"Our basic trouble was not an insufficiency of capital. It was an insufficient distribution of buying power coupled with an over-sufficient speculation in production. While wages rose in many of our industries, they did not as a whole rise proportionately to the reward to capital, and at the same time the purchasing power of other great groups of our population was permitted to shrink.

We accumulated such a superabundance of capital that our great bankers were vying with each other, some of them employing questionable methods, in their efforts to lend this capital at home and abroad. I believe that we are at the threshold of a fundamental change in our popular economic thought, that in the future we are going to think less about the producer and more about the consumer.

Do what we may have to do to inject life into our ailing economic order, we cannot make it endure for long unless we can bring about a wiser, more equitable distribution of the national income.”

Franklin D. Roosevelt, Campaign Speech, Oglethorpe University, 1932

"The problem [First Bank of the United States] was not paper money per se, but the concentration of power and wealth which the abusive use of the paper monetary power had granted to a few powerful individuals and institutions. No system is foolproof when a foolish people will allow the unscrupulous few to operate it in secrecy and without transparency, accountability and the rule of law. And if anything is clear, the crony regulation by the Fed and other regulators of the Banking System, or lack thereof, is a failure and the source of much of our own mischief. And the primary reason we cannot acknowledge the facts of our own situation is that our political and financial class are caught in a credibility trap. They cannot speak the truth without compromising their own personal greed and will to power."

Jesse, Peak Junk, Currency Wars, 11 August 2015

"Fraud and falsehood only dread examination. Truth invites it."

Samuel Johnson

"Change is the law of life. And those who look only to the past or present are certain to miss the future. A great change is at hand, and our task, our obligation, is to make that revolution, that change, peaceful and constructive for all. Those who do nothing are inviting shame as well as violence.

The problems of the world cannot possibly be solved by skeptics or cynics whose horizons are limited by the obvious realities. We need men who can dream of things that never were and ask, why not? History is a relentless master. It has no present, only the past rushing into the future. To try to hold fast is to be swept aside."

John F. Kennedy, Dublin, Ireland, June 28, 1963

Is it any surprise that a generation that was taught and embraced, primarily through its professional class, the belief that 'greed is good' would foster an economy and a nation dominated by self-centered, barely incompetent con-men?

I would suggest that the fruits of this dishonor are yet to be harvested. What has been hidden will be revealed.

The JOLTS report, a government survey of job openings, came in higher than expected this morning, so of course rate fears flamed on and the markets melted.

Things tended to calm down into the close, stocks finished well in the red.

That gap in the SP 500 futures has certainly been closed. Unless they are a runaway gap they often do.

The Dollar chopped sideways, with some range at times.

I have included a longer term Dollar chart this evening for perspective.

VIX jumped higher again, well off its notable lows of not too long ago.

Wash-rinse-repeat.

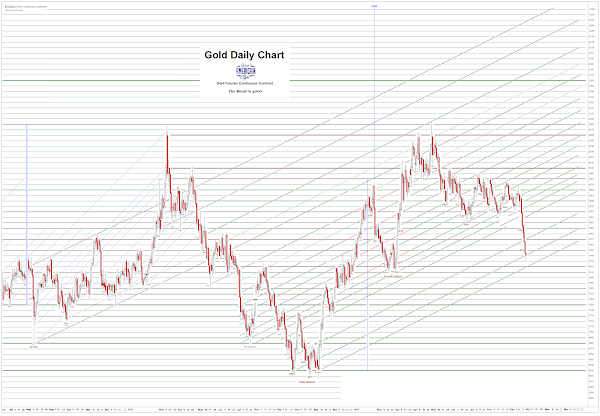

Gold and silver fell with the JOLTS, but then recovered and made a decent showing into the close.

Non-Farm Payrolls report on Friday.

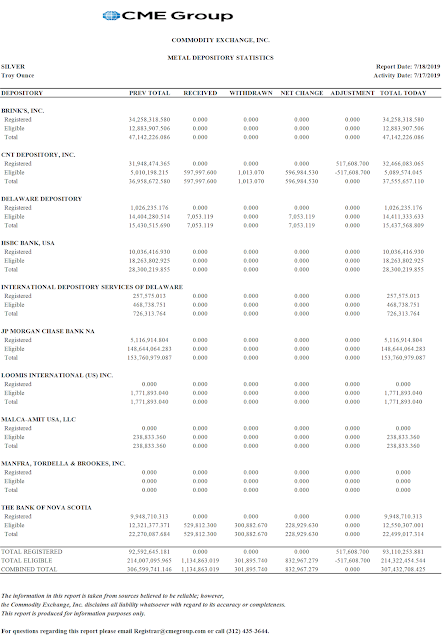

Gold continues flowing from West to East.

Long ignored, at some point this trend will become more generally known, and its consequences felt.

Our position in all this has been given to us clearly, from many years ago.

"Do not join your efforts with the false and treacherous, for what does justice have to do with lawlessness? Or what fellowship does light have with darkness? What is there in common between Christ and Belial? What do the faithful have in common with the faithless?"

2 Corinthians 6:14-16

Some history was made today, as for the first time a Speaker of the House has been rebuked, primarily by his own party.

Interestingly enough this was due to infighting between two MAGA political figures, albeit with slightly different personal styles.

Such as the ways of the proud, and the self-destructive tendencies of narcissists. They sow conflict and misery widely, while gaining little or nothing for anyone, including themselves.

Have a pleasant evening.