“The 20th century has been characterized by three developments of great political importance: The growth of democracy, the growth of corporate power, and the growth of corporate propaganda as a means of protecting corporate power against democracy."

Alex Carey, Taking the Risk Out of Democracy: Corporate Propaganda, 1997

"How did we get into this mess in the first place? As in the 1920s, the current 'disturbance' started with a 'mania.' But manias always have a cause. If you investigate individually the manias that the market has so dubbed over the years, in every case, it was expansive monetary policy that generated the boom in an asset. The particular asset varied from one boom to another. But the basic underlying propagator was too-easy monetary policy and too-low interest rates."

Brian M Carney, Bernanke Is Fighting the Last War, Oct. 18, 2008

"We may make ourselves popular by telling our fellow citizens that they have made Discoveries, conceived Inventions, and made Improvements. We may boast that we are the chosen people; we may even thank God that we are not like other men. But after all it will be but flattery, and the delusion, the self deceit of the Pharisee."

John Adams, Letter to John Taylor, 29 July 1814

"We are entering a speculative mania now. Hysteria and passions are running high with greed and entitlement. When the reckoning comes, the insiders and moneyed interests will be blaming the small speculators. They always do. But they are at the heart of it, urging on the speculation, and steadily weakening the safeguards and regulations at every turn so that they can extend their outsized misappropriation of the nation's wealth."

Jesse, Mania, 26 January 2021

"It is equally beyond doubt, that every speculative mania which has run its course of folly and disaster in this country has derived its original impulse from cheap money."

The Economist, 1858

“In reading the History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds, 1841

"The period of financial distress is a gradual decline after the peak of a speculative bubble that precedes the final and massive panic and crash, driven by the insiders having exited but the sucker outsiders hanging on hoping for a revivial, but finally giving up in the final collapse."

Charles Kindelberger, Manias, Panics, and Crashes, 1978

"In a community where the primary concern is making money, one of the necessary rules is to live and let live. To speak out against madness may be to ruin those who have succumbed to it. So the wise in Wall Street are nearly always silent. The foolish thus have the field to themselves. None rebukes them."

John Kenneth Galbraith, The Great Crash of 1929

Tomorrow will be the Non-Farm Payrolls report for November.

And given that the risk markets are highly dependent on liquidity supplied by the Fed, its importance is greatly amplified.

So let's see how it goes.

The Dollar fell, losing the 106 handle. It's a bit surprising given the economic and political turmoil in Europe. The euro is the largest influence on the DXY index.

VIX marked time at a recent low.

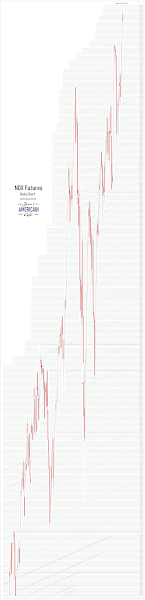

Stocks tried to rally but foundered, with the futures falling even further from unchanged after the close.

Gold and silver were suitable hit the day before the Payrolls, although silver managed to take back all of its losses from the open, finishing unchanged.

But as this latest episode of the Fed's meddling to support its increasingly parasitical banking system winds down, we see the aftermath of the bubble approaching once again.

And the neo-cons, the warhawks in Washington, are gorging themselves with abandon one what the financial system fails to consume of the real economy.

Where can one find a safe shelter from his hysteria, this willful mania?

Not in Bitcoin, of that I am almost sure.

And not in the self-serving strategic blundering of the likes of Blinken, Sullivan, and Biden. They are at the heart of decay and corruption in the bare bones of the Empire.

And almost assuredly not from act two of Don Trumpolini. It will be different, but not likely better.

One must look to history, to see what assets have endured the storms of human greed and foolishness, of broken promises and betrayals.

And stand, to remain standing, despite the lawless winds that blow through the land.

Have a pleasant evening.