Showing posts with label NAV of precious metal funds. Show all posts

Showing posts with label NAV of precious metal funds. Show all posts

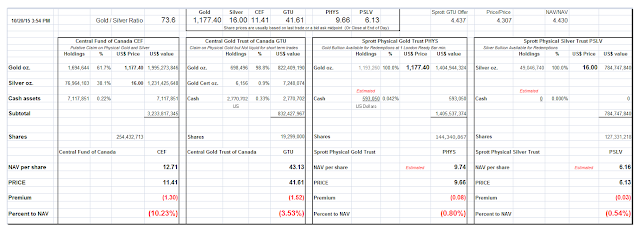

29 October 2015

20 October 2015

NAV Premiums of Certain Precious Metal Trusts and Funds

Sprott silver appears to be temporarily out of cash for current expenses.

Typically they have been selling off a little bullion in order to raise funds, since their premiums do not allow for secondary offerings under their current arrangements.

At at the bottom, central bankers extraordinaire Stanley and Janet take a QE Victory Tour by auto through the Swiss Alps, with Mario Draghi at the wheel.

Category:

NAV of precious metal funds

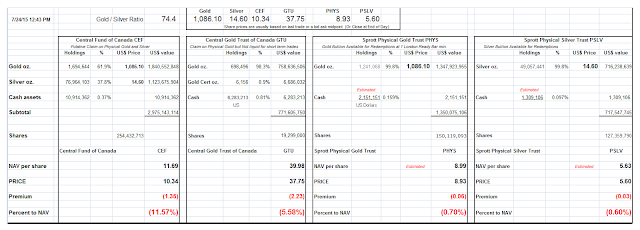

05 October 2015

NAV Premiums Of Certain Precious Metal Trusts and Funds

Since the last time I had updated their statistics on September 30, both of the Sprott Precious Metals Trusts lost a little bullion, presumably to redemptions. If they were bullion sales to raise cash, then they have no yet updated the cash levels with it.

Sprott Silver declined by 10,800 ounces, and Sprott Gold by about 2,231 ounces. There was a commensurate reduction in shares outstanding.

Category:

NAV of precious metal funds

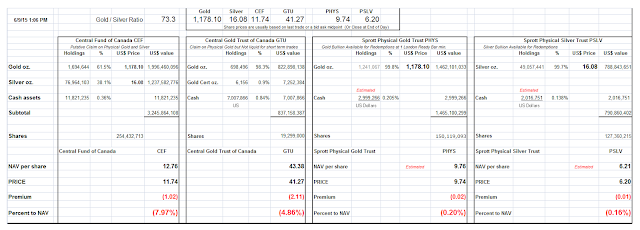

30 September 2015

17 September 2015

NAV Premiums of Precious Metal Trusts and Funds

If you are curious about the additional data on the top right of the spreadsheet, this is just the way in which I am tracking the market reaction to the Sprott offer for an exchange of PHYS for GTU.

As you can see the Sprott offer is almost spot on to a NAV/NAV calculation. There is a slight premium on Price/Price because of the greater discounting of GTU in its market price.

On this I am not accounting for any risks or expenses, merely the nominal market reaction.

The gold/silver ratio remains historically high at 73ish. I suspect that this is because the metals are enjoying a 'flight to safety' more than 'inflation being driven by a robust economy.' But it could be something else.

Category:

NAV of precious metal funds

10 September 2015

NAV Premiums - Comex Paper Ratio Rises to 228:1 - Sprott Gold Reports More Redemptions

"It is virtually impossible to get physical gold in London to ship to those countries now. We get permanent requests in Russia now. Would we please sell our physical gold to India and to China?

Because there is not enough physical about. There are endless promises. And I worry that the market, the paper market, could be stamped on and people say 'sorry we're going to have a financial closeout' and it's all over. If you want to be in the gold business, you ought to be in the physical business."

Peter Hambro

"I just got off the phone with A-Mark which is one of the world’s largest wholesalers. They are reporting that they have no gold and silver at all live available, that they have stopped taking orders for Silver Maples and Silver Philharmonics altogether and that Silver Eagles are available first in the end of November. For Pamp, there is similarly long delivery times for all minted gold bars.

We still have most products in stock because we stocked up as massively as we could in the last weeks but for many products, we are unable to replenish as of now when we run out."

Torgny Persson, BullionStar CEO

The ratio of potential claims per deliverable (registered) ounce of gold bullion has soared to 228:1.

How fortunate that September is not an 'active month' for gold at The Bucket Shop.

Sprott Gold trust lost another 34,356 ounces of gold bullion since the last time we checked their numbers on August 24th. This is just over one metric ton, or tonne.

