If I were to design a stimulus plan, Cash for Clunkers might be among them.

The target of the plan was to incent the public to trade in gas guzzling 'clunkers' for more fuel efficient, safer cars. It provided a spark of buying at a time of serious economic recession.

This is a classic case of promoting an economic and societal 'good' while providing a stimulus to spur economic activity. This is precisely the type of program that Big Business and its demimonde of commentators like when they are the primary beneficiary. Let's say, in a program of tax incentives to promote useful capital expenditure spending. And what many of the private individuals who complain about the program like when it benefits them personally, such as the deduction of mortgage interest.

So why is this likely to fail, at least in part?

That is because the Obama Economic Team, under the leadership of Larry Summers, is grasping at stimulus and aids programs like bank capital asset subsidies that as part of a total package might be useful, but as remedies applied to a sick system do not promote a cure, but merely serve to mask the symptoms.

Stimulus and aid programs do not work when they are merely poured into a system that is broken, or worse, broken and corrupt.

And it cannot be reformed by actors who have been and continue to be willing beneficiaries of its flaws, such as the transference of wealth from the many to the few. Congress and the Administration have to take themselves away from the trough and start acting for the greater good of the people whom they represent, rather than the special interests who give them campaign contributions and fat, overpaid jobs when they leave office.

What we are experiencing is a collapsing Ponzi Scheme, as Janet Tavakoli describes so clearly and yet so well in Wall Street's Fraud and Solutions for Systemic Peril.

This is why we say that the banks must be restrained, and the financial system must be reformed, and the economy brought back into balance, before there can be any sustained recovery.

29 September 2009

Cash for Clunkers Will Go Wrong, But Not For the Right Reasons

21 September 2009

Ding, Ding, Ding, Ding.... For the Market and the Democrats

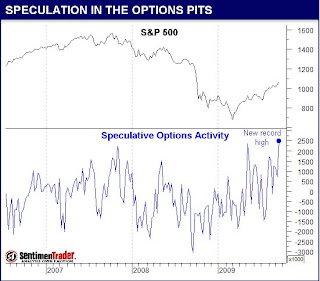

Hard to believe that after one of the greatest credit crises in history, Wall Street and the punters went back to their old ways of chasing beta with hot (taxpayer) money.

As ZeroHedge so insightfully observed:

"Sentiment Trader demonstrates how bullish speculative mania as measured by option activity is now at a decade, if not all time, high. With moral hazard having become the only game in town, everyone believes their investments are implicitly guaranteed by the government..."Paul Krugman, stalwart Democratic liberal economist, took Obama to task recently for his lack of stomach to change and reform the financial system in his column Reform or Bust

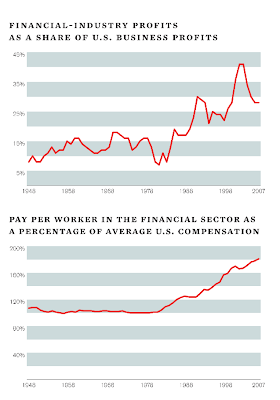

"What’s wrong with financial-industry compensation? In a nutshell, bank executives are lavishly rewarded if they deliver big short-term profits — but aren’t correspondingly punished if they later suffer even bigger losses. This encourages excessive risk-taking: some of the men most responsible for the current crisis walked away immensely rich from the bonuses they earned in the good years, even though the high-risk strategies that led to those bonuses eventually decimated their companies, taking down a large part of the financial system in the process...Paul has not yet been able to express the growing concern that many of Obama's top advisors and key staff managers are hopelessly conflicted, if not corrupted, in dealing with Wall Street.; The question can be asked, "if Obama is that smart, why is he acting so slowly, clumsily, ineffectively, timidly?"

I was startled last week when Mr. Obama, in an interview with Bloomberg News, questioned the case for limiting financial-sector pay: “Why is it,” he asked, “that we’re going to cap executive compensation for Wall Street bankers but not Silicon Valley entrepreneurs or N.F.L. football players?”

That’s an astonishing remark — and not just because the National Football League does, in fact, have pay caps. Tech firms don’t crash the whole world’s operating system when they go bankrupt; quarterbacks who make too many risky passes don’t have to be rescued with hundred-billion-dollar bailouts. Banking is a special case — and the president is surely smart enough to know that."

The answer gets to the heart of the proposition put forward by Richard Nixon, "People have got to know whether or not their president is a crook."

