"If JP Morgan leases gold from the US Treasury it does not mean that they back up a truck in Fort Knox and drive the gold away. There is no need for that. It is just a paper transaction. The gold can sit in Fort Knox. JP Morgan can take a hypothecatable title. Now once JP Morgan has the gold what they do is they sell it at times 100 to gold investors who think they have gold but what they really have is what is called unallocated gold.

Unallocated gold is a euphemism for no gold. If I call up JP Morgan and I say, 'You know I wanna buy a million dollars worth of gold,' they will say, 'Fine. Here is our contract. Send us the million dollars.' I sign the contract. I send the million dollars. They send me a confirmation and it says I own a million dollars worth of gold subject to the contract.

Well, read the fine print in the contract. What it says is your gold is unallocated which means that they do not claim to have any specific bar with a serial number or your name on it. In reality they have taken the same bar of gold and sold it to a hundred different investors.

Now that is fine if we are happy with the paper contract, but if all 100 of us show up at JP Morgan and they have only got one bar of gold, the first person may get the gold. The other 99 people, they are going get their contracts terminated. They are going to get a check for the value of gold at the close of business yesterday, but they are not going to get today's price movement or tomorrow's price movement when super spiking going up to $2,000, $3,000, $4,000 an ounce. That is when you want your gold for the price protection when everything else is falling apart. That is when you are going to discover that you do not have gold."

Jim Rickards, Seeking Alpha: The New Case for Gold, April 2016

"The [Comex gold] exchange is a fractional reserve exchange, and they think that price will solve everything."

Kyle Bass, Hedge Fund Manager, Taking Delivery of Gold as a Fiduciary

"Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise."

Alan Greenspan, Congressional Testimony, July 24, 1998

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K."

Edward George, Bank of England in conversation with Nicholas J. Morrell, of Lonmin Plc, 1999, from Reg Howe v. BIS, JPM et al.

Today was a day of reversals in the recent market trends, just in time for the stock option expiration today.

What a remarkable coincidence!

Stocks fell.

The Dollar fell.

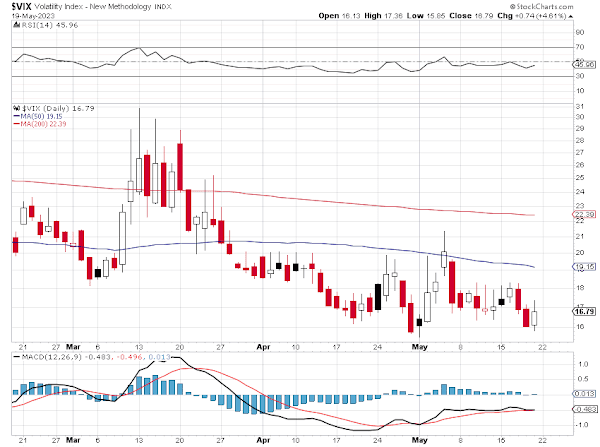

VIX rose.

Gold and silver rallied.

There will be a precious metals futures option expiration on the Comex next week on Thursday the 25th.

My son is exploring the wonders of amateur radio.

Among other things he obtains messages from the international space station as it passes overhead. He has an 'app' of course that let's him know where it is.

It is astonishing how easy it is to see, and how quickly it passes over the area. With the sun glinting off it even at 10 PM given its height, it is very bright, and could be mistaken for a fast moving plane.

Have a pleasant weekend.