"People of privilege will always risk their complete destruction rather than surrender any material part of their advantage."

John Kenneth Galbraith, The Age of Uncertainty

If this is accurate, if this is really happening, I think that the effects of this run on the bullion banks are going to hit quite a few people dead cold, like a smack in the face.

That is because there is so little coverage of what is going on in the media, even the internet media.

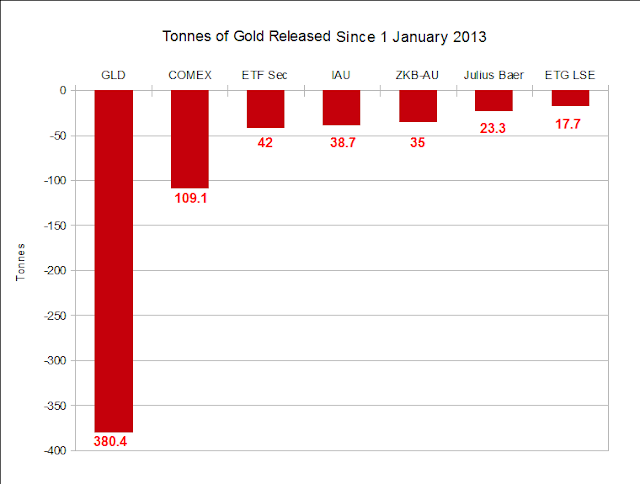

The gambit of smacking down price to dampen the desire for gold appears to have backfired in a big way by sparking an insatiable demand for the physical metal and

a remarkable decline in available inventories. That certainly wasn't what had been expected I would imagine when

the process of a more energetic price manipulation in response to Germany's request for the return of its gold began.

That a sovereign nation asked for the return of its own gold being held in custody, and that request was flatly denied, is almost as unbelievable as the fact that so many are willing to take it in stride, like something that would happen every day.

A seemingly unstoppable force, the flow of gold from west to east, is going to meet the undeliverable object, the nominal inventory of unencumbered gold in the bullion banks and exchanges, sometime over the next twelve months.

Of course one cannot predict exactly what will happen and when, given the phony controversies,

obfuscations, and stonewalling that seem to settle like a thick fog over the markets at every treacherous turn in this slowly unfolding financial crisis. But the math is intriguing.

This is getting very interesting. Let's see what happens.

Is this what I

wish to happen? No, I would prefer that the markets be transparent, honest, and provide genuine price discovery and allocation of capital with relative rationale decision making open to all market participants. I think for now the game is badly tilted in favor of insiders and their powerful friends.

I do not believe that there can be a sustainable economic recovery without genuine reform. A financial disaster is what the financial predators seemingly wish to happen, assuming they even care about the broader effects of their foolish greed.

At some point one would have to anticipate a declaration of

force majeure and/or a change in the rules if the financial interests do not relent on their aversion to a market-clearing price. And when that tide goes out, we will see who is swimming naked.

But there remains plenty of opportunity for more desperate antics, so

as always caution is advised , particularly in the use of any leverage and short term time horizons. This is not a healthy trading environment for the non-professional. And many a person has gone bust by underestimating the shameless manipulation of the markets when regulation is lax.

The exchanges and the Banks will not fail, because the financiers and their friends make their own rules as they go along, and do not hesitate to act in their own interests, promises and customers be damned. That seems to be the way of modern finance and monetary theory. Whatever we say it is, is because we say it is.

The time for debate seems to be coming to an end. Weighed and found wanting.

Stand and deliver.