So which is it to be: ineffective blowhard or corrupt politician? The jury is still out, and there is time for change. But the window is closing.

30 March 2009

How the Financial Industry Holds America Captive

You heard this here first.

"The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time."

The Quiet Coup - Simon Johnson - The Atlantic Monthly

11 March 2009

Mr. Pot Calling Mr. Kettle. Mr. Pot Calling Mr. Kettle.

Steve Schwarzman of the Blackstone group blames the Ratings Agencies for the crisis and the historic 'loss of wealth' throughout the world.

Steve Schwarzman of the Blackstone group blames the Ratings Agencies for the crisis and the historic 'loss of wealth' throughout the world.

Note to Steve. It was not real wealth.

It was a bubble that was created starting in 1996 when Alan Greenspan changed his policy stance towards the markets after a visit from Mr. Rubin. This was around the time of his famous 'irrational exuberance' speech. We can only wonder what was said at that meeting.

Real wealth has substance. It is created by savings and hard work, and is only destroyed by real world events like natural disasters and wars, and of course theft.

The destruction of the real wealth was in the bubble when the middle class was systematically destroyed. This is just the settling of accounts. What we are seeing now is the paint peeling off the rotten economy which the financiers created for their personal benefit.

The ratings agencies and the regulators and the Fed and the media and the Presidency failed in their duties and responsibilities. They failed because they were corrupted. They were enthralled in a deep capture within a climate of fraud and market manipulation. They succumbed to temptation and became participants. And now they are afraid and ashamed of what they have done.

But they were the pawns, the tools. The primary actors are still in place and are still doing their worst for America. Jamie Dimon is on the financial news networks today speaking to the US Chamber of Commerce, weaving a revisionist view of what happened, blaming everyone but the banks in an amazing display of calculated spin.

Until the Wall Street banks are restrained, until real reform is accomplished, there will be no recovery, and the corruption will continue to taint all who come near it. It is already having its way with the new 'reform' administration.Blackstone CEO: As much as 45% of global wealth is gone

CFA Institute Financial NewsBrief

03/11/2009

Describing the event as "absolutely unprecedented in our lifetime," Stephen Schwarzman, CEO of Blackstone Group, said the credit meltdown has wiped out between 40% and 45% of the world's wealth.

He said credit-rating agencies are partly to blame for the crisis. "What's pretty clear is that if you were looking for one culprit out of the many, many, many culprits, you have to point your finger at the rating agencies," Schwarzman said. Reuters (10 Mar.)

07 March 2009

Weekend Reading: How Wall Street and Washington Are Betraying America

The original title for this essay was "How Wall Street and Washington Betrayed America." As you can see from the above, this blog has a slightly different perspective.

We would like to be able to say that this was an unfortunate problem that has occurred, and that we are dealing with its aftermath. The repair of the economy is just a matter of time and money.

It is not, and we are not.

The problem continues. This was not an exogenous event like an accident. It is a pernicious condition, a chronic wasting disease. The carriers of the infection are still at work.

The system is distorted, sick, incapable of self-cure. Feeding intravenous liquidity to obtain the appearance of health will not work, only allow the disease to progress. Strong medicine is required.

We will have no recovery until we have reform.

We will have no reform until the banks are restrained, and balance is restored.

The looting of the public Treasury will continue while the Congress and the Executive take their direction from Wall Street.

Paying for Policy in Washington

Wall Street's Best Investment

By ROBERT WEISSMAN

"The entire financial sector (finance, insurance, real estate) drowned political candidates in campaign contributions, spending more than $1.7 billion in federal elections from 1998-2008. Primarily reflecting the balance of power over the decade, about 55 percent went to Republicans and 45 percent to Democrats. Democrats took just more than half of the financial sector's 2008 election cycle contributions.

The industry spent even more -- topping $3.4 billion -- on officially registered lobbyists during the same period. This total certainly underestimates by a considerable amount what the industry spent to influence policymaking. U.S. reporting rules require that lobby firms and individual lobbyists disclose how much they have been paid for lobbying activity, but lobbying activity is defined to include direct contacts with key government officials, or work in preparation for meeting with key government officials. Public relations efforts and various kinds of indirect lobbying are not covered by the reporting rules.

