Showing posts with label SP Daily Chart. Show all posts

Showing posts with label SP Daily Chart. Show all posts

26 August 2011

25 August 2011

SP 500 and NDX Futures Daily Charts - Coiling for a Move

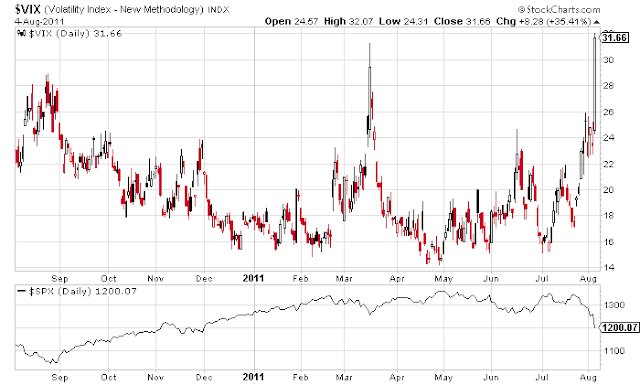

Volatility remains elevated, to say the least, and the major indices appear to be 'coiling for a move,' as they say.

Hurricane Bernanke may provide whatever is required to make that move happen tomorrow, either by what he does, or does not do.

I would look for some aftershocks from this in the coming weeks as additional economic data rolls in.

I ended up NOT going short stocks, since playing the dip in gold and some miners today and flipping out of them into the close provided a more than sufficient amount of short term kicks, bangs and thrills. I had to remind myself that I am not a daytrader these days, and such extravagant profits are often illusory, being quickly dissipated by losses.

Category:

NDX Daily Chart,

SP Daily Chart,

VIX

24 August 2011

SP 500 and NDX Futures Daily Charts

On Friday Uncle Ben will be speaking from Jackson Hole, and the markets are eagerly awaiting some words regarding any version of QE3.

This is of course one of the best signs of how utterly dislocated and distorted the real economy can be.

It is also a clear sign of how many 'free market capitalists' are really on the government feedbag, from bailouts to subsidies to tax breaks, of one kind or another.

Category:

NDX Daily Chart,

SP Daily Chart

23 August 2011

SP 500 and NDX Futures Daily Charts

"As mentioned in previous quarterlies, the main long-term risk is that after two massive bubbles and two equally massive resurrection programs, the Fed may be out of ammunition.

Should more building blocks fall and a serious global double-dip develop, then the pattern of market behavior this time may be more historically typical. That is, instead of quickly recovering, markets will become cheap and stay below long-term averages for several years as was the case pre-Greenspan."

Jeremy Grantham

A big technical relief rally in stocks despite some very poor economic news, earthquakes and an approaching hurricane, lol.

The market was on support and deeply oversold. Yesterday was the 'stutter step' at support that indicated they were going to try and take it back up today no matter what. And so they did.

All eyes on Jackson Hole. I doubt Benny will roll anything out of significance, but some jaw-boning is de rigeur.

There is no economic recovery for people, just corporate people.

Category:

NDX Daily Chart,

SP Daily Chart

22 August 2011

SP 500 and NDX Futures Daily Charts - Banks Lead Shaky Market, Lloyd Hires an Attorney

A very volatile day on Wall Street as stocks came in higher from the overnight trade, but then lost their early gains and dipped much lower led by the Bank of America which is rumoured to be in trouble.

Stocks recovered their losses to be almost unchanged, but a late breaking story from Reuters quoted a 'government source' that Goldman Sachs CEO Lloyd Blankfein has retained an attorney, Reid Weingartern, from the White Collar Criminal Defense group at Steptoe and Johnson. Goldman plunged more than 5 percent on the news.

The action may be related to a subpoena received from Justice regarding the Carl Levin report, and possible perjury charges. Lloyd Blankfein is a Harvard Law School graduate himself, and is reputed to have a very smart legal mind. He could be acting out of an excess of caution. It is hard to imagine the Obama Justice Department actually DOING anything to any of the pampered princes of Wall Street.

Once again the markets are near the pivots and key support levels. Most likely a big move is hidden somewhere in the cards.

Category:

NDX Daily Chart,

SP Daily Chart

19 August 2011

18 August 2011

SP 500 and NDX Futures Daily Charts - Worries About the Double Dip

I noted yesterday that the failure to rally appeared a little ominous.

Stresses in the European banking sector had worried of another Lehman like spike in LIBOR and a eurodollar squeeze had the markets off balance all night.

The US market went down on weak economic new in initial claims and company prospects, but the Philly Fed came out with a dramatic contraction, and that sent equities tumbling and Treasuries soaring.

There was a pronounced flight to safety in the dollar and especially gold.

Tomorrow is option expiration, so the real market action will show up after the opening trades. Keep your eye on support levels.

Category:

NDX Daily Chart,

Philly Fed,

SP Daily Chart,

VIX

17 August 2011

SP 500 and NDX Futures Daily Charts - Uncertain Seas Ahead

As a reminder there is an options expiration for equities on this Friday.

