“Fraud and falsehood only dread examination. Truth invites it.

Whoever commits a fraud is guilty not only of the particular injury to him who he deceives, but of the diminution of that confidence which constitutes not only the ease but the existence of society."

Samuel Johnson

Stocks were on a late afternoon tear, led by the real meme stocks, the big cap techs.

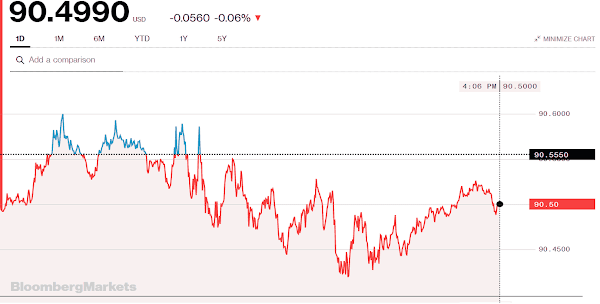

The Dollar edged a bit lower.

The VIX show a decline in the perception of risk. Or at least an increase in the mispricing of it.

Gold and silver were hit very hard in the quiet overnight trading.

They recovered quite a bit from the overnight losses, but still finished the day a bit lower.

The big tickle this week is the FOMC meeting on Wednesday.

This is a non-organic economy, and the stock market reflects that fully in its lack of value fundamentals and underpinnings.

One of the best indicators of this is the current declines in the velocity of money. There is very little organic growth from the money the Fed is throwing at the financial system and their patrons in one percent.

I doubt it will happen, but if M2 Velocity approaches zero the risk of a more serious monetary inflation becomes much greater. Tra la.

Adding to the state of shenanigans, there will be a stock market option expiration on Friday.

A bloodbath is coming in financial asset valuations. It is a matter of time now.

Probably later this year, or next, depending on how long the moneyed interests and their financiers can keep the long con going.

They will be weighed, and found wanting. And no one could have seen it coming.

Have a pleasant evening.