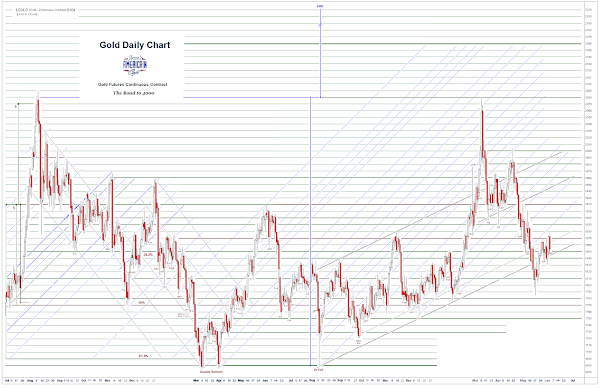

"It seemed as though the markets thought that there would be a weak jobs number tomorrow, which would put a chill on the Fed's zeal of rate increases.

Or it could just be a bulltrap, yet another means of skinning the speculators."

Jesse, 2 June 2022

"Over the last thirty years, the United States has been taken over by an amoral financial oligarchy, and the American dream of opportunity, education, and upward mobility is now largely confined to the top few percent of the population. Federal policy is increasingly dictated by the wealthy, by the financial sector, and by powerful (though sometimes badly mismanaged) industries such as telecommunications, health care, automobiles, and energy. These policies are implemented and praised by these groups’ willing servants, namely the increasingly bought-and-paid-for leadership of America’s political parties, academia, and lobbying industry.

If allowed to continue, this process will turn the United States into a declining, unfair society with an impoverished, angry, uneducated population under the control of a small, ultrawealthy elite. Such a society would be not only immoral but also eventually unstable, dangerously ripe for religious and political extremism.

Thus far, both political parties have been remarkably clever and effective in concealing this new reality. In fact, the two parties have formed an innovative kind of cartel—an arrangement I have termed America’s political duopoly, which I analyze in detail below. Both parties lie about the fact that they have each sold out to the financial sector and the wealthy. So far both have largely gotten away with the lie, helped in part by the enormous amount of money now spent on deceptive, manipulative political advertising."

Charles Ferguson, Predator Nation, May 21, 2013

"Why are people so reluctant to believe that sociopaths and narcissists can use the power of the pen to prey on people? Because they are well spoken and organized? We would contend that these are the most dangerous of the emotionally warped with a need to acquire, dominate and control, because they are smarter and more calculating than the impulse murderers, burglars, rapists, thieves, and pedophiles.

There is a need for economic law and enforcement as there is a need for the less cerebral, hairy knuckled criminal law and enforcement. The notion that people become naturally good, rational and well-adjusted because they are wearing a suit is ludicrous, especially to anyone who has worked with many of those who move in the upper echelons of money and power.

Some of the scariest people we have ever met were articulate and pathologically driven borderline psychopaths with a need to acquire political and economic power. It is the focus of their illness that makes them powerful. They are not distracted by the diffusion of emotional responses that color most people's actions. They have a need, and the will to satisfy it, no matter what it takes.

There will always be those at the extremes who need to 'take it to the limit,' with a well stocked foreign retreat in case things get ugly. But for most of us, restoring a sense of justice and order and putting the nation back into some kind of working balance will be high on the priority list, if not for ourselves, then for our families."

Jesse, Predator Class, 26 December 2008

A bulltrap it was indeed.

Whipsaw city.

A little of the old wash and rinse.

What a surprise.

I played it as a trap and it worked out fairly well. It was worth a go.

So, in honor of the Non-Farm Payrolls report gold and silver were smashed.

Stocks declined.

The dollar strengthened.

And Wall Street insiders win again. Hi ho.

I made some modifications to the CrashTrak model in the data for 1929. I tightened up the timeframes to bring it more into line with a 'crash' as a singular event, and not the ensuing depression that resulted from the numerous policy errors by the Republican government and the Fed.

The 1929 event was about three months in duration, and the 1987 was about two months.

Given the amount of government and Fed intervention in markets which became policy after 1987 I think we can be flexible about our current timeframes however.

A crash in slow motion?

Let's keep an eye on that second high and the principle of lower highs and lower lows.

I am also including a analysis of the 1987 crash that I did in 2004 for my old Geocities blog.

Have a pleasant weekend.