skip to main |

skip to sidebar

This is the news report that rallied US stocks this afternoon.

And we might suspect that this is the root cause for the major bear raid on gold that occurred earlier today.

The Guardian UK

France and Germany Agree to €2 Trillion Euro Rescue Fund

By David Gow in Brussels

France and Germany have reached agreement to boost the eurozone's rescue fund to €2tn (£1.75tn) as part of a "comprehensive plan" to resolve the sovereign debt crisis, which this weekend's summit should endorse, EU diplomats said."

After the bell Yahoo and Intel both showed positive results with Intel increasing its stock buybacks.

Waiting for Apple.

Update: Apple missed! The shortfall was in iPhone shipment and iPads/iPods.

But they then RAISED their forecast for next quarter. This could be a sales effect, shifting

buying from this quarter to next based on buyers waiting for new models.

"Tricks and treachery are the practice of fools, that don't have brains enough to be honest."

Benjamin Franklin

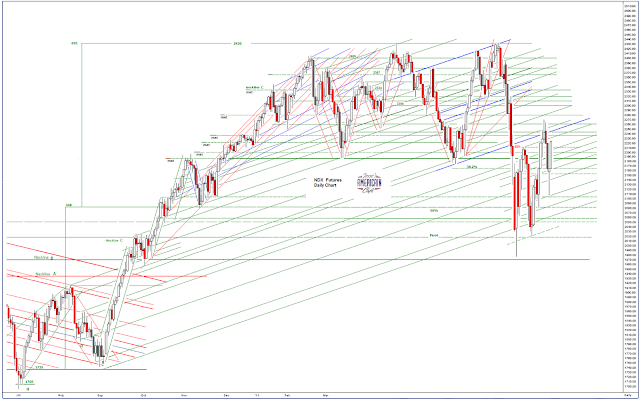

This is about as far as it goes before breaking out, and the volumes had better pick up because they are too thin to sustain a new bull leg just yet.

The G20 are meeting over the weekend and expectations for a comprehensive solution to the European debt crisis are high.

More of the Financials report their earnings next week. They could be disappointing.

I see a higher risk here for a surprise to the downside, but absent that the liquidity can take it higher first.

I will be surprised if the G20 meets expectations for a general resolution to the debt crisis.

A big rally on Wall Street today as the bond market was closed for Columbus Day. In other words the adults stayed home. So stocks had their way on hopes that Merkel and Sarkozy would come up with a feasible plan to take the French and German bank debts on to the public balance sheets, or at least whichever part is not served up as a haircut to bondholders and bank shareholders.

The US is keenly interested in this because despite assurance otherwise the contagion and counterparty risk with Wall Street is significant.

Volumes were very low so the rally was not as impressive as one might imagine. But the shorts were there and they were squeezably soft and overexposed.

This will likely continue to be an event driven market and when the events subside, then the gimmicks and technicals of the traders take over.

The markets were under three primary influences today.

An FDIC memorandum concerning the details of the Volcker Rule which will be voted on next week was leaked, and it has some strong prohibitions about insured banks engaging in proprietary trading. The bank lobbyists were on full alert, and the politicos will be buzzing in the Capital this weekend. Try the steak and lobster at The Palm with peas and pearl onions with an apertif of soft money bribes.

The Non Farm Payrolls Report came in a little stronger than expected albeit because of a one time addition of 45,000 returning strikers. The recovery is there, but fragile, awaiting only a stiff dose of austerity to bring it crashing down, for the sake of short term political gains. Cloudy today with a chance of more economic hostage threats tomorrow.

Fitch issued downgrades of European debt (Spain and Italy) during the day, which had a marked negative effect on risk perception. The credit agencies have suddenly become fearless international macroeconomic forecasters. And you wondered why Ben and Timmy kept them around.

The equity markets are a nearing key resistance, and VIX is near the bottom of its intermediate trading range. The financials remain very sensitive to risk because they are, after all, the court officials of the credit bubble hive, right after the queen bee Treasury.

Have a pleasant weekend.

"Heroes are not giant statues framed against a red sky. They are people who say: This is my community, and it is my responsibility to make it better. Interweave all these communities and you really have an America that is back on its feet again. I really think we are gonna have to reassess what constitutes a 'hero.'"

Studs Terkel

Big up day, third in a row, ahead of the Non Farm Payrolls report.

It was 'risk on' today. Let's see if it can hold through the weekend.

