"It is the time of the harvest, and the reaper cuts into the ripe grain with wide strokes. Mourning takes up her abode in the country cottages, and there is no one to dry the tears of the mothers. Whoever today still doubts the reality, the existence of demonic powers, has failed by a wide margin to understand the metaphysical background of this war.

Behind the concrete, the visible events, behind all objective, logical considerations, we find the irrational element: The struggle against the demon, against the servants of the Antichrist.

Everywhere and always demonic powers lurk in the dark, waiting for the moment when man is weak; when of his own volition he leaves his place in Creation, as founded for him by God in freedom; when he yields to the force of evil, he separates himself from the powers of a higher order; and after voluntarily taking the first step, he is driven on to the next and the next at a furiously accelerating rate.

Everywhere, and at times of greatest trials, men have appeared, prophets and saints who cherished their freedom, who preached the One God and who with His help brought the people to a reversal of their downward course. Man is free, to be sure, but without the true God he is defenseless against the principle of evil. He is a like rudderless ship, at the mercy of the storm, an infant without his mother, a cloud dissolving into thin air."

Please distribute this as widely as possible.

The White Rose, Fourth Leaflet, Munich, 1942

"We who lived in concentration camps can remember the men who walked through the huts comforting others, giving away their last piece of bread. They may have been few in number, but they offer sufficient proof that everything can be taken from a man but one thing: the last of the human freedoms — to choose one's attitude in any given set of circumstances, to choose one's own way.”

Viktor E. Frankl, Man's Search for Meaning

“If you can feel that staying human is worth while— you've beaten them.”

George Orwell, 1984

“It is very easy to get drunk with hate. Hate is like the glass of whisky which is given to the soldiers before a bayonet charge. Whisky stimulates but does not nourish. What we can do and and should do is to seek truth and to serve it when we have found it. The real conflict is the inner conflict. Beyond armies of occupation and the catacombs of extermination camps, there are two irreconcilable enemies in the depth of every soul: good and evil, sin and love. And what use are the victories on the battlefield if we are ourselves are defeated in our innermost personal selves?”

Maximilian Kolbe, executed at Auschwitz, 14 August 1941

What good is morality? What good is love?

Because they give meaning to our lives, and over time, even to our suffering. Because they keep us from losing our selves. And because they can save us from becoming what we hate, from being one with it, bound together for all time.

The bloody terrorist attack in the Mideast roiled markets.

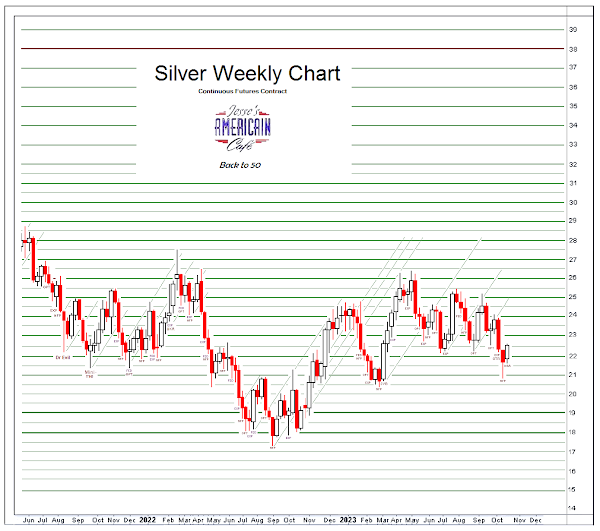

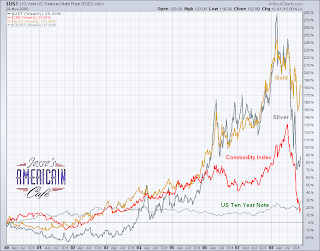

Gold, and to a lesser extent silver, saw a definite flight to safety.

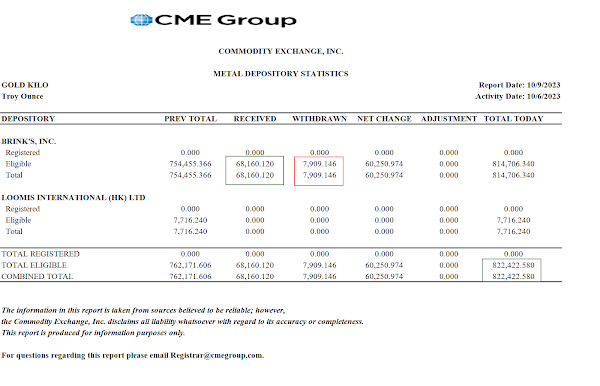

The gleaning of the ETFs for physical bullion for the East must be put temporarily on hold.

Stocks slumped hard in the overnight futures, but rallied during the day, going out on the highs.

Let's see if that defiant bullishness can be maintained.

The Dollar chopped sideways, still at an intermediate high.

VIX spiked and then dropped sharply during the day.

We will not be seeing much economic data in the US until Wednesday and Thursday as noted in the calendar below.

We will be remembering the 60th anniversary of the political assassinations of the 1960s starting in November.

I remember times of war many, too many times, over the past seventy years. Since the Vietnam War it seems that they have never had an end for us. Some few must surely think they benefit from all this carnage.

I do not know them. I only see the misery, suffering and tears that they bring. And for which there will be a judgement they do not expect— a reckoning. For God is not mocked.

Have a pleasant evening.