Buoyant growth in the economy makes the financials system more fragile, in part due to the demand for capital and in part due to the tendency of some institutions to take on more risk than is prudent. Leaders in government and the financials sector implement policies that advertently or inadvertently increase the exposure to risk of crisis.

An economic shock hits the financials system. The mood of the market swings from optimism to pessimism, create a self-reinforcing downward spiral. Collective action by leaders can arrest the spiral, though the speed and effectiveness which they act ultimately determines the length and severity of the crisis."

Robert Bruner and Sean Carr, The Panic of 1907

Stocks did a mild pop 'n flop, or a wash and rinse as you may prefer, in honor of the stock market index options expiration.

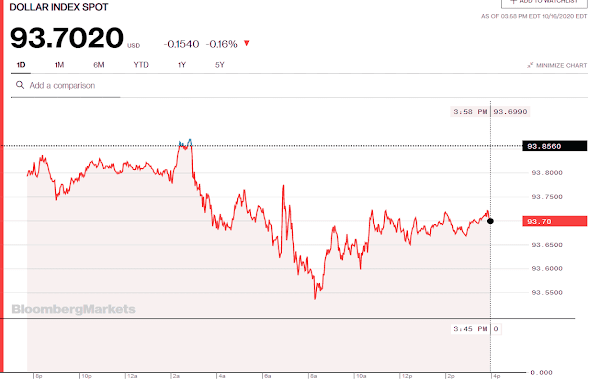

Gold, silver, and The Dollar were lower.

The VIX was slightly elevated.

Outside of algo-driven trading shenanigans, I am not confident that The Street has a better idea of what's going on, or coming over the horizon, than most others who are at least mildly informed.

Nonetheless, something of note is coming, and it looms closer by the day.

Have a pleasant weekend.