"It is not possible to found a lasting power upon injustice, perjury, and treachery. These may, perhaps, succeed at first, and limp along on hope for awhile with a flourishing appearance. But time betrays their weakness, and they eventually fall into ruin of their own designs."

Demosthenes

"Every century is like every other, and to those who live in it seems worse than all times before it."

John Henry Newman

"Foolishness has a knack of getting its way; as we should see if we were not always so much wrapped up in ourselves. In this respect our townsfolk were like everybody else, wrapped up in themselves; they did not believe in plagues."

Albert Camus

Reality surfaced once again today, and took the bloated speculative values of some financial assets down in its wake.

Stocks were hammered, going out near the lows. This was the broadest equity selloff since March.

The purported impetus for this action is the re-imposition of lockdowns and other social measures in Europe to control the resurgence of the coronavirus.

The fear is, of course, that such a thing could occur in the US, despite the recent assurances from the White House that victory over the virus has been achieved.

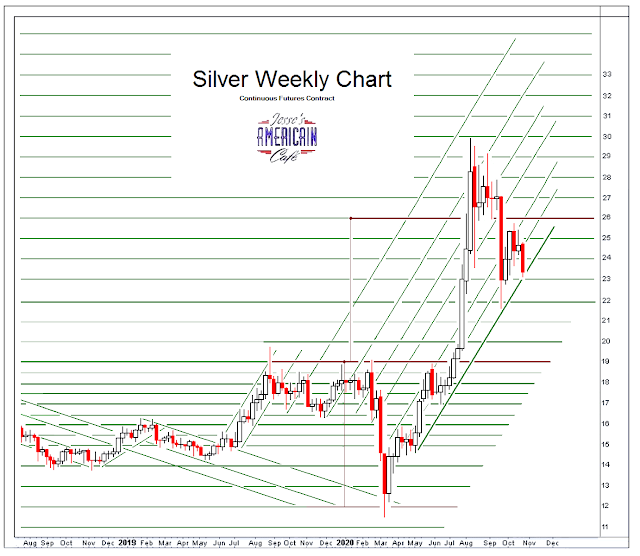

Gold and especially silver were hit fairly hard.

The dollar gained back some ground in the DX index, as a result of weakness in its biggest counter-component the euro.

There was a minor option expiration for the Nov gold contracts on the Comex yesterday.

The levels of physical gold available for demand in Hong Kong in the Comex sanctioned warehouses remains dismal with incremental physical gold going out as quickly as it comes in. Hmmmm..

We are likely to get a big positive number for US GDP tomorrow morning.

Let's see how the Street plays it.

That may tell us quite a bit about where we are in this.

Have a pleasant evening.