Tomorrow appears to be showtime for Turbo Tim, Zimbabwe Ben, and Leisure Suit Larry. The Yes We Can Man probably will get a few more chances if he throws one or all of them to the wolves if the plan fails which it probably will. We'll have to wait to see it.

If it is the "guarantee program" then it is only as good as the price floors of the guarantees. Too high and the banks are welfare queens. And to say that the 'market will set the price' with an implicit price guarantee from Treasury underpinning it sounds like the Son of Fannie and Freddie, and not even a remotely fair price for the taxpayers.

The most serious flaw in the solution, of course, is that bank lending is really not the problem. Easy money for lending was the solution Greenspan used the last five times we reached a point like this, a little worse on each revisit. We have probably reached the limit of the law of diminishing returns of hitting that old easy money for the banks booty call again.

Why? Because the consumers themselves have hit the wall. Years of suppressing the median wage and understating inflation as a matter of government industrial policy have left the consumer flat out busted.

Saving the banks so they can lend more is like fixing the holes and repairing the engines on the Titanic so it can ram the iceberg again. Can we please consider changing course?

09 February 2009

SP Futures Hourly Chart at Market Close

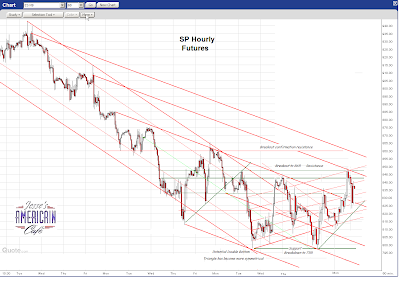

06 February 2009

SP Futures Hourly Chart at Market Close

The Street wants to bring IPOs to market next week so hide your women, children and small pets.

This can either be the top of a trading range, or the neckline of an inverse H&S bottom with a significant upside potential.

The markets will be looking for news on the stimulus package, but even more importantly, on a plan for the banks. There is significant disagreement in the Obama circles with regard to the banking bailout part two. Larry Sommers wants a 'bad bank' and Tim Geithner is promoting 'guarantees' but the crux of the matter is the valuation of the assets.

We are now at about day 20 in the Obama Administration, and there is a decided lack of serious reform backing up the rhetoric.

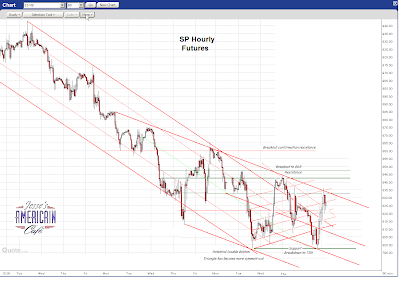

05 February 2009

SP Futures Hourly Chart

The Congress will be voting on the stimulus package tonight. We think the market has this baked in. The action today *could* have been a front-running of this news, but it had all the look and feel of a simple short squeeze. The specs were getting short ahead of what looks to be a bad Non-Farm Payrolls number tomorrow.

04 February 2009

30 January 2009

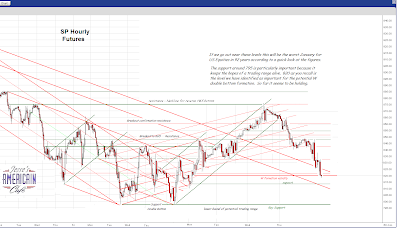

SP Futures Hourly Chart at 3:30

Postscript After the Close:Today is the last trading day for January. If we go out near the current lows of the day, this will be the worst January for US equities in the last 92 years.

The Dow Jones Industrial Average finished January down 8.84% on the month. Previously, the worst January for the Dow had been that of 1916, when it fell 8.64%. Friday, the Dow dropped 148.15 points to 8000.86 after briefly dipping below the 8000 mark. The Dow has fallen five straight months and in 12 of the last 15.

There will be no sustained recovery in the economy until the median wage improves. Allowing the banks to lend again to support consumption is a complete waste of capital. The purpose of not allowing bank failures, as in the 1930's, is not to save the banks, but to preserve the funds of private savers.

We should back the pensions and the savings of individuals one hundred percent. Government support should not be given to banks that are insolvent. They should be restructured first, and then recapitalized.

29 January 2009

SP Futures Hourly Chart Update at Noon

The SP futures failed at the resistance target and have rolled over to near support at 850.

We are still in the end of the month tape painting but earnings are deteriorating badly, causing some of the major players to start edging towards the exits, taking their profits from this double bottom rally off the table.

As an interesting change, there is a groundswell of interest among the wealthy to own physical gold bullion: not paper, not miners, not ETFs, but the actual gold. This was even referenced several times today on Bloomberg Television and in interviews from Davos. There are also fresh examples of delivery problems from Comex, and in particular with regard to 1000 oz. bars of silver which is something new. Previous shortages from commercial sources had been reported in the smaller unit bars only, with the Comex seen as a steady source of the big bars.

Part of this seems to be a swirl of talk coming out of London that there is going to be a bank holiday, and a major government action to shore up the financial system.

We do NOT have any particular insight into what is driving this and the specific short term timeframe. Rumours are easy to ignore since in the short term the technicals on the chart are most important to us, and specific news events. The macro events are on our 'radar screen' and are looking for any specific data or potential trigger events.

As a reminder, GDP for 4Q comes out tomorrow. Wall Street is bracing for the worst print since the Great Depression, on the order of -6%. Given the lags, and the monkey business that the Government plays with the numbers, we're not willing to bet on 4Q, although it does serve their purposes to come out badly, justifying the stimulus program.