Category:

NAV of precious metal funds

24 August 2015

NAV Premiums of Certain Precious Metal Trusts and Funds

Gold was functioning as a 'safe haven' this morning as the Dow Jones Industrials opened down 1,000+ points.

Silver was hit. I bought a little more to add to the new position from last week.

Stocks recovered from their early losses into the European close.

Let's see how the trading closes in New York this afternoon ahead of another day's trading in China.

The Street crawlers on the financial networks are pounding their desks for the public 'to buy the dip.'

Gold and silver were hit after the morning opening and will likely go out lower on the day.

I would be slow to do something like that. Very slow.

Category:

NAV of precious metal funds

18 August 2015

12 August 2015

NAV Premiums of Certain Precious Metal Trusts and Funds - The Windtalkers

There are 'no fundamentals.' Everything is just what we say it is, so buy our overpriced paper at a higher price than we recently paid for it. And no 'pet rocks.' Ah, the assorted wisdom of the grifters.

Yowza yowzer, get yer hot stocks and nekkid ladies.

I hope you don't allow this sort of nonsense to affect your longer term investment decisions about anything.

As for trading short term, that is a carny game. Go there at your own risk.

For some reason the Street's windtalkers have an uncanny way of cheerleading the 'small investor' into the latest trend tops, and bottoms, and right into the maw of the big trading desks.

What a striking coincidence.

They do not know the next big market trends with certainty anymore than you or I do, but they know how game the system and skin the rubes in the short term. And they do. Day in, and day out.

Financial manipulation is the friction that keeps the real economy from recovering.

A little more gold was redeemed out of the Sprott Physical Gold Trust since the last time I updated this chart.

I see from the CME clearing reports that Goldman and HSBC continue to add gold to their 'house accounts' even as the small specs had taken their largest short against gold on record as I recall.

These yuan devaluations may spark more interest in Asia in physical gold and silver as safe havens against currency depreciation, and as an alternative to paper asset bubbles in dodgy new era stocks and junk bonds.

So let's see if the metals can finally break out of this bear market grip.

Category:

NAV of precious metal funds

24 July 2015

NAV Premiums of Certain Precious Metal Trusts and Funds

The discount on CEF is remarkable.

The gold to silver ratio is quite high.

Both metals are oversold.

If the precious metals rebound silver will have quite a bit of catching up to do, and will likely outperform to the upside as they have outperformed to the downside. Beta giveth, and beta taketh away.

Silver has done this over the last six months for example.

Category:

NAV of precious metal funds

18 June 2015

NAV Premiums of Certain Precious Metal Trusts and Funds - Shenanigans /off

The premiums in the Sprott Funds remain tight, but certainly not as expansive as we had seen in the prior bull market leg in the precious metals.

It was nice to see gold rebound so sharply after the FOMC antics earlier this week. Silver is lagging a bit.

If and when the bull market returns in metals I would expect silver to outperform gold just on the basis of its greater volatility.

Last night I posted a few charts showing the extreme to which silver seems to have been driven. You may see them here. Others have written more eloquently and repeated about the expanding open interest in Comex silver on declining prices that suggests a shorting campaign by the bears.

If this is in fact the case, then they might very well get stuffed rather handily should silver turn and break out. But I suspect the ringleaders will have taken their gains by then and left some patsies holding the bag.

If this is in fact the case, then they might very well get stuffed rather handily should silver turn and break out. But I suspect the ringleaders will have taken their gains by then and left some patsies holding the bag.

The spread between price and NAV widened back out on the Central Gold Trust (GTU) after having narrowed with the announcement of the Sprott offer. Not quite sure exactly what to make of it, except that perhaps holds of the unitholders are not favorably viewing the offering which is intended to decrease the discount to NAV. I don't think it is a reversal of the arbitrage which we had seen narrow it down to around 4 percent.

Category:

NAV of precious metal funds

09 June 2015

NAV Premiums of Certain Precious Metal Trusts and Funds - Arc of Justice, Rising and Falling

The gold/silver price ratio remains extraordinarily high at 73.

NAV premiums are thin, which is a bit of a change from their more deeply negative trend.

In general, people with whom I speak seem discouraged, disheartened, tempted to hide in apathy and meaningless diversions. Those who promote reform see the monolith of a corrupted governance spoiled by big money that seems impenetrable. Truth is hidden and whispered, with lies and deceptions abounding, spread by the megaphone of the mainstream media.

It can be discouraging indeed, to see the sense of duty and honour so poorly treated in this triumph of the age of greed. There is a temptation to see ourselves at some low point, lower than those who have gone before us, and then to wallow in apathy and inaction, in a kind of a sick hopelessness that 'nothing can be done.'

But this is where a sense of history and of human nature can provide to us a great comfort and encouragement to continue on. Liberty and the hopes and aspirations of the common people are always rising and falling, as is the rise and fall of wickedness, and the darker powers of this world that at times would seem to block out the very light.

