After a deep overnight spike lower in the precious metals futures, designed to run the stops and skin the spec long out, gold and silver managed to snap back in the NY trading hours.

Early this morning I was telling some guys to look for the big cap miners and the silver fliers to lead the way higher ahead of the bullion futures if we were going to get a reversal, or at least a relief rally.

And that is what happened.

I did short the broader stock index, but only to provide a little hedge for the stock exposure in new miner longs taken on yesterday afternoon.

But that worked too, in its own right, as a little air from yesterday's moon launch leaked out.

While March may be a potentially risky month for stocks, overall the climate for equities is still bubble friendly.

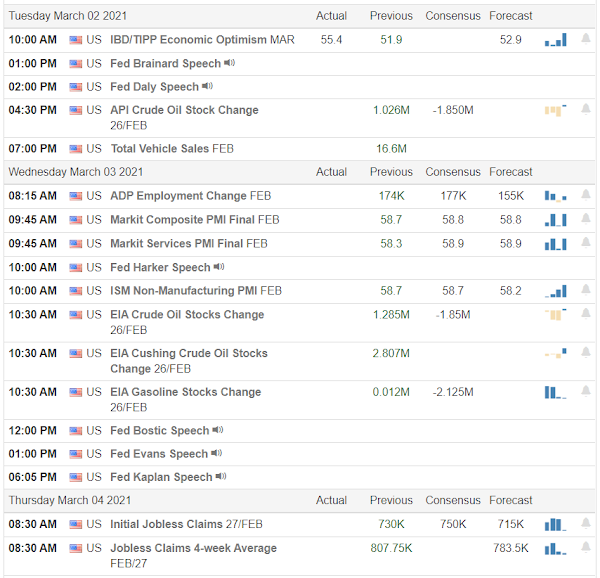

There will be a Non-Farm Payrolls Report on Friday.

I think the wiseguys were covering their bullion shorts, and even covering shorts and going long into some of the miners.

Even quality names with fairly strong 3-4% dividends were crushed in this take down of the bullion. We were seeing price levels going back quite a while to multi-year lows on the charts.

The bullion bear raid freed up a quite a bit of gold from the ETFs, which will help to relieve the pressure on physical in London and Asia.

Look for this kind of wash and rinse to repeat, as the gold pool continues to deteriorate. And surprisingly enough, silver seems to be getting in on this action.

JPM is sitting on a major silver hoard. Otherwise there are no central bank holdings of silver to speak of, to be deployed on leases to help out the bullion banks.

And while it was nice to make a gain on both ends, this was the trade for the day.

Let's see how we get past the Payrolls and finish the week, and try to determine if we have a practical bottom here after these antics, or not.

It is tough to see a coherent pattern on the daily gold chart.

On the silver weekly chart, however, the W bottom is still holding strong and survived a backtest.

If it works the price objective is in the high 30's. I have marked it on the chart.

But there are some very big 'ifs' in there.

And these are some very lightly regulated, almost verging on lawless, markets. We might have to cut Warren and Sanders some political slack if we want to see genuine financial reform. Gensler *might* be up for it, but I am not optimistic. And Biden is from the corporate wing of his party.

Trump and his crew were never going to reform anything. They didn't want to stop the soft corruption and crony capitalism— they wanted to private label it.

Genuine change and reform is going to be a long time coming, especially as long as our political system is mired in deep pools of dark money.

Let's see if the silver rocket can achieve liftoff, before we look for escape velocity. But it might be impressive.

Even though most of our yard is still covered in fairly deep snow, in the warmer areas around the house daffodils are rising, and crocuses and snowdrops are almost ready to bloom.

Change is coming, if but slowly, and then all at once.

Have a pleasant evening.