During the decade-long period:

* Commercial banks spent more than $154 million on campaign contributions, while investing $383 million in officially registered lobbying;

* Accounting firms spent $81 million on campaign contributions and $122 million on lobbying;

* Insurance companies donated more than $220 million and spent more than $1.1 billion on lobbying; and

* Securities firms invested more than $512 million in campaign contributions, and an additional nearly $600 million in lobbying. Hedge funds, a subcategory of the securities industry, spent $34 million on campaign contributions (about half in the 2008 election cycle); and $20 million on lobbying. Private equity firms, also a subcategory of the securities industry, contributed $58 million to federal candidates and spent $43 million on lobbying.

Individual firms spent tens of millions of dollars each. During the decade-long period:

* Goldman Sachs spent more than $46 million on political influence buying;

* Merrill Lynch threw more than $68 million at politicians;

* Citigroup spent more than $108 million;

* Bank of America devoted more than $39 million;

* JPMorgan Chase invested more than $65 million; and

* Accounting giants Deloitte & Touche, Ernst & Young, KPMG and Pricewaterhouse spent, respectively, $32 million, $37 million, $27 million and $55 million.

The number of people working to advance the financial sector's political objectives is startling. In 2007, the financial sector employed a staggering 2,996 separate lobbyists to influence federal policy making, more than five for each Member of Congress. This figure only counts officially registered lobbyists. That means it does not count those who offered "strategic advice" or helped mount policy-related PR campaigns for financial sector companies. The figure counts those lobbying at the federal level; it does not take into account lobbyists at state houses across the country. To be clear, the 2,996 figure represents the number of separate individuals employed by the financial sector as lobbyists in 2007. We did not double count individuals who lobby for more than one company the total number of financial sector lobby hires in 2007 was a whopping 6,738.

A great many of those lobbyists entered and exited through the revolving door connecting the lobbying world with government. Surveying only 20 leading firms in the financial sector (none from the insurance industry or real estate), we found that 142 industry lobbyists during the period 19982008 had formerly worked as "covered officials" in the government. "Covered officials" are top officials in the executive branch (most political appointees, from members of the cabinet to directors of bureaus embedded in agencies), Members of Congress, and congressional staff.

Nothing evidences the revolving door -- or Wall Street's direct influence over policymaking -- more than the stream of Goldman Sachs expatriates who left the Wall Street goliath, spun through the revolving door, and emerged to hold top regulatory positions. Topping the list, of course, are former Treasury Secretaries Robert Rubin and Henry Paulson, both of whom had served as chair of Goldman Sachs before entering government. Goldman continues to be well represented in government, with among others, Gary Gensler, President Obama's pick to chair the Commodity Futures Trading Commission, and Mark Patterson, a former Goldman lobbyist now serving as chief of staff to Treasury Secretary Timothy Geithner.

All of this awesome influence buying has enabled Wall Street to establish the framework for debates in Washington, and to obtain very specific deregulatory actions, with devastating consequences."

Click below to find the full report with Executive Summary.

Sold Out: How Wall Street and Washington Betrayed America

24 February 2009

Coup d'Etat by Crisis

"Necessity is the plea for every infringement of human freedom. It is the argument of tyrants; it is the creed of slaves." William Pitt (1759-1806)

Quite the dire, almost inflammatory piece from Time Magazine. It certainly paints Bank of America, Citigroup, General Motors, and AIG in a bad, almost villainous light.

It is time to for a real change. It is time to stop allowing the country to be held hostage by a relatively small number of financiers who have gamed the system and corrupted the regulatory and legislative process. It is time to stop allowing those deeply involved with the problem to manage the investigation and the solutions.

Put the money center banks into a managed restructuring, and stop calling it nationalization, which wrongfully suggests the British socialism of the post World War II era. We did not have to use that sort of language or raise these emotional issues when the Savings and Loan scandal was cleared.

Let's get this open sore cleaned, bound and stitched.

But one thing we might wish to keep in mind is that it may not be AIG, BAC, and C that are pulling the strings, that are at the center of this. They look more like patsies than prime motivators.

Transparency would be interesting in this case with regards to the CDS market and the derivatives markets.

Who has the most to gain and lose if Citi, Bank of America, and AIG are put into managed restructuring? Who has the most and biggest bets on their failure?

Let's have transparency of positions now. And we cannot afford to take anyone's word on this.

The real sticking point is not the shareholders or managers of these companies, although they may be making the most noise at this point.

