"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it.

It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K."

Sir Eddie George, Governor Bank of England to Nicholas J. Morrell, chief executive of Lonmin Plc, 1999

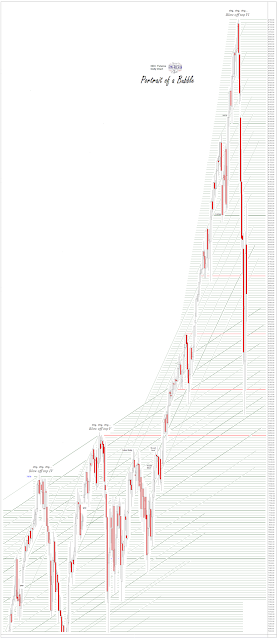

The Fed did a 50 basis point rate cut today because of the deteriorating economic conditions due to the coronavirus. And the collapsing asset bubble, but that was unspoken.

The big risk on rally of yesterday and this morning, with the slaughter of the gold price last week, did a complete turnaround on the rate cut news, with the Dollar and stocks falling, and gold and silver rallying back much of what they had lost.

There is little doubt in my mind that the big knockdown on the metals the other day was to prepare the way for this rate cut.

Otherwise the price of gold may have broken through 1700, and some bullion banks carrying heavy to the short side positions might have been hurt, as the managed monetary marketeers lost their 'control' over the paper price of gold in NY and London.

Shortly after that big surprise rate cut, Trumpolini was complaining that it wasn't big enough, and the Fed should have cut more.

The Fed of course is not interested in getting anywhere near the zero bound again. It seriously inconveniences them in their policy degrees of freedom.

And as always, the Banks.

Anyone who thinks that the dampening economic impact of the coronavirus is going to fade quickly in Asia is living in some alternative reality.

It is the knock on effects of the quarantines and closures on economic activity that is the biggest concern overall for the markets.

Today is Super Tuesday, and there will be a number of Democratic primary elections that may shed some clarity on the newly reduced field of candidates. The Democratic Establishment is making its all out attempt to 'stop Bernie' and provide 'more of the same.' The GOP is already in full pig-on mode. No surprises expected there.

Rough seas ahead, mateys. Now is not the time for non-professionals to get tactical and try to trade short term.

Get right and sit tight. Values and reality still count for something, at least at the end of the month.

Have a pleasant evening.