Not a strong close for the month to say the least.

Traders were not interested in hold long positions over the weekend.

See you on Monday.

Stocks are still weak, and in a trading range, looking for some impetus to their next big move, up or down.

The old Wall Street adage says:

"Sell on Rosh Hashanah and Buy on Yom Kippur."

Rosh Hoshanah begins at sundown on Wednesday, 28 September this year, and Yom Kippur at sundown on Friday, 8 October.

And the selling did come in today as stocks turned lower after a stronger open.

We are into the end of the month tape-painting period, and barring any fresh negative developments from Europe we *might* have seen a bottom to the selling. But...

There was a gathering of hedge fund gurus today, including the heads of Carlyle and Blackstone. And some of these wealthy and worldly wise sages are saying that the US needs a 'financial shock' to scare the politicians into action, presumably some action that they would approve. Some shock like back to back 1000 point down days, or several huge drops in the dollar.

And Europe is floating the idea of a financial transaction tax again, which would have a devastating effect on the HFT crowd since the amount, although slight at about .1% for stocks and bonds and .01% for derivatives adds up when you are doing thousands of transactions per hour and running trillions in derivatives. The Wall Street crowd is adamantly against it, almost Dimon-esque in its opposition. I suppose that a nice wide exception for the wiseguys would work, but Europe does not seem as inclined to pander as the Yanks.

More threats to the economy from the financial sector? Why not, it has worked every time so far.

So the US market is jittery, and it is hard to see them stick a rally with any conviction in this environment of high volatility and artificial money flows guided by a few hands.

A vote in Germany on the bailouts is coming so let's see how it goes.

We get the third estimate of US Second Quarter GDP on Thursday but otherwise the domestic news is light, and US markets are being dominated by sovereign debt concerns in Europe.

US stocks bounced hard today from a deeply oversold short term position.

However, the proximity to support in a somewhat cynical trading range is notable.

If it breaks out of that channel, either direction for more than a day, stay out of the way unless you are riding the trend.

Big drop in the US stock market on European jitters and recession fears.

Markets are starting to look for support here, with biggest tell in the NDX. Let see how that develops.

Potential 'island top' in the Vix.

Then again, things could continue to deteriorate. But the probability is that unless we are going to hell in a handbasket, the wiseguys are already starting to buy back in.

Stocks sold off sharply and went out on their lows as the Fed did exactly was was expected, no more no less, but went on to cite 'significant downside risks.'

Given the downgrades of US and Italian banks this was too much for trader's to take, and there was a flight into the dollar and Treasuries, the latter at least in part as a reaction to Operation Twist which will be buying in the 6 to 30 year Treasuries.

It will not surprise me to see a rally tomorrow, grinding higher perhaps after a weak open, and gaining momentum after the European close. Or perhaps I am just being too cynical. So let's see what happens.

Stocks were rallying today, when fresh jitters about a Greek default caused the afternoon trade to turn south, finishing almost even to slightly in the red.

I suspect quite a bit of that selling was due to traders squaring up their positions ahead of the big Fed announcement tomorrow.

Expectations of some action from the Fed are high. Reassuring words alone will not sustain the equity markets. If the Fed does nothing we might see stocks sell off badly.

As a reminder, tomorrow is a 'quad witching' day for equities in the US.

Next week there is a two day FOMC meeting, and the Comex will have an option expiration.

Volumes were light on the NYSE today with under a billion shares traded.

I found this story on the $2 Billion trading loss at UBS to be interesting. I was going to write something in this vein, but he says it quite well. Rogue Trader My Ass - Matt Taibbi

The Banks must be restrained...

“I’m very close to thinking the United States shouldn’t be in Basel any more. I would not have agreed to rules that are blatantly anti-American. Our regulators should go there and say: ‘If it’s not in the interests of the United States, we’re not doing it'...

I think any American president, secretary of Treasury, regulator or other leader would want strong, healthy global financial firms and not think that somehow we should give up that position in the world and that would be good for your country. If they think that’s good for the country then we have a different view on how the economy operates, how the world operates.”

Jamie Dimon, in an interview with Financial Times

Europe may consider taking Mr. Dimon up on his offer, and ban the participation of the unreformed banks and their associates from all activity in European markets until they reform themselves, and park their arrogance at the border.

But I believe that the Iceland and Sweden models are the appropriate response for dealing with reckless banking losses, that is, nationalize the bank and force the principals to eat the losses, so this might be skewing my opinion on this.

