"All animals are equal, but some animals are more equal than others."

George Orwell

h/t Stacy Herbert

"In the Incarnation the whole human race recovers the dignity of the image of God. Thereafter, any attack, even on the least of men, is an attack on Christ, who took on the form of man, and in his own Person restored the image of God in all. Through our relationship with the Incarnation, we recover our true humanity, and at the same time are delivered from that perverse individualism which is the consequence of sin, and recover our solidarity with all mankind."

Dietrich Bonhoeffer

As a rule of thumb, the worst possible time to convert lump sum savings into a fixed income annuity would be when interest rates are historically low.

Although products may vary, this is roughly equivalent to buying long term bonds at a time when interest rates are likely to increase, substantially reducing your principal in real terms, and eroding your fixed returns through inflation.

For some reason the Obama Administration is promoting the idea now that there should be some encouragement for Americans to start converting their 401K's and IRA's into annuities, to provide themselves with lifetime income.

The effort is being spear-headed by Mark Iwry of the Treasury and Phyllis Borzi of the Department of Labor. Here is a paper written on the subject by Mark Iwry when he was at the Brookings Institution.

The essence of this paper is that distributions from IRA's and 401K's would automatically be rolled into an annuity providing a monthly income by default.

This concept is known on the Street as the handling fees for meager returns pork barrel pigfest. The Fed likes it because they will undoubtedly get a two year rolling chunk of the people's retirement cash to play with.

Perhaps just rolling those 401K's and IRA's into Social Security or the Long Bond would be what they have in mind. Somehow the panacea of TIPS with inflation defined by the government sounds probable. The drawback perhaps is that this would not generate the highest recurring fees for Wall Street and the FIRE sector, which have to be eyeing that 'cash on the sidelines' hungrily.

How about Patriot Bonds that are fully invested in Mortgage Debt formerly owned by the Fed, with some tranches of Commercial Real Estate to add some zest to the recipe? The Treasury can give this option a small tax break, which can be largely consumed by Wall Street fees and mispricing of risk returns.

And I thought that Greenspan's advice for homeowners to step into ARMs into the knee of the housing bubble was foul.

Here's a modest proposal. Raise the amount of losses from investments that can be deducted from income in one year from $3,000 to $20,000 for individuals and $40,000 filing jointly so mom and pop can clean up their balance sheets. And if they really want to jump start the economy, declare a tax and penalty exemption on the first $150,000 that an individual can withdraw from their IRA or 401K in 2010.

And for God's sake fix the Alternative Minimum Tax levels.

Does it seems as though I have barely given this annuitization effort a chance, a fair hearing, the benefit of the doubt, improperly assumed it might not have the best intentions of the American public at heart?

Are you serious? After Healthcare Reform and TARP? These people in Washington and Wall Street have no shame, much less good intentions, common sense, or a conscience. They are strangling the real economy, slowly but surely.

My model for thinking about this annuitization is that the government wishes to appropriate your savings for a 2.0% return, ex fees and mispriced risk and inflation, as a source of funding for the bailouts of an oversized and insolvent FIRE sector (like AIG) and the imploding pretensions of a global financial elite.

"Officials in the Obama administration are moving quickly to develop the investment infrastructure behind the president’s proposal for mandatory automatic enrollment in individual retirement accounts, which could be supported by the creation of Treasury-issued retirement bonds

J. Mark Iwry, deputy assistant secretary for retirement and health policy at the Department of the Treasury, said that administration officials are exploring some “conservative” options for investing the assets of 78 million Americans that he estimates could be automatically en¬rolled in this “universal” workplace retirement system.

He said that officials have discussed the possibility of making a low-risk life-cycle or target date fund the default investment option for these auto-IRAs, which would be mandatory for employers if they don’t offer a retirement plan to their workers.

But there is also a chance that they could rely on a new form of bond — an “R bond” — as the basic building block for the auto-IRA, Mr. Iwry said in addressing reporters at the Treasury Department in Washington last week.

Administration officials are discussing the exact details of these R bonds, such as their interest rates, maturities and minimums, he noted. These bonds ideally would provide individuals with a source of secure, steady returns that would protect their initial investments."

