"The [unanswered] questions include why does silver have the largest concentrated short position in terms of real-world production of any other commodity? Next is why have the big shorts always been allowed to add as many new short positions as needed to cap the price and then buy back those shorts on lower prices? This is not allowed anywhere but on the COMEX. Finally, how could the 4 big shorts being the sole short sellers into the price rally into Feb 1, not show that these traders capped the rally? All while the physical silver market had never been tighter. I believe these are the only legitimate questions that matter."

Ted Butler, May 12, 2021, The Questions No One Has Legitimately Answered

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Upton Sinclair

The CPI came in much higher than expected this morning, causing the markets to sell off briskly on concerns about inflation and the Fed posture towards interest rates.

The Dollar rallied on the expectations of higher interest rates.

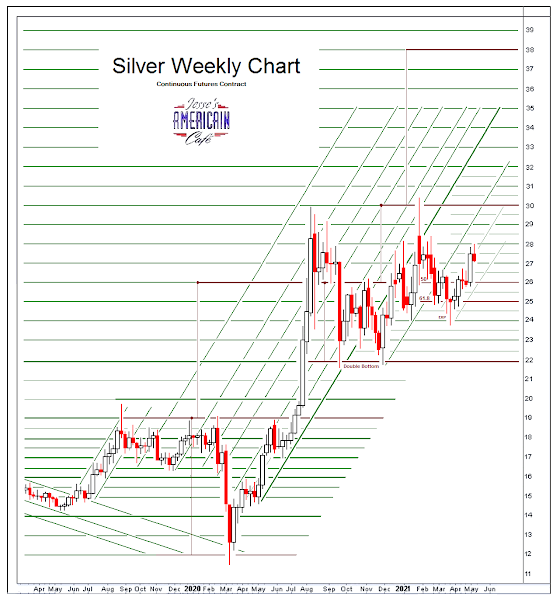

Gold and silver retreated.

Stocks sold off fairly sharply and steadily again, going out near the lows.

As a reminder there is still an open gap around 4000 level, lower than the close of the SP 500 today.

PPI tomorrow will give us a look at the wholesale inflation picture.

Personally I do think this is a sign of an uneven recovery from the Covid shutdown.

The results of the CPI were heavily skewed by just a couple of factors that are not likely to repeat over time.

But fear sells clicks.

And facilitate the wash cycle of a valuation wash and rinse adjustment.

Have a pleasant evening.

Here is a blast from the past. I remember almost every one. Some I have not thought about in years.

We only had three black and white channels to watch back then. So choices were limited.