To do this, one might best consider the appropriate role of banks vis a vis the sovereignty of nations, and this is one area where I have some sympathy for those who have some sense of historical proportion, and even the Modern Monetary Theorists, who generally do not.

I think the failure to reform the banking sector when he had the best opportunity will be viewed as Obama's fundamental policy error from which all his other errors flowed. What else can one expect with advisors like Summers and Geithner.

I am rereading Berlin Diary 1934-1941 by William Shirer, and this also is probably prompting me to view some of the developments of the last three years in a slightly different historical perspective. How else can one interpret the incessant demands, the threats, the overturning of the rule of law, the endless appeasement in order to maintain order, the corruption of public officials, and the bully boy attitude of those most recently caught in frauds and massive encroachments on the public sector?

I don't think it is possible to view the US market action too cynically or skeptically today, if not in general.

The chip stocks led the way higher, with a faux fear masking the real action.

“A psychopath can tell what you’re thinking but what they don’t do is feel what you feel. These are people without a conscience.”

Bob Hare

It was 'fear on' as concerns about a Greece default had stocks selling off led lower by the financials. The VIX remained elevated. We will have to see if anything comes out of the G7 or the ECB before Monday.

The Ten Year Treasury hit a record low of 1.91 yield today.

Gold and silver were repeatedly pummeled but remained resilient in the light trading sessions overnight and in the access market this evening. The perception management was painfully obvious.

Although there were many smacking Obama today, it was not clear what he might have offered as a solution to please the Congressional sociopaths on the right, except human sacrifices of the poor, the elderly, the immigrants, and the different. The hyper-polarization of the monied interests has been inflamed by the moral hazard of the bailouts and excuses of the financial sector fraud. These fellows despise conciliation and compromise as weakness.

This is one of those remarkable episodes in history that Americans, Europeans, and Brits might have trouble explaining to their grandchildren. But ignorance is a familiar excuse.

The market paused to listen to an address from Bernanke, and for the Jobs Talk by Obamination this evening.

I do not hope for anything innovative. Perhaps a refi program and some payroll tax break.

A payroll tax suspension is tantamount to taking the money from Social Security, which is why the Republicans might favor it.

America is being held hostage by the monied interests.

Big rally today and a relaxation of the fear trade.

Republican candidates debate tonight.

Obama, more right of center than the raving socialist than the spinsters paint him, should join them as a placeholder for the Nelson Rockefeller wing of that party.

Ron Paul will stick out like a sore thumb. He is third party material, although his libertarianism suits the rapacious. Still, he is not in favor of supporting the Wall Street Welfare Queens and the Military Industrial Complex in the manner to which they have become accustomed, so he will be marginalized by the GOP.

Better accept your corporate masters, or the socialists will take your money and give it to the weak, the immigrant, the unworthy. Such simplistic arguments rarely fail to sway the unthinking and the fearful.

The plight of US corporations, which are enjoying the lowest effective tax rates and fattest profits in years, and who are still digesting the gains of fraud from deregulation and pocket politicians, will be trotted out en masse like a Memorial Day Telethon for Pig-itis.

Cut corporate taxes, deregulate, free the market from the burdens of government, and the riches will trickle down to the middle class. That is what we will hear, with little to the contrary.

One would think that CEOs are standing in breadlines, the banksters are going to Coney Island instead of frolicking in the Hamptons, and their wives are driving Fords instead of Ferraris.

Where is the Justice? Where is the Reform?

The hardy individualists in the financial sector are letting Benny know that they need another government QE handout, and expect it to be delivered at their September meeting.

Despite the big decline in the overnight, it fell to a predictable support level, and drifted up much of the day on light volume.

The bulls are still not out of the woods. Obama gives his jobs speech on Thursday. He sounds like Nelson Rockefeller moreso than Franklin Roosevelt, so I am not expecting much in the way of innovative ideas.

Markets sputtered on light volumes and largely technical trade ahead of the Non-Farm Payrolls tomorrow.

Consensus of economists is +110,000 jobs for non-farm private payrolls, and +70,000 overall including government.

I am of an open mind to see the equity market react perversely to a low number tomorrow. It would be one of this reactions that says, 'since the number is bad, then the Fed will ease and so stocks can rally.'

Or not. This is an iffy one especially because it comes in front of a three day holiday weekend.