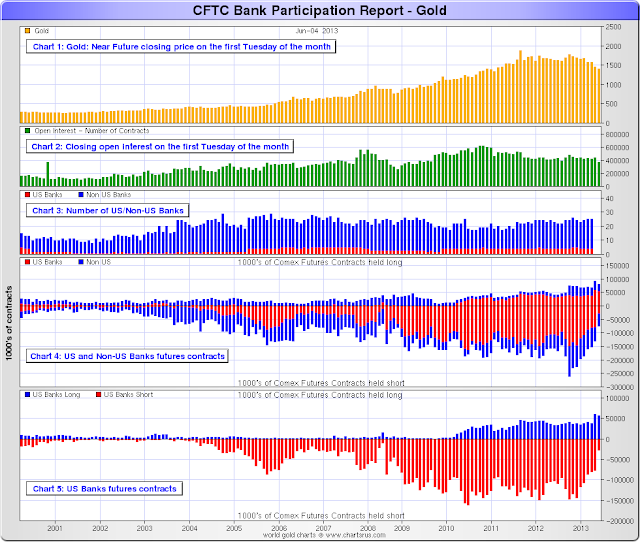

The US Banks have gotten net long of gold in this last report.

The charts below are from Sharelynx.com.

Here is what Ted Butler of Butler Research had to say about this report today:

"Since the BPR of February 5, the US bank category position (in effect, almost exclusively JPMorgan) has swung by a net 100,000 contracts, from net short 70,000 contracts to net long 30,000 contracts (all rounded). There has never been a move of such magnitude before. Over that same time, the total net commercial short position (in the COT) declined by 113,000 contracts, meaning that JPMorgan accounted for almost 90% of the entire commercial decline. It is not possible for that extreme degree of concentration and market share not to be manipulation, pure and simple.

And here’s the manipulative icing on the cake – JPMorgan was able to flip a net short position in COMEX gold of 50,000 contracts in February to a net long position of 50,000 contracts on a gold price decline of as much as $350. I would submit that the singular purchase of 10 million ounces of gold (worth the equivalent of $15 billion) within four months on a greater than 20% price decline could only be accomplished if the price was manipulated lower by the purchaser. No other explanation would be possible...

JPMorgan’s emergence as the big COMEX gold long changes the dynamic of the gold market. In addition to conclusively proving that this is the most crooked and evil financial institution ever to exist, it confirms the extremely bullish set up for the gold price...

Of course, if JPMorgan can continue to accumulate inventory on lower prices, we will get lower prices temporarily. But having JPMorgan confirmed as being on the long side of gold is a game changer. That’s why I continue to throw money out the window on silver call options."

I read Ted twice a week for color commentary on the metals markets. Its a subscription service. I tend to take some confidence from what he says about the bullish set up because several other things that I watch carefully are inclining to show the same setup for a serious short squeeze on the funds.

He also had quite a bit to say about silver, which is his area of special interest and unsurpassed expertise, but you will have to subscribe to read that.

I took my first silver position in a while on Friday and expanded my gold position on that weakness.