"The London Gold Pool was the pooling of gold reserves by a group of eight central banks in the United States and seven European countries that agreed on 1 November 1961 to cooperate in maintaining the Bretton Woods System of fixed-rate convertible currencies and defending a gold price of US$35 per troy ounce by interventions in the London gold market.

The central banks coordinated concerted methods of gold sales to balance spikes in the market price of gold as determined by the London morning gold fixing while buying gold on price weaknesses. The United States provided 50% of the required gold supply for sale. The price controls were successful for six years until the system became no longer workable. The pegged price of gold was too low and runs on gold, the British pound, and the US dollar occurred and France decided to withdraw from the pool. The London Gold Pool collapsed in March 1968.

The London Gold Pool controls were followed with an effort to suppress the gold price with a two-tier system of official exchange and open market transactions, but this gold window collapsed in 1971 with the Nixon Shock, and resulted in the onset of the gold bull market which saw the price of gold appreciate rapidly to US$850 in 1980."

Wikipedia, The London Gold Pool

"Let us create a society in which it is easier for people to be good."

Peter Maurin

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K."

Edward 'Steady Eddie' George, Governor Bank of England 1993-2003, from Reg Howe v. BIS, JPM et al.

"God intended things to be much easier than we have made them."

Dorothy Day

"You might think that parking your money in a big bank like JP Morgan Chase would insulate you from fraud. It’s just the opposite. The big banks are the biggest perpetrators of financial fraud – fraud that affects millions of us, either directly or indirectly, on an ongoing basis. While they are wrist slaps when properly scaled, you can see the list of 'settlements' made between the government and the big banks here. These 'settlements,' the aftermath of Wall Street's near production of a second Great Depression, entailed not a single criminal indictment. The top two repositories of banksters, based on the number of settlements, are Bank of America and JP Morgan Chase.

The banks engage in fraud for two reasons. First, they profit from swindling the public. Second, they can get away with it via a simple technique. They buy off the regulators with promises of enormously lucrative jobs when they leave government service, and they buy off the politicians with huge direct and indirect campaign contributions."

Laurence Kotlikoff, When Banksters Buy Regulators and Prosecutors, Forbes, October 21, 2014

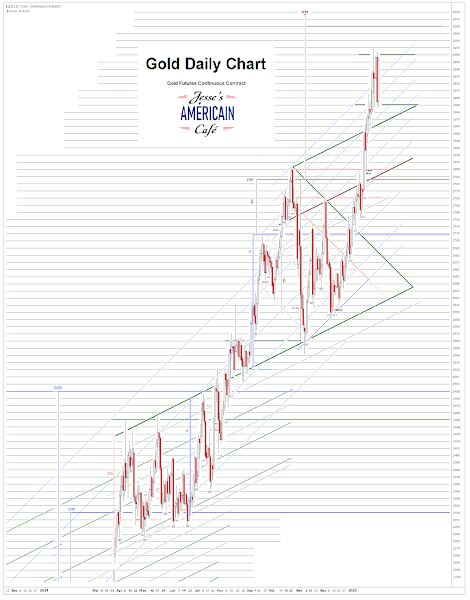

Gold and silver rebounded sharply from the calculated slamdown of last Friday. So why did they bother?

What they accomplished was to break the upward momentum of the precious metals, in order to keep their price 'under control' in heavy demand. And more importantly it loosened up some of the physical bullion that was being borrowed from certain funds at increasingly higher rates.

The precious metal complex in New York and London is highly leveraged, and gold is often leased and rehypothecated multiple times.

The collapse of a leveraged scheme like this can result is some serious fireworks in the financial markets.

Stocks managed to hold on and eke out some gains.

VIX wallowed.

The Dollar ticked up a bit.

There will be a stock market option expiration this Friday.

Precious metals futures contracts options expiration next week.

Each day we are becoming a creature of splendid glory, or one of unthinkable horror.

Often without really making up our minds to be either good or evil.

Have a pleasant evening.