You may be reading more and more commentary about the platinum coin solution, and arguments why it doesn't really matter if the US does it or not.

To summarize the concept, the Treasury creates one special platinum coin, with a stated face value of $500 billion [Now a trillion they say] or so.

They trot down to the Fed and deposit the special coin(s), redeeming that amount of US notes and voila. It is an overt monetization [of debt], but the platinum coin adds a novel touch, and a bit of shiny misdirection...

But what people forget, or rather, what they would like us to forget, is that a modern fiat currency is based on the full faith and credit of the issuer, and the willingness of people in the market place to trust them, their word as contract, and the integrity of their actions.

Trust is a funny thing. One can bend it, twist it, and strain it by their actions over time. But at some point it may break.

And trust is gone, broken. And retracing one's steps to regain it is not a simple matter of a apologizing for and remediating their latest transgression, but a long slow climb back through what in many cases are years of continuing abuse and broken promises.

It is good to note that when dealing with people's resistance to accepting this monetization and artificiality of value, the MMTers quickly resort to arguments that involve the use of force, legal but even physical, in order to stifle dissent to an arbitrary monetary power.

That is the significance of taking the step of overt monetization at will, which is what the gimmicky platinum coin solution is all about. And those who promote it best understand that this is what they are doing, and be prepared for the consequences.

Jesse, Platinum Coin: Crossing the Monetary Rubicon, , 6 January 2013

Joe Weisenthal (pro) and Michael McKee (con) were discussing the 'trillion dollar platinum coin' solution to a debt ceiling impasse this afternoon on Bloomberg.

It's a goofy idea promoted around the time of the occasional 'debt limit' brinkmanship that occurs when the GOP has control of the House. I think of it as goofiness fighting goofiness.

The real solution is to eliminate this 'debt ceiling' completely, since it is dealing with programs that have already been passed by the House. It is a political circus wagon. An alternative to real legislation wielded by those who prefer hostage-taking and fear-mongering to thoughtful work.

The House always has the option of trying to limit programs through legislation. But that requires discussion and measured thinking, which is not an enhancement to demagoguery.

"The demagogue is one who preaches doctrines he knows to be untrue to men he knows to be idiots."

H. L. Mencken

And the Democrats have the ability to try and change things when they are in control of both houses, but they never do it seems. Everyone likes a good circus to keep the people distracted. And not every servant to the corporate and moneyed interests is as obvious as some.

Perhaps this is why some others are always cheerleading and promoting almost unthinkable wars every few years.

War is a racket. It's good for a few, and a tragedy to most.

It's old as Babylon, and evil as sin.

So stocks rallied today.

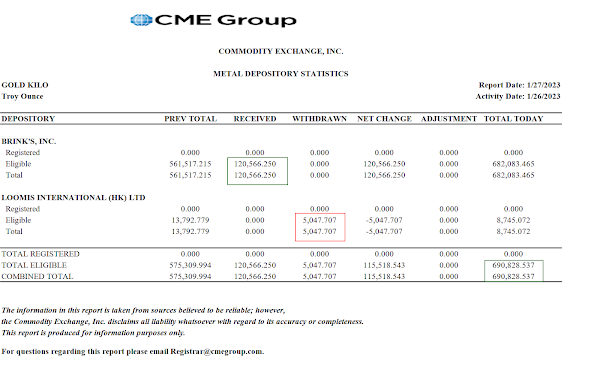

Gold and silver took the usual volatility ride after an option expiration.

VIX fell.

The Dollar edged just a little.

FOMC and Non-Farm Payrolls this week.

Have a pleasant weekend.