Administration Explores R Bond For Retirement Accounts - Investment News 7 June 2009

"None are so hopelessly enslaved as those who falsely believe they are free." Johann Wolfgang von Goethe

Maybe it's a mistake. Did Timmy have time to run their return on TurboTax?

Maybe it's a mistake. Did Timmy have time to run their return on TurboTax?

Well, at least it will make the results of the TARP program look better on paper if it drives up Citi's stock price by inflating their financial results. That's a plus, right?

I guess raising the credit card rates to 26% and free money from Ben was not enough to push Citi over its capital objectives in time for bonus season. We'll all have to really tighten our belts for this one.

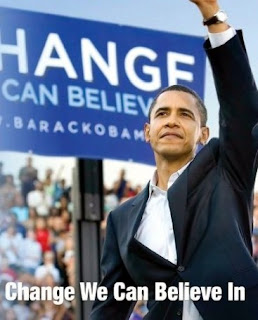

Change you can believe in.

Washington Post

Citigroup gains massive tax break in deal with IRS

By Binyamin Appelbaum

Tuesday, December 15, 2009; 8:05 PM

The federal government quietly agreed to forgo billions of dollars in potential tax payments from Citigroup as part of the deal announced this week to wean the company from the massive taxpayer bailout that helped it survive the financial crisis.

The Internal Revenue Service on Friday issued an exception to longstanding tax rules for the benefit of Citigroup and the few other companies partially owned by the government. As a result, Citigroup will be allowed to retain $38 billion in tax breaks that otherwise would decline in value when the government sells its stake to private investors.

While the Obama administration has said taxpayers likely will profit from the sale of the Citigroup shares, accounting experts said the lost tax revenue could easily outstrip those profits.

The IRS, an arm of the Treasury Department, has changed a number of rules during the financial crisis to reduce the tax burden on financial firms. The rule changed Friday also was altered last fall by the Bush administration to encourage mergers, letting Wells Fargo cut billions from its tax bill by buying the ailing bank Wachovia.

"The government is consciously forfeiting future tax revenues. It's another form of assistance, maybe not as obvious as direct assistance but certainly another form," said Robert Willens, an expert on tax accounting who runs a firm of the same name. "I've been doing taxes for almost 40 years and I've never seen anything like this where the IRS and Treasury acted unilaterally on so many fronts."

Treasury officials said the most recent change was part of a broader decision initially made last year to shelter companies that accepted federal aid under the Troubled Assets Relief Program from the normal consequences of such an investment. Officials also said that the ruling benefited taxpayers because it made shares in Citigroup more valuable and asserted that without the ruling, Citigroup could not have repaid the government at this time. (Thank God. Just in time for prime bonus season - Jesse) "This guidance is the part of the administration's orderly exit from TARP," said Treasury spokeswoman Nayyera Haq. "The guidance prevents the devaluing of common stock Treasury holds in TARP recipients. As a result, Treasury can receive a higher price for this stock, which will benefit the financial system and taxpayers." (George Orwell would have fun with this one. Let's give them a lot more money, so that when they give some back it will make our government program look better - Jesse)

"This guidance is the part of the administration's orderly exit from TARP," said Treasury spokeswoman Nayyera Haq. "The guidance prevents the devaluing of common stock Treasury holds in TARP recipients. As a result, Treasury can receive a higher price for this stock, which will benefit the financial system and taxpayers." (George Orwell would have fun with this one. Let's give them a lot more money, so that when they give some back it will make our government program look better - Jesse)

Congress, concerned that the Treasury was rewriting tax laws, passed legislation earlier this year reversing the ruling that benefited Wells Fargo and restricting the ability of the IRS to make further changes. A Democratic aide to the Senate Finance Committee, which oversees federal tax policy, said the Obama administration had the legal authority to issue the new exception, but Republican aides to the committee said they were reviewing the issue.

A senior Republican staffer also questioned the government's rationale. "You're manipulating tax rules so that the market value of the stock is higher than it would be under current law," said the aide, speaking on condition of anonymity. "It inflates the returns that they're showing from TARP and that looks good for them." (And a nice accomplishment for Timmy's year end performance review - Jesse)

Read the rest here.