"The Fibonacci retracement levels are 23.6%, 38.2%, 61.8%, and 78.6%. While not officially a Fibonacci ratio, 50% is also used. T he indicator is useful because it can be drawn between any two significant price points, such as a high and a low. The indicator will then create the levels between those two points." Investopedia

Stocks were beaten down today, taking out all of yesterday's bounce and then some.

The PP500 has now retraced 61.8% of its most recent rally upleg.

The big cap techs in the NDX have tested that level but finished well above it.

Interestingly enough, gold closed around its own 61.8% retracement level today.

There is nothing magical about these retracement levels. And the same goes for cycles and waves, moving averages and all the rest of it..

They just tools that allow us to have some perspective about where we are.

I definitely closed out my stock short potion too early today. Oh well.

The dollar continued to gain, finishing above the 94 handle.

Silver just got beaten with an ugly stick. I have cautioned about the two-edged sword of silver volatility many times before.

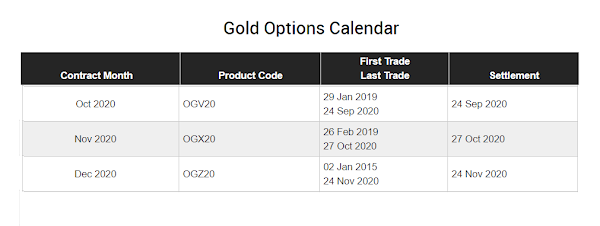

Tomorrow is the option expiration for the October gold contract on the Comex.

I am sure this recent price action has freed up quite a bit of gold from the big ETFs. Some of itmight even be physical and unencumbered.

Have a pleasant evening.