A reader informs me that OptionsHouse increase the margin requirements for options to 100 percent today. Someone obviously expects some turmoil and wishes to reinforce their extended value at risk.

I was not encouraged by the failure to rally above resistance today, but in the short term anything can happen, especially with plenty of hot money and light volumes at traders' backs.

Category:

NDX Daily Chart,

SP Daily Chart

16 August 2011

SP 500 and NDX Futures Daily Charts

The European situation is starting to make Wall Street edgy again. The Merkel-Sarkozy proposal for a financial transactions tax especially spooked the financials.

The market is showing weakness, but there is a strong desire for it to recover. A long down or up candle this week may illuminate its next sustained direction.

"How far that little candle throws his beams!"

Wm. Shakespeare, Merchant of Venice

Category:

NDX Daily Chart,

SP Daily Chart

15 August 2011

SP 500 and NDX Futures Daily Charts - Options Expiration Week

As a reminder this is stock option expiration week.

Stocks were in rally mode today. The volumes were a little lighter than last week's downdrafts. Some might call this a seller's strike.

The key question for the intermediate term, is if this is a bear market rally, or a bull market correction.

The charts may provide us some information there.

The correction from the long rally proceeded as far as it possibly could before it would be called a new bear market. We are now seeing what might be a technical bounce.

It is the continuation from here, perhaps after this option expiration, that will let us know if this is a bull market correction, or a new bear market.

I am reasonably sure we will know by October.

Category:

NDX Daily Chart,

SP Daily Chart

12 August 2011

SP 500 and NDX Futures Daily Charts - A Nation of Financiers

"To found a great empire for the sole purpose of raising up a people of customers may at first sight appear a project fit only for a nation of shopkeepers. It is, however, a project altogether unfit for a nation of shopkeepers; but extremely fit for a nation whose government is influenced by shopkeepers."

Adam Smith, Wealth of Nations

Most people do not realize that it was Adam Smith who wrote this famous characterization. He was writing about narrowly mercantilist nature of the British Empire and its colonial market strategy. The exploitation of the Empire's resources and peoples by a few legendary companies is well known.

If one substitutes 'crony capitalists' or 'financiers' for 'shopkeepers' it might well be a decent fit for the latter years of the American Century's empire, which is based on a regime of guns and dollars.

As the Boer War marked the high tide for the Brits, and the invention of the concentration camp in their frustration, the American Century seems to be on the wane as well, resorting to camps of a sort of their own.

What broke it? Why is the American moment running out of steam? It is probably the failure to move to a non-military based economy after the cold war, and invest the peace dividend into domestic infrastructure and basic technology development for peaceful purposes and the improvement of life, instead of financial legerdemain, economic hoaxes and frauds. The stagnation of the median wage is telling.

Having fed so well for many years on war, the crony capitalists had to expand their operations at home again, and create new wars, to maintain their exorbitant privilege.

Will history judge them harshly? It all depends on who ends up writing the history. As the famous epigram observes:

"Treason doth never prosper: what’s the reason?Perhaps not so much as treason in this case, but plunder, and the betrayal of oaths and trusts, and fraud on a grand scale. But this control of history and the interpretation of events is a major component of the credibility trap that impedes legitimate reform.

Why, if it prosper, none dare call it treason."

We may see more action on Sunday evening depending on the developments in Europe. I believe the Iowa straw poll results for the American election will be released tomorrow, but they do have a spotty record of forecasting the primary results.

The elections will be interesting as they will represent a major power struggle, but conducted largely 'behind the scenes.' It is confusing I know, since the candidates have a somewhat wispy and ephemeral character about them, more like an ad for toothpaste than a profound and substantial leader of the free world.

We seem to have left those kinds of leaders behind several decades ago. Or at least the leaders are still out there, but they cannot obtain the leverage to make it into the selection process which is dominated with the taint of corporate money and the vested interests that seek only to maintain the status quo, the public be damned. I am not so much an idealist as you might think, having first started observating politics during the Kennedy era, with the Nixon and Johnson administrations that followed. I even recall the dark days of McCarthy and the Watergate hearings.

Politics is always a dirty business. But at least there was some hope that things would get done, and that a love of country and the Constitution would prevail at the end. One has to reach a bit for that feeling these days. There has always been a bad element. It is just there as a minority, and not prevalent and so widely accepted and tolerated.

These things move in cycles. The idealistic youth of a hard pressed generation spawn greedy and self-centered children of privilege and relative ease, but their grandchildren rebel against vain materialism and find their voices again. And so it goes.

Category:

credibility trap,

NDX Daily Chart,

SP Daily Chart

11 August 2011

SP 500 and NDX Futures Daily Charts - Abandon Ship

I hear today that a number of the Congressional participants named to the Super Committee to Balance the Budget have signed pledges never to contemplate any tax increases. Perhaps the Democrats should sign a pledge to cut no entitlements, and the first meeting they can ask, 'So what do you want to talk about tonight Marty?'

So once again the Great Compromiser appears to be a hapless diddler attempting to organize a herd of squirrels.

