"The demand for silver may temporarily exceed available supply that is acceptable for delivery to the Trust, which may adversely affect an investment in the Shares. To the extent that demand for silver exceeds the available supply at that time, Authorized Participants may not be able to readily acquire sufficient amounts of silver necessary for the creation of a Basket.

It is possible that Authorized Participants may be unable to acquire sufficient silver that is acceptable for delivery to the Trust for the issuance of new Baskets due to a limited then-available supply coupled with a surge in demand for the Shares. ...In such circumstances, the Trust may suspend or restrict the issuance of Baskets.”

SLV Silver ETF

“As of the date of this prospectus, an online campaign intended to harm hedge funds and large banks is encouraging retail investors to purchase silver and shares of Silver ETPs to intentionally increase prices. This activity may result in temporarily high prices of silver.”

SIVR Silver ETF

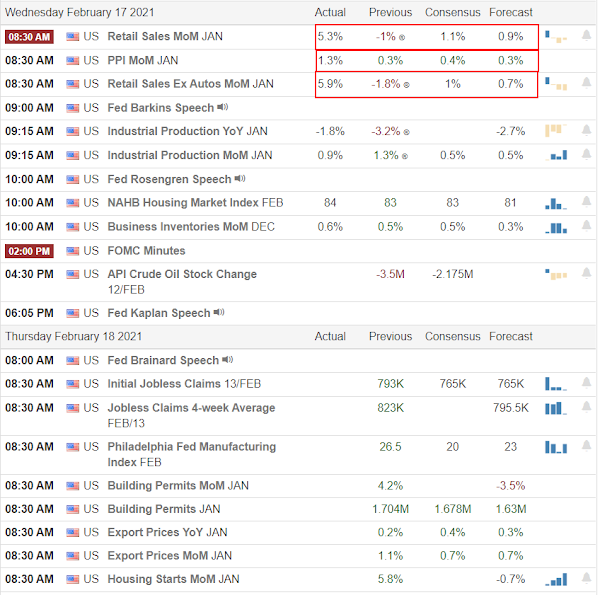

Stocks slumped hard today on the much stronger than expected retail sales number and the inflation in the PPI.

Just another sign how dependent stock valuations are on easy Fed money.

Gold and silver were thunked again, but silver came back for a gain.

Miners were hammered ahead of their stock option expiration again.

And another snow storm is on the way I hear.

The State of Texas independent power grid is giving major hardships to the public.

I began to get very bullish in my outlook for the precious metals today.

Let's see how things play out and then I will let you know what I may be seeing, if it develops.

Today is Ash Wednesday, the first day of Lent.

Repentance -Forgiveness - Thankfulness.

Have a pleasant evening.