"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake.

Therefore at any price, at any cost, the central banks had to quell the gold price, manage it."

Sir Eddie George, Bank of England, in private conversation, September 1999

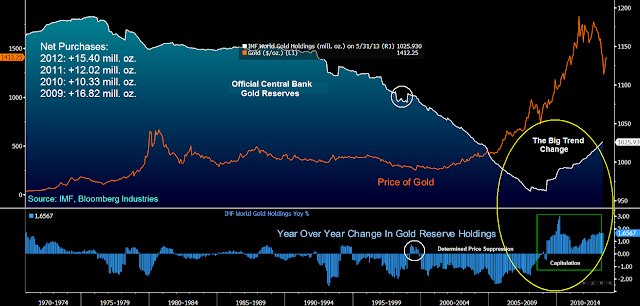

Few people realize that around 2008 central banks turned from being net sellers of gold to net buyers, and began to accumulate gold reserves in a big way for the first time since the 1970's, when Nixon slammed shut the gold window.

This is based on what they report officially to the IMF. There is strong anecdotal evidence that the actual turn in buying occurred quite a few years earlier, and more in line with the rapid appreciation in price as selling declined.

First the selling slowed and the stealth buying began, particularly in Asia and the Mideast.

There was a

sea change in the gold market as central banks scaled back on their strategy of supplying official gold to the bullion banks in order to keep the price down.

The bottom in the gold price occurred when Gordon Brown threw England's gold with a pre-announcement into the market in order to bail out any bullion banks that were caught flatfooted 'in the turn' in May of 1999. This was the first clear sign that change was in the wind.

The Big Turn occurred in 2007 when the western central banks capitulated, and realized that they must allow the price of gold to rise, or exhaust their own gold reserves in the process. The central bank change did not

cause this, although it certainly reinforces the trend. It is a symptom of the great change and the first unmistakable manifestation of the currency war. Although astute observers could see this coming in the aftermath of the Asian currency crisis in the 1990's and the Russian default on the rouble.

Gold commentators who do not realize this significant dimension of what has occurred and account for it in their thinking have been simply left behind, lost in an outdated frame of reference. They do not see the forest for the trees.

This is about much more than gold and silver. This is about a major, an historic change, in the composition of the world's global currencies and trading system. The dollar regime that has been in place since the end of World War II is undergoing a major evolution.

If there is anything that shocks me, it is how few economists understand it, or even realize it. I suppose that is how it is when the big things occur. Most of the operational people are left staring at the old paradigms, and wondering why their models are malfunctioning.

Rather than accept the change and understand it, they get busy trying to prove that it is not happening, since they have such a vested interest in the past. And so we see the occasional hysterical outburst from the

status quo, that what is indeed happening does not make sense, and is irrational.

Their reasoning begins to take on the shrill character of propaganda as they do their duty for their powerful patrons. And they further discredit and isolate themselves from things as they are, and from people who have eyes to see.

The Anglo-Americans will be the last to let this folly go. And I hear there is quite a bit of official irritation with those bullion banks who do not wish to go along with them. They prefer to get out of this while they can with their balance sheets intact, even to the extent of getting out of the business, and enduring subtle retaliation for their recalcitrance.

I cannot foresee exactly where we are going, no one can, because there are simply too many exogenous variables. But I doubt that it will be back to where we have been.