This US equity market action reminded me today of a description I read about the equity markets during the summer of 1929. The American Experience series used one of the books which I read to formulate their wonderful documentary, The Crash of 1929.

It was an exceptionally hot summer, and the market had ups and downs that left investors shaken as if they had ridden on a roller coaster. Leverage was high, and the markets were rife with speculation driven by newly created money and paper profits.

Of course there are profound differences as well. The markets are hardly optimistic, and we have already seen a strong correction. This is not to say that I expect the equity market to crash. They can always crash something else, like the dollar or the bonds, or the system of governance. Or perhaps the financial engineers will muddle through once again for a few more years.

Still it does not hurt to review an example of markets that were swinging widely because of serious problems in the economy, laissez faire politics, easy money policies, and the structure of the markets and their leverage themselves. Perhaps this time Benny does not tighten, but perhaps the government will.

Category:

NDX Daily Chart,

SP Daily Chart

10 August 2011

SP 500 and NDX Futures Daily Charts

It is going to take a selling capitulation with the DJIA down over 1000 points intraday, or some sort of government announcement or action to turn this market around.

It does seem to be trying to find some footing on the chart here, but lately that just means a pause before we see another downdraft.

Markets like this are deadly for bottom-pickers. Be careful. Rough waters, matey.

Category:

NDX Daily Chart,

SP Daily Chart

09 August 2011

SP 500 and NDX Futures Daily Charts

Any excuse will serve a tyrant.

Aesop

The Fed threw the market a bone, stating that they would maintain easing through the upcoming Presidential election if the economic conditions called for it.

And so a powerful relief rally ensued. Whether it will be maintained is another question and answer, heavily influenced by the upcoming economic reports, especially with regard to employment, median wage, and spending. And of course the sovereign debt situations and wobbly governments around the world.

Category:

NDX Daily Chart,

SP Daily Chart

08 August 2011

SP 500 and NDX Futures Daily Charts - VIX - Deeply Oversold at Must Hold Support

In the gold silver commentary tonight I will explain what happened today and why the markets reacted as they did. I thought the message was loud and clear.

US equity levels are down to the 'rally or die' level, and are completely and utterly oversold short term from a purely technical standpoint. However, this is the point where confidence could break, and stocks could move sharply lower if the situation is mishandled tomorrow, or later this week.

Say what you will about him, but Obama is certainly no leader, all show and no go, a profile in diffidence. But the polticial opposition for the most part are either self-preserving clones, or even worse, short sighted, reckless idiots on the payroll of sociopaths.

So it is a tough situation. lol.

The markets are looking for any excuse to rally. I would not bet the if-come yet, but would be aware of it.

Category:

NDX Daily Chart,

SP Daily Chart

05 August 2011

SP 500 and NDX Futures Daily Charts - US Debt Downgrade Looming?

Since the end of QE2 the stock market is down about ten percent.

Do not think that this is lost on Bernanke and the FOMC which meets next week.

After the bell there were stories that the US government is preparing for a sovereign debt downgrade by S&P. See the blog entry above for details.

I am not so sure that they will formally announce a QE3 on Tuesday, but I think that it is a good bet that between the Congress and the Fed there will be even more subsidies and supports for the banks and the corporations that surround them.

And these will be paid for the bottom 85 percent of the American people.

Category:

NDX Daily Chart,

SP Daily Chart

04 August 2011

SP 500 and NDX Futures Daily Charts - VIX - SELLOFF! - Fresh Calls for QE3

There was a major selloff in Europe and the US today as fears of slowing economies and a sovereign debt crisis intensified.

There was a flight to safety in the dollar and Treasuries, and early on in gold. But the price rise in gold and silver was cut short as selling increased and it turned into a general liquidation.

Non-Farm Payrolls will be released tomorrow morning.

The Federal Open Market Committee will be meeting next Tuesday. The cynical part of me suggests that this week is a setup for QE3.

Category:

NDX Daily Chart,

SP Daily Chart,

VIX

03 August 2011

02 August 2011

SP 500 and NDX Futures Daily Charts

As much as one can be, I was a little impressed that the NDX reached down to hit the support level I had drawn last Friday, some distance from where it had been. And the SP has also fallen to clear support.

These short term trends are now a bit extended, but the eyes will be on the economic data, especially the NonFarm Payrolls on Friday, and not the buffoonery in Washington with the Tea Party and the bought and paid for politicians.

There really is only one solution, and the prerequisite is political campaign reform. Partisanship is poison. But change cannot occur in times of influence peddling, bribery and corruption. So things must get worse before they get better.

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery.

Category:

NDX Daily Chart,

SP Daily Chart,

VIX

01 August 2011

SP 500 and NDX Futures Daily Charts - VIX - Daytrader's Delight

A big swing in the stock markets today, as they opened much higher, and then plummeted on the ISM report, and more jitters about the deficit faux deal.

NonFarm Payrolls at the end of the week. See the comments intraday below.

Category:

NDX Daily Chart,

SP Daily Chart,

VIX

Subscribe to:

Posts (Atom)