just fuel the asset bubble.

So gold and silver caught a bid, while the Dollar dived.

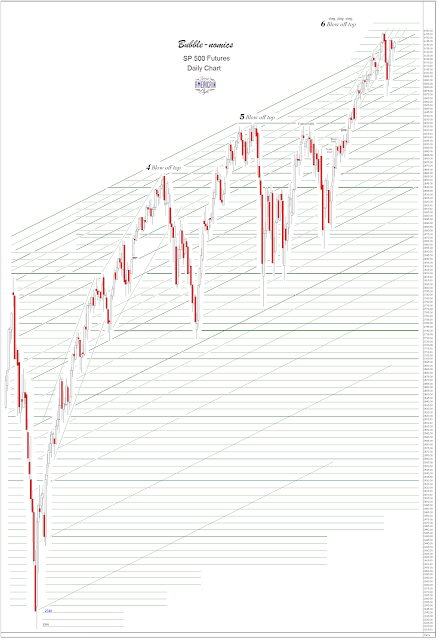

Stocks finished up a little higher, but seem to be struggling at these levels despite the enormous amount of liquidity being put into the hands of Wall Street by the Fed.

And so now the eyes of the markets now turn to the UK general election, and even moreso to the 'trade war' and the deadline for tariff increases on this coming Sunday.

I have a feeling that things are going to become quite a bit worse before they can get better. The general strike in France, and civil unrest in other parts of the world, is just a taste of things to come.

We are afflicted by some social and economic theories that are quite mad, and rather destructive. And as Yeats noted, 'the best seem to lack all conviction, while the worst are filled with passionate intensity.' And willful madness, in some circles at the fringes, has become fashionable.

This too shall pass. Pride always struggles with the humility of creation, and seeks to destory it as it destroys itself. It cannot win of course, because that victory has already been won by the most human and most humble of all His creation.

Have a pleasant evening.