"The wind blows where it will, and you hear the sound of it, but you do not know whence it comes or whither it goes"

28 January 2009

SP Futures Hourly Chart Update for Market Close

There was a picture perfect breakout, at the intersection of our horizontal breakout resistance and the outer bound of the big downtrending diagonal channel.

So what next? While the futures remain in this tight channel a trader will not fight the tape, and no new shorts should be put on.

Now having said that we sold most of our straight up index longs into the close and did buy selective shorts into our hedge. Our bias is now short for a pullback potential off that touch on the big resistance at 875 which is now a very key level.

Trade this with care as the situation remains volatile. But as a rule of thumb when we see such a nice straight ramping pattern in the SP futures we assume that some big banking players are walking the index higher into a short squeeze. Its hard to miss as the will clearly signal their intention to the market.

Volatility remains high. The most important change is that this breakout has shifted the bias of the market from the bears to the bulls, and so now we are in rally mode until it fails. The failure points are obvious on the chart, at least for now.

26 January 2009

SP Futures Hourly Chart at 3:30 PM

The theme for this week is Fed Watch for Wednesday afternoon, and an advance look at 4Q GDP on Friday, with earnings before and after the bell all week.

The bulls are working that bottom formation and it will run if they get the breakout. Notice the failure of a similar pattern about a week ago.

This can go either way. It may not give a clear signal until after the FOMC decision, unless 'something happens.'

23 January 2009

SP Futures Hourly Chart at 3:30 PM

All scenarios are still on the table.

Trendline has moderated a bit, making a more symmetrical triangle pattern that has not yet resolved either way. Guilty until proven innocent.

Keep one eye on the VIX. There is a choppy tension on the tape.

A good indicator of stock market price dislocations is often referred to by traders as "tension on the tape." What they are actually referring to is a type of volatility that moves the market in rapid intraday extremes or very tight trading ranges. As we have seen recently, the market can open up or down 50-100 points or more and then seemingly reverse instantly to the same extent.Big data out next week with an FOMC meeting (jawbone opportunity), Chicago PMI, and Q4 Advance GDP on Friday. The figures are always revised and economists expect -5.2% so be wary of a 'better-than-expected' print.

22 January 2009

SP Futures Hourly Chart at 3:30 PM Update

The SP failed at overhead support today, and is now winding withing a symmetrical triangle within the downtrend.

The news of Microsoft layoffs dampened the bubbly froth over AAPL overnight.

The market at this point is guilty until proven innocent and so we continue to ride our hedge to the much shorter side after the failure at 844.

We're not riding a pure short because the bulls keep trying to find a footing and we have not seen the failure yet at 805. We'll also look for confirmation on techs.

Gold and silver are consolidating gains as the T Bond shows continued weakness.

Google out with earnings after the bell. Keep an eye out for the GE news and outlook tomorrow morning.

21 January 2009

SP Futures Hourly Chart at 3:30

The Nasdaq is in a similar pattern.

Note the long end of the Treasuries was down again as money came out looking for βeta. Quite often it comes out looking for risk and is consumed on these technical bounces. The dollar eased as well, and the yen is moving. We like our thought that the Pound is heading for parity with the euro, and may be with the dollar before Buck takes a dive.

We were net long for the day, but are flattening out and taking some profits, including a big Long Bond short, into the close, leaving a slight edge on to the short side of financials and long tech.

Dollar down gold up but nothing of substance. Watch to see if any of these moves extend. We're believers in the January full month indicator so obviously the action this week is important.

We may break out, so be aware of the resistance. We could see a short squeeze if we do.

AAPL and EBAY after the close. They may give us a better read on tech, now that IBM has become an accounting black box.

The word for the day is: FROSTY. Let the market show us the way short term.

15 January 2009

SP Futures At Key Support on the Hourly Chart

Even if you trade on fundamentals, it is a good idea to keep an eye on the charts to select your entry and exit points.

If we break down out of the short term trend (the hourly chart) then we would look to the SP daily and weekly charts to see where support might be found. Although things may seem obvious, they are rarely certain.

Keep in mind tomorrow is stock options expiry and the put buyers have been active. We are also going into a three day weekend in the States as Monday is a national holiday. There is significant worry about the Citi earnings report due out tomorrow.

Here is a snapshot of the SP500 emini futures at 10:30 AM.

19 November 2008

Trading Note. Approaching our SP Futures Target of 810

We were looking for 810 to the downside and have been riding Index doubler shorts down since yesterday afternoon in our trading portfolios. We make changes to our investment portfolio only a few times each year.

We were looking for 810 to the downside and have been riding Index doubler shorts down since yesterday afternoon in our trading portfolios. We make changes to our investment portfolio only a few times each year.

Now we are buying some long positions to offset those shorts since we approach a possible support area.

The longs are individual stocks, precious metal miners and oil producers with strong cashflows and/or dividends, and some of the long index funds.

Please note that these longs are MORE than offset by the remaining short positions. This is a hedged play to take some short profits off the table without necessarily selling them. If we get a rally from here it will be relatively easy to reduce the three short positions. The longs are more diversified so obviously there are many more positions, but less in total dollar and leverage value. We are trading without margin.

We'll have to see how we close and what happens as we approach 800 if we do. If we go lower tomorrow we can adjust the long-short balance in the portfolio to take advantage of the decline.

Recall that we are in an option expiry week, and we have expiry in some of the commodity futures as well.

We offer the occasional example of how we might be trading a market not for specific examples or 'calls' but rather to reflect the style and money management we are using to match the character of a particular market. This one needs a whip and chair. Use of uni-directional positions and leverage are particularly dangerous since even in a bear downtrend, there is room for enormous swings even intraday.

Today did seem a little 'climactic' but it is too soon to tell.

Have a pleasant evening.