“As observers of totalitarianism such as Victor Klemperer, I Will Bear Witness To the Bitter End 1933-1945, noticed, truth dies in four modes, all of which we have just witnessed.

The first mode is the open hostility to verifiable reality, which takes the form of presenting inventions and lies as if they were facts.

The second mode is shamanistic incantation. The fascist style depends upon 'endless repetition,' designed to make the fictional plausible and the criminal desirable.

The next mode is magical thinking, or the open embrace of contradiction. Accepting untruth of this radical kind requires a blatant abandonment of reason. Klemperer’s descriptions of losing friends in Germany in 1933 over the issue of magical thinking ring eerily true today.

The final mode is misplaced faith. It involves the sort of self-deifying claims. When faith descends from heaven to earth in this way, no room remains for the small truths of our individual discernment and experience. What terrified Klemperer was the way that this transition seemed permanent. Once truth had become oracular rather than factual, evidence was irrelevant. At the end of the war a worker told Klemperer that 'understanding is useless, you have to have faith.'

If people feel lost and alone and broken and hopeless today, what will it be like if the world begins to come apart at the hinges? Jesus was a man for simple people. He didn't make his messages incredibly complex. If you were a person that had the eyes to see and the ears to hear, then his message was easily understood.

Many who claim today with their mouths that they follow Jesus will abandon him then with their lives.”

Brandon Andress, And Then the End Will Come, April 2013

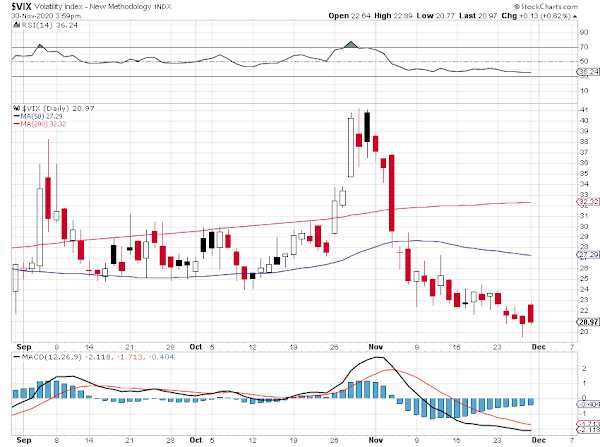

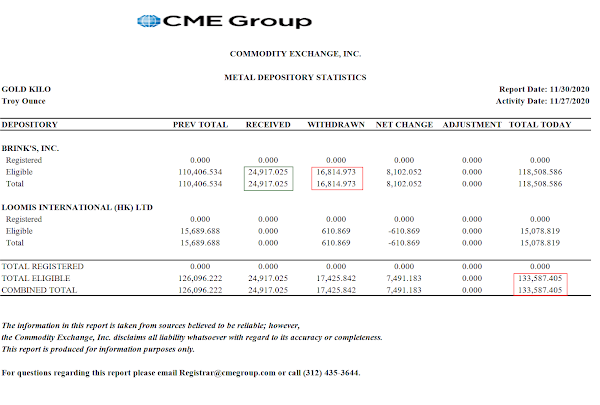

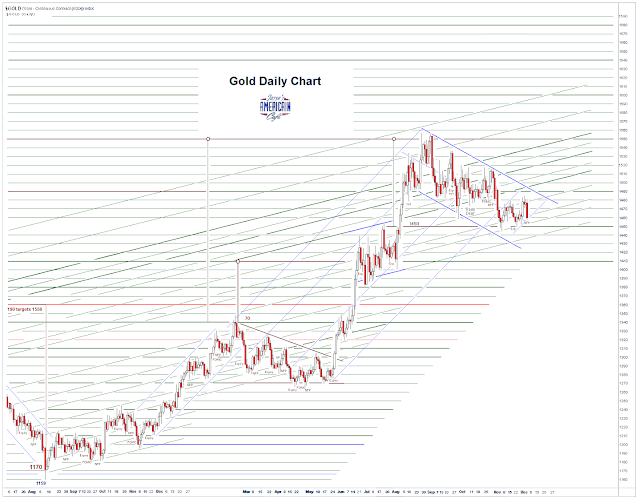

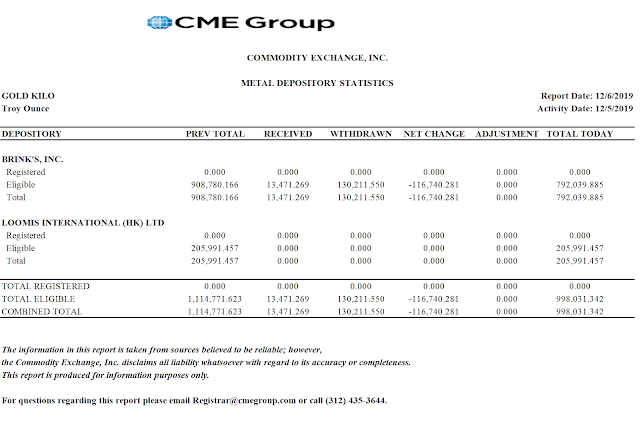

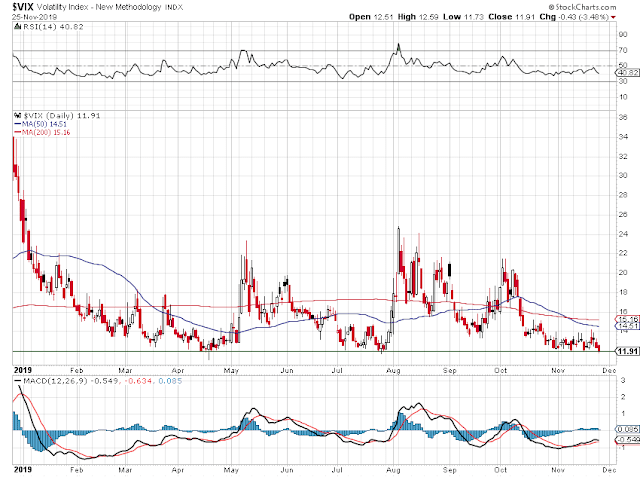

Today was an option expiration day for precious metals December contracts.

A classic wash and rinse for a big contract month. Take it up, and then smack it down hard.

Everything else is commentary.

If you have been following along here, you know what is likely to happen next.

How many times do you have to see this, to finally see it?

And yet this is far from the worst thing happening in plain sight, that few are willing to see.

Gradually, and then all at once.

Are you not yet entertained?

Have a pleasant evening.