"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K."

Eddie George, Bank of England, From Reg Howe v. BIS, JPM et al.

"What is offensive is that they lie, and worship their own lying."

Fyodor Dostoevsky, Crime and Punishment

"It is in the gold lending market that the central banks of the world lend out their gold holdings to commercial bullion banks, where the physical gold is sold and shipped out, and where the central banks then claim to hold interest-earning ‘gold deposits’ with the bullion banks. These gold-deposits (which are merely a claim on a bullion bank) then mostly roll over short-term, passed around indefinitely between the clubby LBMA cartel of bullion banks, in a totally opaque behind the scenes network.

The physical gold bars lent out are long gone to Switzerland and the Far East, and the central banks then deceptively claim that they still hold the gold on their balance sheets when in fact all they have is a liability to the bullion banks. In the middle of this market sits the Bank of England, offering gold custody and storage to other central banks (in the vaults under the Bank of England headquarters in London) and offering gold accounts to the bullion banks concerned."

Ronan Manly, French central bank and JP Morgan team up to boost Gold Lending

The Dollar jumped to take the 114 handle today, off the weakness in the Euro, Yen, Pound et al.

This record Dollar strength poses serious earnings risks for dollar-based companies with international exposure.

Gold was hammered down to a multi-year low, along with silver.

Tomorrow is a fairly important Comex option expiration for gold, for the October contract.

What a surprise.

The physical inventories in Hong Kong Comex warehouses remained very thin.

Bonds are getting clocked by the rising interest rates, although the shorter term bills can be held to maturity.

Gold from the ETF selling may be some assistance, in addition to the usual Bank shenanigans.

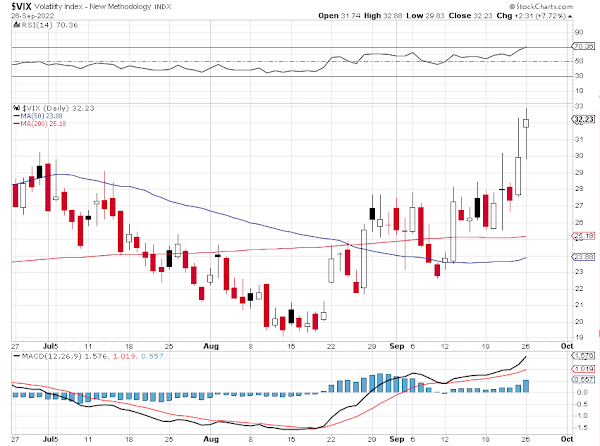

Stocks were lower once again, with the SP flirting with the important CrashTrak prior low.

I don't think we have seen capitulation in the equity markets yet.

Or from the gold and silver cartels in NY and London either.

What is the old market saying, Sell Rosh Hashanah and buy Yom Kippur.

But the high ground seems to be a reasonable good position for waiting, as indicated many times here previously.

Or perhaps even more appropriate for this year, Sell in May and go away.

The atonement for the Wall Street financial assets bubble compels the Fed to continue to feed our children's future to the Moloch of the money men.

But in this as always, remember what is truly important.

"The most important problem in the world today is your soul, for that is what the struggle is about."

Fulton J. Sheen

There are the three great gifts of His tender mercy.

Repentance - forgiveness - thankfulness.

Have a pleasant evening.