We will be surprised, if transparency is actually provided, and new and independent regulators armed with the full array of investigative tools, dig into this mess to see where the strings lead, if we do not find many of them in the hands of the other major Wall Street banks, media giants, and corporate conglomerates, among others.

We will keep an open mind, but do not expect any light or serious new information to come from these Congressional Committees with their circus, show trial atmosphere.

Time to bring back Glass-Steagall and to enforce the Sherman Anti-Trust laws. Time to compel the three or four banks to unwind their trillions in opaque derivatives. Time to audit the Federal Reserve, and clarify their role in our system to them, and nail a copy of the Constitution to their front door.

We do not need or want fewer, bigger, more powerful banks as a drag on the real economy, taking a tax on each transaction whether it be through credit cards or fees or loans or subsidies.

Time for a real change. Time to remind Congress where the power and legitimacy of their offices resides. Time for the lobbyists, corrupt regulators, corporate princes and the enablers and motivators of this grand theft to find a place in an unemployment line or a witness stand.

We must demand action from the Congress and the Administration who we recently put in place through the elections to clean this mess up and then change the system that delivered it.

Contact the White House

Contact Your Senator

We do not want fewer, bigger banks exacting a fee on every commericial transaction in this country.

1. Bring back Glass-Steagall.

2. Clean up the derivatives mess, starting with J.P. Morgan.

3. Enforce the various anti-trust laws, enacting new ones where necessary, and break up the media and banking conglomerates.

4. Enact aggregate position limits in all commodity markets and transparency with immediate disclosure of all position over 5% in any market.

5. Effective restrictions and enforcement of naked short selling, price manipulation, reinstatement of the 'uptick rule,' the prohibition of regulated banks from engaging in any speculative markets either for themselves or as agents, and usury laws and regulation of all interstate financial transactions at the national level.

And for the sake of the country, establish a vision, a model, of what the system should look like in accord with the Constitution. And then strike out for it, as painful as that may be, and stop this management by crisis, and weaving a shroud for our freedom out of a web of endless fixes, concessions and necessities.

"If there must be trouble, let it be in my day, that my child may have peace." Thomas Paine

Time

AIG's Plan to Bleed the Government Dry

By Douglas A. McIntyre

Tuesday, Feb. 24, 2009

Management at AIG has calculated exactly how much money the Treasury and Fed will have access to after all of the TARP, financial stimulus, and mortgage bailout projects have been funded. The insurance company then plans to ask for whatever is left to fund its deficits so that it can stay in business, effectively making the federal government insolvent.

According to CNBC, AIG is about to post another huge loss. "Sources close to the company said the loss will be near $60 billion due to writedowns on a variety of assets including commercial real estate." The financial channel also reports that the need for capital may be so great that AIG might have to enter Chapter 11, something the government has spent over $130 billion trying to prevent.

Just like Detroit, Bank of America (BAC), and Citigroup (C), AIG is playing a game of chicken with Washington that the government does not feel it can afford to lose. Imagine what it would be like if all of these businesses failed at the same time.

It is actually worth imagining. The government has so many balls in the air between the financial systems and deteriorating parts of the industrial sector that it may not have either the capital or intellectual capacity to go around. The Treasury has just appointed a prominent investment banker to help oversee the mess in Detroit, but it would take an army of financiers to first comprehend and then advise on what should happen to GM (GM) and Chrysler. The period for comprehension is already in the past. The trouble in the auto industry has to be addressed in the next few weeks or its capacity to operate will go up in flames.

The government made noises about taking a larger position in Citigroup (C). Based on the market's reaction, not may analysts and investors believe that the action will solve much. The poison of bad investments is in the blood of the financial system. Quarantining Citigroup will not solve that problem. The Treasury and Fed will have to take a holistic approach which involves healing the entire financial system. It is not clear that can even be done. How it would be done is an even more complicated matter.

The Little Dutch Boy is running out of fingers. The water that threatens to swamp the international financial system is getting closer to breaching the walls and pouring in. A month ago that seemed inconceivable. Now the odds that the government will have to allow large operations like AIG go into bankruptcy are fairly high. The trouble with that is not what will happen to AIG. As the market found out with the Lehman Brothers bankruptcy, many of the firms that are doing business with a very large financial institution when it becomes insolvent can have transactions worth billions of dollars wither voided or devalued.

In the intricate global financial system, there is no such things as one big player going down in a vacuum.