And yet if we have read and understood what our fathers and mothers, and our grandfathers and grandmothers and those who went before them faced, it does not seem so terrible now, not at all.

There is only one real difference. Now is our time to take up the reins of humanity, and stand and work and wait for the inevitability of the human spirit to rise once again, if we will only continue on in our struggle and endure with hope and faith in ourselves and a higher power that arcs, if slowly but faithfully, towards justice.

And perhaps we might remind ourselves that we have not lost, we can have a personal victory that matters, if we can maintain the spark of love in our hearts. And bear in mind that the struggle is never over in this world, but that our own struggle only will be over when we go to our final rest, and hand over the instruments of our warfare to those who come after.

This is the nature of the world and of our humanity, always winning and losing, rising and falling. At long last, the world will pass away, and does not matter. Money is necessary, but it is not the end of the game. Power will not sustain our soul when we are stripped naked. These worldly prizes are not winning, they are snares and traps. Having riches will not 'enable you to do good.' It would corrupt and condemn you to a life of graceless desperation. What matters is how we have lived and loved, and what we bring with us when we finally face the last.

But for now it is our time to take up the struggle, and to act to promote justice and to prevent the spread of oppression and deceit. This is our calling. People may ask, 'Look at the way things are. If there is a God, why doesn't He do something about it?' And He did. He sent us.

But for now it is our time to take up the struggle, and to act to promote justice and to prevent the spread of oppression and deceit. This is our calling. People may ask, 'Look at the way things are. If there is a God, why doesn't He do something about it?' And He did. He sent us.

So despite these failings and misgivings, despite the short term triumphs of those who would use the body politic as their personal servant, and harness the moneys of the world as their new armies for plunder and colonization, we might, with some eye to history, take courage in the words of the great lights of history who shine across the ages for us like beacons. As William Gladstone said in the fight for voting rights for the common people:

"You cannot fight against the future. Time is on our side. The great social forces which move onwards in their might and majesty, and with the tumult of our debates does not for a moment impede or disturb-- those great social forces are against you; they are marshaled on our side; and the banner which we now carry in this fight, though perhaps at some moments it may droop over our sinking heads, yet soon again will float in the eye of heaven, and will be borne by the firm hands of the united people of the three kingdoms, perhaps not to an easy, but to a certain and to a not distant victory."William E Gladstone, Representation of the People Act Speech, 1866

02 June 2015

NAV Premiums of Precious Metal Trust and Funds - 15,230 Ounces Gold Redeemed From Sprott

Since the last time this was posted on May 29, about 15,230 ounces of gold were redeemed from the Sprott Physical Gold Trust. That represents a bit less than half a tonne, and $18,276,000 at $1200 per ounce.

With the discount to NAV so slim at about 0.32%, or around $58,000, less fees and storage costs, there might be another reason to do something like this other than a pure arbitrage. I can see someone doing it to take the gold as a long term physical holding, and to essentially avoid the Sprott management fee. But again, why take it out of the ETF and not the Comex? Is the Comex somehow more difficult than usual in obtaining physical delivery out of the system?

Yes, Sprott has an offer out to acquire some gold and silver assets at GTU and SBT, but an arbitrage on acquisition could be carried out in the conventional way buying and selling the units in size with leverage, not taking delivery of a relatively small amount of gold.

If one were to take that gold and move it into a Far Eastern market where physical commands a premium it might make more sense.

Before you ask, the Trust did not 'sell it' because their cash level has not increased commensurately with such an action. And if an individual holder of the units wanted to raise cash for some purpose, the sale of the units themselves on an exchange is much more cost effective. No it seems more likely that someone wanted gold bullion for some reason.

Funny way to take your delivery, isn't it? Out of the ETFs. Rather than buying futures contracts and standing for delivery on the Comex, for example, or in the so-called wholesale market in London.

Curiouser and curiouser.

Category:

NAV of precious metal funds

29 May 2015

NAV Premiums of Certain Precious Metal Trusts and Funds

Sprott has made a formal offer for the Central Gold Trust which has certainly pulled the discount to NAV in quite a bit since they first disclosed their plans some time ago.

The Gold/Silver ratio remains historically high at 71.

The Sprott funds have their usual precious metals flat market price with a slight discount to NAV. Few animal spirits there.

Category:

NAV of precious metal funds

05 May 2015

30 April 2015

NAV Premiums of Certain Precious Metal Trusts and Funds - Silver Active In May Delivery Report

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it."Sir Eddie George, Governor Bank of England 1993-2003

And I think they have been desperately attempting to cover up the consequences of their poor decision making in in bailing out the speculative interests of their banking cronies for the past sixteen years, while digging the hole in which they found themselves ever deeper.

The expected FOMC slam on the metals happened this morning with the news that new unemployment claims were much lower than expected.

That the economic news this morning also showed *zero* growth in personal income was ignored.

Jobs without living wages. Is this like making bricks without straw?

May is an active month for silver, but not for gold.

So we saw a spike for silver in the delivery report from yesterday as May becomes the silver front month.

I have included that report below. As a reminder, although the number of ounces is large, the volumes moving around the warehouses are also larger than gold.

Still, I wonder what the wiseguys will do if silver ever becomes in short supply, since the central banks do not hold any, and the US long ago depleted its strategic supply.

What happens when there is a run on the bullion banks again?

Excess leverage on supply constrained assets. Ain't it a bitch?

Category:

NAV of precious metal funds

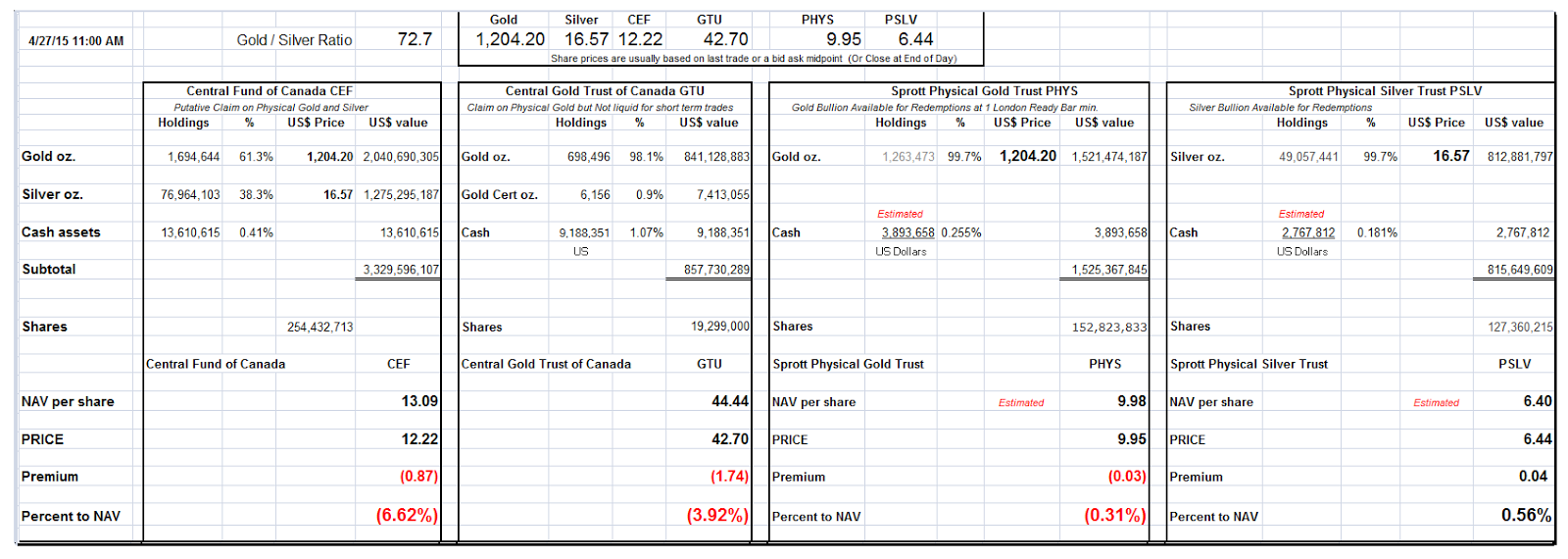

27 April 2015

NAV Premiums of Certain Precious Metal Trusts and Funds - FOMC On Wednesday

I think we have a little short squeeze going on this morning. I have not looked at the composition of the option trade or the futures contracts but maybe some specs came in leaning on the short side, looking for some easy money on an option expiration.

As a reminder there is a two day FOMC meeting this week with their rate decision on Wednesday. My friend Dave thinks this is a setup for that. Perhaps he is right. The price riggers like to take a price up to lure in speculators, and to have their raise their stop loss arrangements, to make the price hit more effective.

This is a bucket shop after all. That is what most of the US markets are becoming.

I tend to watch support and resistance and try not to predict the future. There is some precedent for a smackdown on the FOMC announcement as we all know.

Category:

NAV of precious metal funds

20 April 2015

08 April 2015

NAV Premiums of Certain Precious Metal Trusts and Funds

There has been quite a bit of silver bullion activity in imports to Turkey as noted here.

Otherwise the action at the bucket shop on the Hudson has been the same old same old.

Premiums are dampened as usual.

Category:

NAV of precious metal funds

06 April 2015

Subscribe to:

Posts (Atom)